2022 has been a volatile year, not just for the markets, but for the world’s population, thanks to geopolitical events, inflation, and a host of post-pandemic effects. In this article, we take a look at some of the current events that will continue to impact the global economy in 2023.

Overview: What will Impact the World’s Markets in 2023?

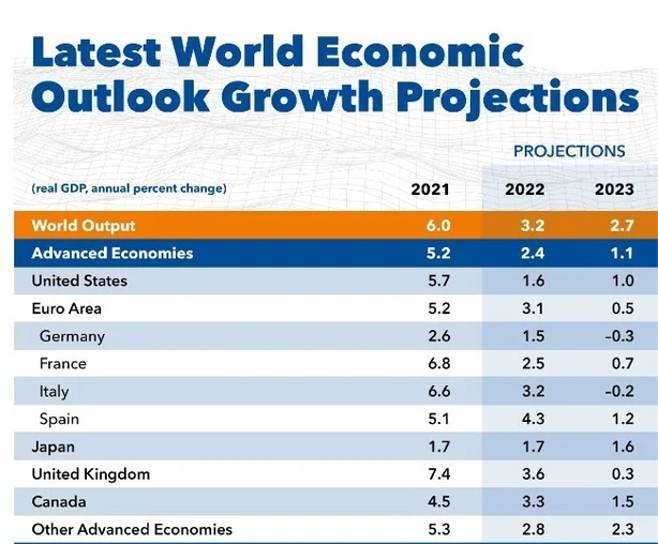

Recently, the International Monetary Fund cut its global growth forecast for next year; economic pressures, according to the institution, will collide as aftershocks from the war in Ukraine, high energy, and food prices, as well as increasing interest rates happen.

In fact, it predicts that more than a third of the world’s economy could contract in 2023, with the world’s largest economies – the US, China, and the euro area, continuing to stall.

In terms of global GDP growth, it will likely slow to 2.7%, a decrease of .2% from the 2.9% forecast in the middle of this year, as a result of higher interest rates, which have slowed down the US economy. In Europe, rising gas prices are shaking things up, and in Asia, China is continuing to deal with COVID-19 lockdowns and a weakening property sector.

Source: RTE

Verily, the IMF states that the health of the global economy will rest on the world being able to calibrate monetary policies, mitigating the impact of the war in Ukraine, and sufficient preparation against further pandemic-related supply-side disruptions.

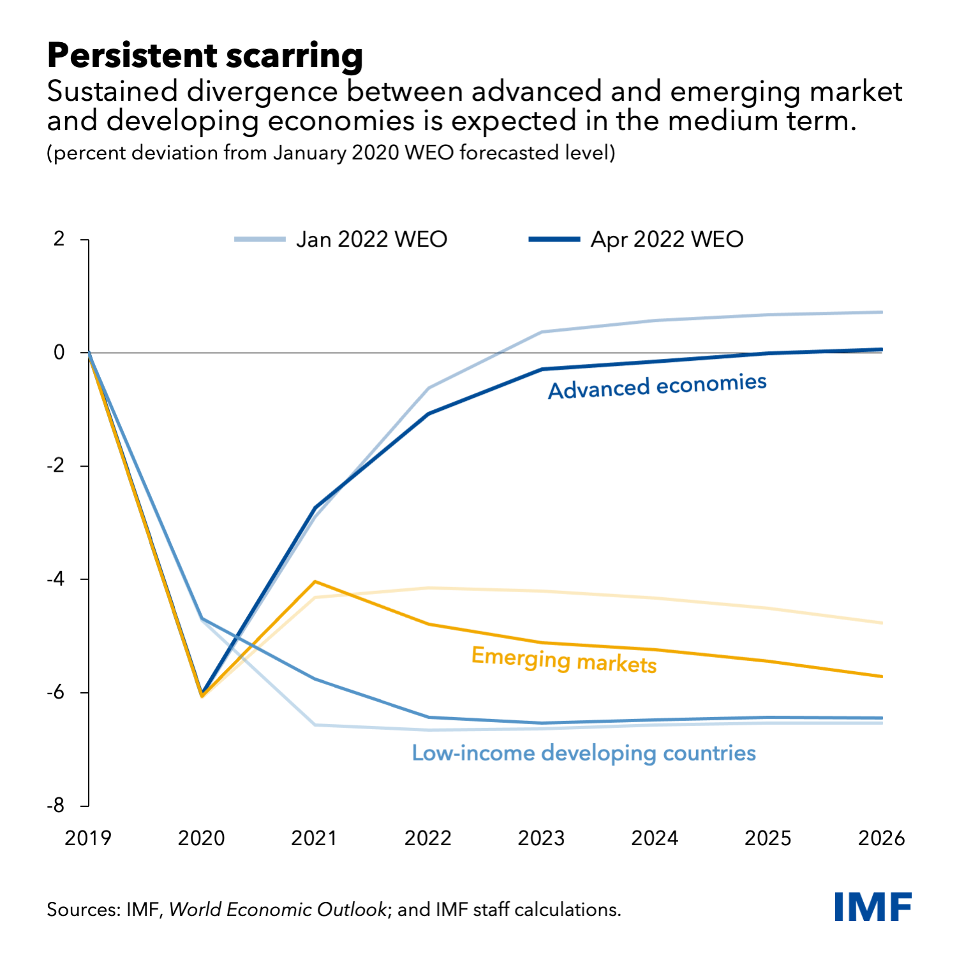

Central banks will have to execute a delicate balancing act to fight inflation; they will have to be careful not to overtighten as this could push the global economy into a severe recession, causing disruptions to financial markets and more stress on economies in developing nations.

