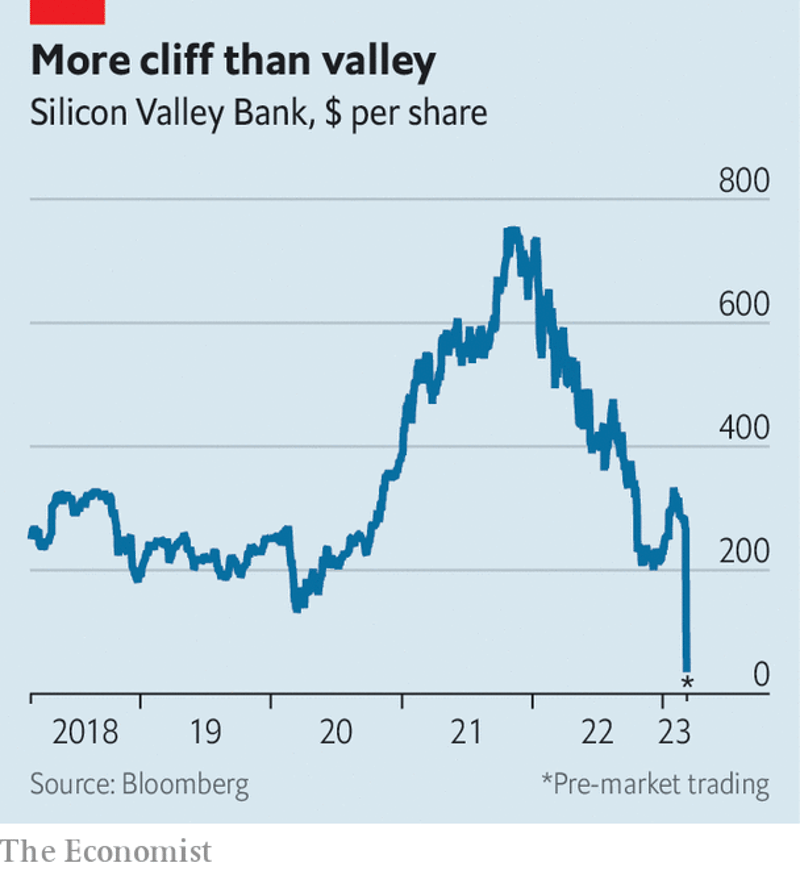

The post-pandemic era has brought on a lot of turbulent changes and developments across the world’s industries, with the tech sector and the banking industry both heavily affected. For tech players, 2022 saw both large and small companies downsizing as well as cutting costs to deal with the dip in business they have faced since the reopening of countries and a return to the office. However, as 2023 rolls on, it’s clear that their troubles aren’t over; with the collapse of Silicon Valley Bank (SVB) posing yet another obstacle for them to face. For finance and banking businesses, this event has far-reaching consequences and may even change the way they operate forever.

The Banking and Finance Sectors: Geopolitical Implications and a Change in Operations

SVB’s fall has broader implications than just affecting the tech industry and the companies that chose to trust the bank with its capital. It was a major player in the banking industry, and had a network of relationships with other banks, financial institutions, tech companies, and governments across the world. Thus, when it collapsed, questions arose globally about the US’s ability to maintain its position as a tech and finance leader and, according to Reuters, has even led some to doubt whether the US will be able to maintain its global influence in these two sectors.

