From the peak of both sentiments and valuations in 20/21, driven by the spotlight COVID put in the sector to the strong decline the following years, we came into 2023 with a careful optimism that it will be a year of recovery. Although not near the highs of 20/21, there has been steady momentum within the sector with a strong push right at the end ($31bn worth of deals announced in December 2023). We highlight key topics that will potentially carry-over into 2024.

M&A Activity to Continue Momentum into 2024

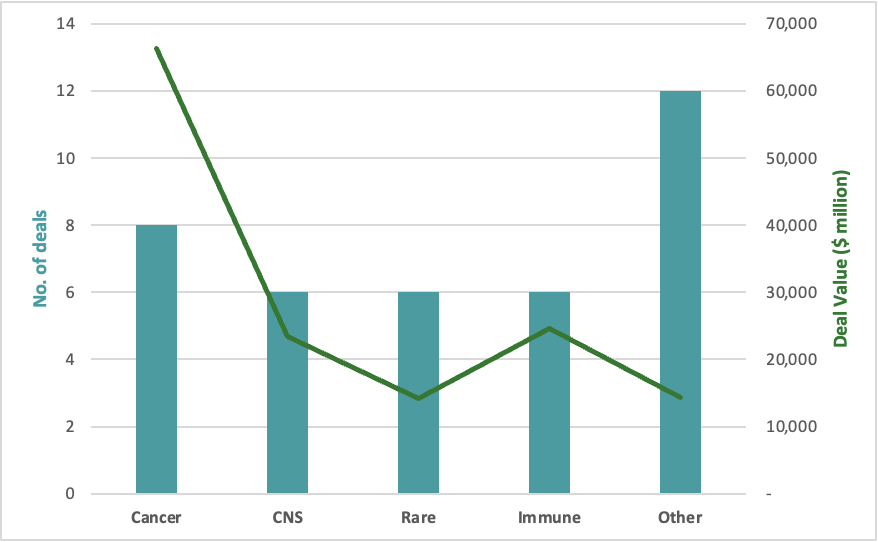

Big pharmas went on a buying spree in 2023: two mega deals last year (Pfizer/Seagen for $43bn; Amgen/Horizon Therapeutics for $28bn), strong activity towards the year end, with more than $140bn spent by large pharmas. Other than the mega deals, overall deal values are sizeable at an average of ~$7.5bn. We anticipate this trend to continue going into 2024. Four deals totaling USD 4.3bn was announced at the recently concluded JPM conference, as large pharmas seek to fill their late stage pipeline. Their blockbuster brands (including Humira, Keytruda, Opdivo Yervoy, Eylea) are expected to lose patent exclusivity before 2028, which is +$160bn of revenues at risk.

Figure 1. 2023 M&A in key therapeutic areas

Several Sectors are Seeing Increasing Interest

Oncology remains a consistent interest from Biopharmas across 2020-2023. Specifically, antibody drug conjugates observed a significant spike not only in acquisitions but also licensing activities. We also saw an increased interest in radiopharmaceuticals with two sizable acquisitions this year (Lilly/Point Biopharma $1.4bn deal and Bristol Myers/Rayze Bio $4.1bn deal). To add on, it’s a space that’s received a 550% increase in VC deals from 2017 according to GlobalData. Given the large oncology market, large biopharma’s goal seems to be at amassing the broadest number of approaches across each specific tumor type and breadth of oncology as a whole.

This year we experienced a surge in activity in obesity, with a total addressable market of $50-100bn, it is set to be the largest therapeutic class of this decade. Therefore, we expect to see more activity here beyond existing players (Novartis and Lilly), including complementary/combinatorial mechanisms to the GLP1s.

Interest in CNS/Neuro diseases also saw an uptick in activity with AbbVie and Bristol Myers making back-to-back acquisitions of Alzheimer’s assets this year. Another reference point is that many pharma companies have specifically called out neuroscience as an area of interest during their investor calls/updates (AbbVie, Bristol Myers, JNJ). JPMorgan’s report on Biopharma Licensing and Venture showed CNS as the second highest indication in terms of R&D licensing activity for 2023, with $21.1bn in deal value. We will definitely be watching this space closely.

Public Company Valuations Entered into a Big Correction Zone

This is bad news for the 2021 IPO cohort given their high valuation entrance point. In a Jefferies Investor Note, analysts reported that recent IPO valuations of pre-clinical companies are now at $300-400m range (vs. $800m in 2021) and Phase 1 companies are starting valuations near $300m (vs $900m in 2021). We hope investor appetite will return in 2024, given more tempered valuations and an improved XBI.

Biotech Sentiments are Improving

We track the XBI (S&P Biotech ETF), a benchmark that is used to gauge biotech sentiment. The index comprises of more than 130 US small/mid cap biotech companies that are equal-weighted. There are 62 early-commercial or near commercial stage and the rest are clinical stage making them more volatile on binary clinical catalysts. The XBI ended at a positive +10% at the year-end 2023 (vs. -28% in 2022, -20% in 2021), rebounding from multiple lows throughout the year. XBI is also slightly up the first week of Jan (+3%), no doubt riding on the strong sentiments coming out from JPM2024.

Figure 2. Positive momentum for XBI towards the end of 2023

We believe the sector will continue recovering in 2024, catalyzed by these key events: big binary Phase III data readouts, successful execution of recently FDA-approved products in large TAMs (Alzheimer’s, sickle cell, obesity, RSV vaccines, etc.), rate cuts encouraging investors to take on more risk and the burgeoning access to capital. We maintain an optimistic outlook on the sector driven by strong progress, technological advancement and returning investor confidence.