The world’s policymakers are thus far focused on price pressures, which are proving quite stubborn. The IMF now expects global inflation to peak in late 2022 at 9.5%; it will remain elevated for a longer period than previously anticipated, and will eventually decrease to 4.1% in 2024.

For the purposes of this article, Xeraya takes a look at two key areas that will impact the global economy next year: the US midterm elections in November, and the ongoing conflict between Russia and Ukraine.

Midterm Elections in the US

A group of researchers from New Zealand’s University of Canterbury has kept a close eye on US midterm elections since 2018; in their report “Midterm Elections” Stock Market Surge – An Unintentional Gift from US Politicians, they found that nine times out of 10 from 1954 to 2017, US markets have felt positive impact over the October to June midterm period, with compounded returns over those three quarters being recorded at 25%.

While there is a chance that this trend may not be repeated this year, it still holds promise. Should the effect continue to hold, it would be among the strongest impacts of the political cycle on markets, and may actually matter more than Presidential elections do.

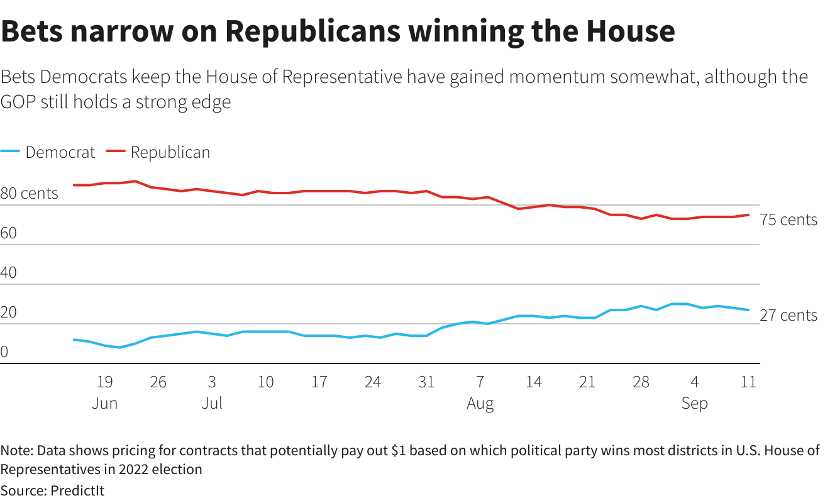

The reason for this is that midterm elections in the US often lead to political gridlock or a divided government. The Democrats are currently in control of the US House of Representatives, the Senate, and the Presidency, which is actually a risk for markets, as legislations could happen that are bad for firms’ profits or could at the very least make the future riskier.

By contrast, gridlock is usually good for markets; fewer laws are passed and the ones that are will be less controversial. This translates to predictability and fewer surprises, which bodes well for markets.

As of September 12, the Republican party has a 74% chance of gaining control of the House of Representatives, down from 88% in July. This means the Democrats have a 69% chance of controlling the Senate, while Republican chances went about 50% as recently as late July.

Source: Reuters

The Russia-Ukraine War

The conflict rages on between Russia and Ukraine, and the World Bank has already predicted that this will impede the post-pandemic economic recovery of emerging Europe and Central Asia; economic activity will remain stagnant and low throughout 2023, with a minimal growth of 0.3% expected, mainly due to energy price shocks.

Globally, the economy is still suffering due to significant disruptions in trade and food as well as fuel price shocks, which has contributed to high inflation and the subsequent tightening of global financing conditions.

CBC reports that the IMF has similarly downgraded its outlook for next year, citing the Russia-Ukraine conflict, chronic inflation pressures, high interest rates, and the residual effects of the pandemic. It estimates that the global economy will only see growth of 2.7% in 2023.

Source: IMF

Another key development is the energy crisis; globally, prices for oil, gas, and coal have been on the rise since early 2021, but after the invasion happened, they jumped to unprecedented levels. This increase will have a massive impact on consumers and Governments, constraining their fiscal affordability, firm productivity, and household welfare.

The Way Forward

While it isn’t possible to fully predict how the economy will fare next year, these two developments point the way to a challenging year ahead. As such, the IMF and other institutions are now calling on everyone to be prepared to mitigate this situation in 2023; governments must help their citizens by establishing social protection systems that will support people during these uncertain times and keep them resilient in the event of longer-term challenges, such as transforming labour markets, globalisation, demographic trends, technological innovation, and the impact of climate change and climate action.

Sources:

5. https://www.cbsnews.com/amp/news/imf-dims-outlook-for-2023-global-economy-ukraine-russia-war/

For more insights and information on Xeraya Capital, please visit: https://xeraya.com/#!/