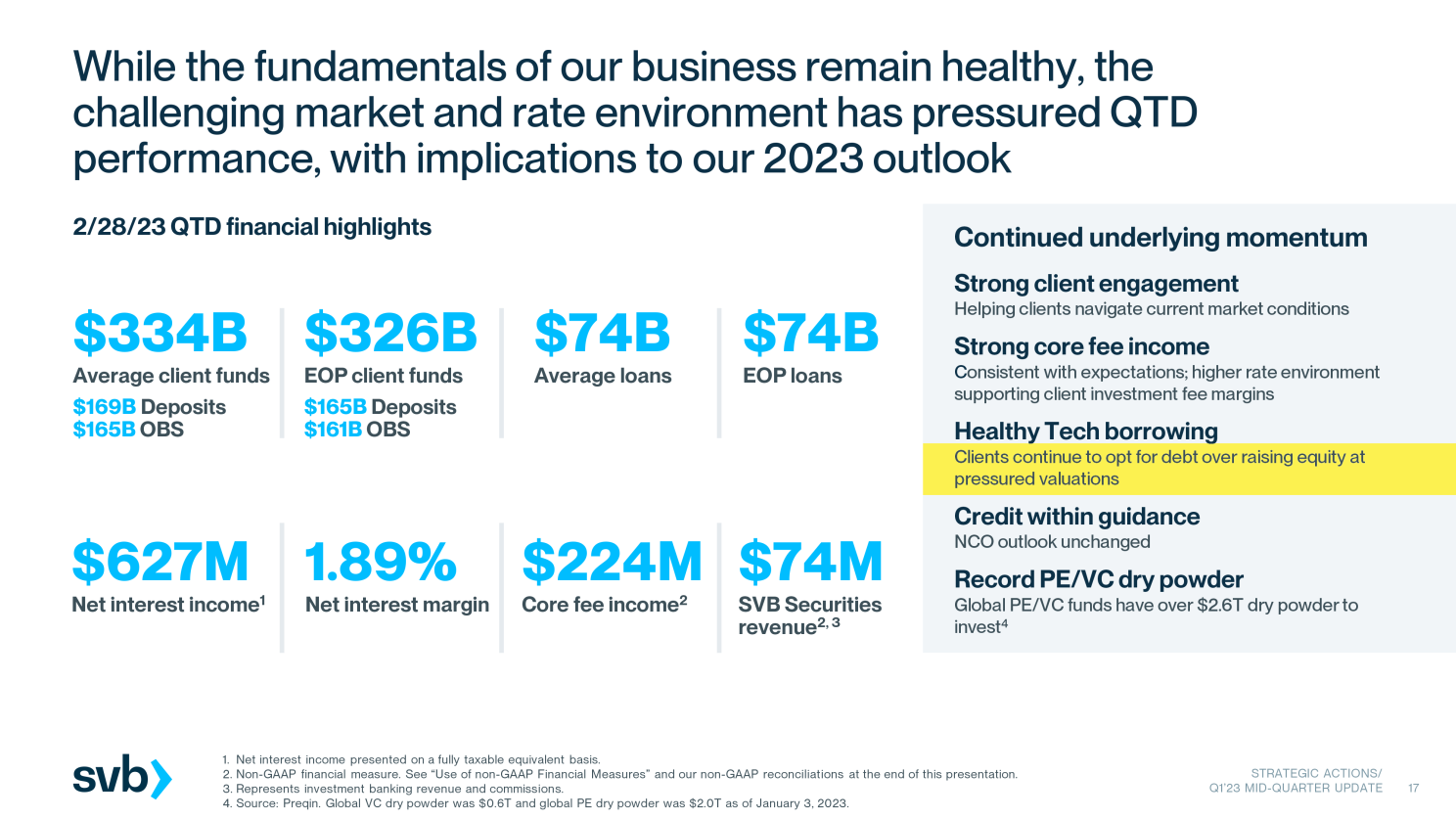

Zooming in to how this event impacts the banking and financing sectors specifically, there has been plenty of speculation on how banks and financial institutions will have to operate moving ahead, and what this means for both sectors. In terms of banking transactions specifically, this collapse can affect the confidence and stability of the entire financial system. To date, the following theoretical symptoms which have bandied about by subject matter experts since the announcement of SVB’s failure have already been realized:

- A loss of trust and confidence: Customers and investors have lost their faith in the broader banking system and have become reluctant to engage in transactions with other banks.

- The domino effect and systemic risk: Other banks and financial institutions could potentially collapse or face troubling times, resulting in a broader system risk. As mentioned above, SVB had an extensive network of connections with other banks and exposure to other financial institutions, meaning that there is a high probability of this risk coming to pass.

- Market volatility: The collapse has led to uncertainty amongst investors, with some reacting to the news by selling off their shares in other banks and financial institutions.

- Regulators and their response: Regulators have had to step in to address the fallout from SVB’s collapse; for other finance and banking players, this means that there will be increased scrutiny from regulators and the implementation of stricter rules and regulations.

- A disruption in transactions: SVB’s former customers are now experiencing a disruption in terms of their financial transactions, which in turn has impacted their operations and stymied their ability to engage in transactions with other banks.

The Tech Sector: Global Ramifications and Another Hurdle for Funding

As mentioned above, tech players globally have already been facing a year or so of uncertain times; with the reopening of economies and outdoor activities, many companies have seen a drop in profits, resulting in a slew of retrenchment exercises and cost-cutting. Additionally, this decrease in business has led to investors (VC and PE firms) to hold off on joining another round of funding or decreasing the amount of capital they are willing to provide to startups. The direct effects of the SVB collapse on the tech sector are as follows:

- More woes for employees: For companies who had deposits in SVB, its collapse means that they may be unable to pay their staff, resulting in a potentially huge loss of manpower.

- Liquidity at risk: The major problem of the collapse for startups is the loss of liquid cash, which can lead to the business shutting down.

- More bootstrapping: Even for businesses that have managed to survive the post-pandemic crunch as well as investment losses and hiring freezes, they are now having to cut costs even further as investors and employers lose their access to liquid funds which are used for operating costs and short-term debt.

Most importantly, the above challenges are not only being faced by US-based startups, but by the world’s startups community at large. Tech publication Rest of World reported that businesses in countries as far away as India, China, and Mexico, were all scrambling to move their money out of SVB before its collapse.

The issue is that SVB was very adept at wooing foreign startups to open accounts with the bank, as it allowed companies to create one remotely without requiring a minimum balance. Additionally, its interface (UI) proved both pleasing to the eye and convenient for startup founders, making it easy to do international wire transfers. Now, many small businesses are paying the price of placing their cash with SVB.

The fact of the matter is, SVB’s crash was reportedly the second-biggest bank failure in US history, and has caused global tech hubs to worry about the fallout and the future of the funding and regulatory environment.

Where do we go from here?

Beyond the immediate impact the SVB collapse has had on both industries, stakeholders are now worried about global companies going bankrupt from low liquidity at risk of defaulting. Should this come to pass, national banks will have to result to bailing them out in order to avoid having their respective economies collapsing, which will worsen debt burdens for the nation.

Lessons learnt

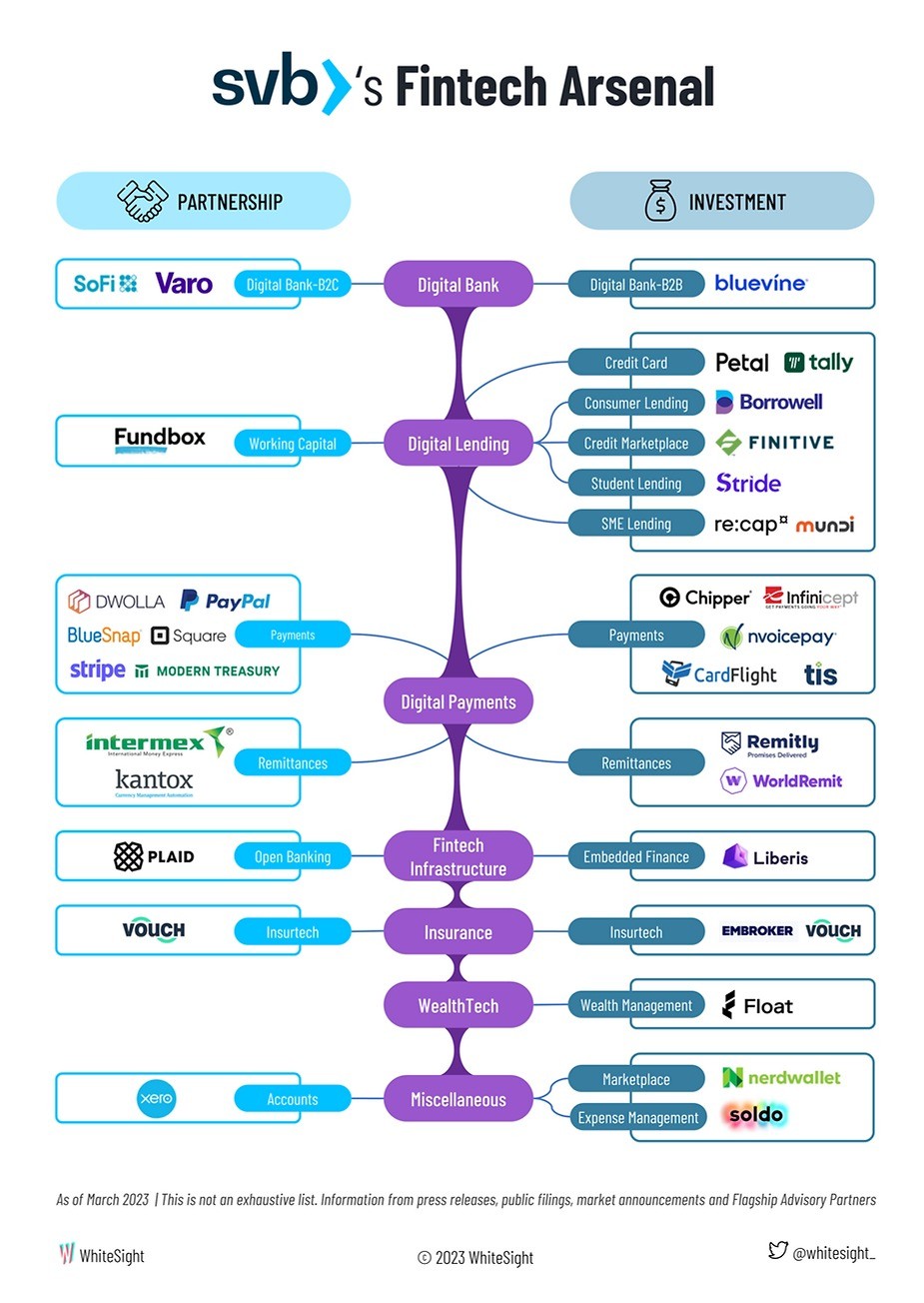

Ultimately, the most important lesson startups and their investors have to take from the SVB collapse is its indirect impact on the ecosystem. This implosion has in fact highlighted the fragility of neo-banks and payment institutions, two entities which many startups across the world have come to rely on since the beginning of the startup boom in the mid 2000s.

In addition, two truths have now been exposed by the fall of SVB: firstly, that the concentration of capital by VCs and their startups in one bucket is bad risk management, and secondly, that focusing on one client base can also be fatal. The concentration of SVB client base among VC funds meant that the herd behaviour of the industry led to it being brought down in 24 hours. Because so many investors encouraged their startups to do business with SVB while also conducting their own financial transactions with the bank, meant that the bank’s failure impacted all of their stakeholders, not to mention their customers and employees.

Overall, for VCs and other financing institutions, the message of the SVB collapse is clear: they must advise their startups to diversity their investment portfolio and to not entrust their liquid cash with just one banking institution; additionally, while the lure of an easy-to-use neobank may come calling, it is best to also invest in traditional banking while waiting for the fintech space to fully mature.

Sources:

1. https://globaledge.msu.edu/blog/post/57251/effects-of-the-silicon-valley-bank-colla

2. https://www.tradefinanceglobal.com/posts/details-and-implications-silicon-valley-bank-collapse/

3. https://www.theedgemarkets.com/node/659015