Following our article on the National Energy Transition Roadmap, Xeraya outlines the Chemical Industry Roadmap 2030 (CIR2030), which was announced earlier this month. A strategic plan for the development of Malaysia’s chemical industry, the Roadmap’s aim is to drive economic growth, create socio-economic benefits, and promote sustainability. Additionally, policies and strategies under CIR2030 will help increase the contribution of the chemical output value to the sector (which is currently between RM80 billion and RM90 billion) with an additional RM40 billion by 2030.

CIR2030’s Scope and Aspirations

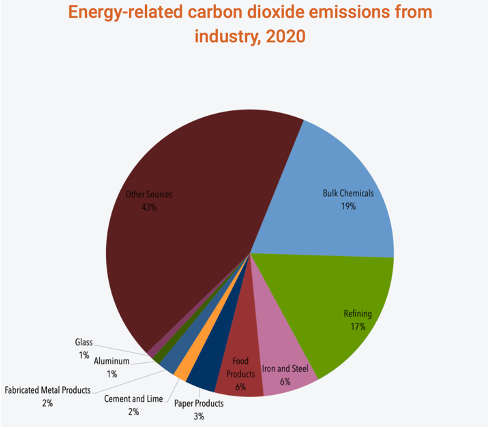

Broadly speaking, the CIR2030 is aligned with the nation’s Twelfth Malaysia Plan (RMK-12), the National Investment Policy (NIP), and lastly, the New Industrial Masterplan 2030 (NIMP2030), which is currently being finalised and should be announced by the end of August 2023. While CIR2030 is focused on enhancing the competitiveness and the addition of higher value-add products in the chemical space, it also has the goal of facilitating Malaysia’s sustainability efforts and ESG goals. This is timely, as the chemical industry is known to be a significant contributor to climate change; in terms of energy produced by oil and gas, the industry accounts for 28% of industrial energy use, and 10% of total energy use. Additionally, it is responsible for almost one-fifth (or 18%) of global industrial carbon dioxide emissions.

In terms of scope, CIR2030 and its initiatives cover the entire chemical value chain, with the government having assessed 25 industry sub-segments which are now under its purview. These 25 segments are divided into three categories:

- Organic chemicals – Base chemicals (methanol); organic intermediates (acrylic acid); specialties (plastic additives); fertilisers (ammonia), polymers and plastics (commodity plastics); and agrochemicals (pesticides).

- Inorganic chemicals – Building blocks and intermediates (chlorine); as well as specialties (electronic chemicals).

- Bio-based feedstock – Oleochemicals and biochemicals (fatty acids, methyl esters, and glycerine).

Overall, the purpose of this Roadmap is to achieve Malaysia’s aim of becoming a leading chemical player in the APAC region, which will be measured by considering global benchmarks and expanding on untapped potential within the local chemistry industry. As such, CIR2030 has five overarching objectives or aspirations that adhere to these two principles and will drive the plan forward:

Aspiration 1:

Increasing the industry’s value: expanding the industry’s size and diversifying its capabilities to increase its share of high-value products and special segments;

Aspiration 2:

Enhancing industry integration: bolstering the country’s transition into a primary supplier for downstream industries (i.e., companies that refine petroleum crude oil and process and purify raw natural gas to create products), boosting the share of domestic content within the industry, and reducing imports, as well as increasing links between this sector and other high-priority sectors.

Aspiration 3:

Increasing the industry’s competitiveness: positioning Malaysia as a leading player in the chemical exports market in Southeast Asia, and as top investment destination for chemical industry players.

Aspiration 4:

Improving the sustainability of the industry: the initiatives should support Malaysia’s climate ambitions, reduce carbon intensity, and boost the nation’s economy by providing new high-skilled jobs.

Aspiration 5:

Introducing technology to advance the industry: using high-tech products in the industry’s processes which are the result of local innovation and technology development.

CIR2030’s Priority Segments

While CIR2030 has 25 sub-segments of the chemical industry to focus on, three key segments have been highlighted as the starting point for this Roadmap – base chemicals, such as fertilisers, oleochemicals, and CI (chemical ionisation) intermediates; plastics and polymers, including high-performing composites, and synthetic rubber; and specialty chemicals, such as agrochemicals, care chemicals, nutrition chemicals, electronic chemicals, and construction chemicals.

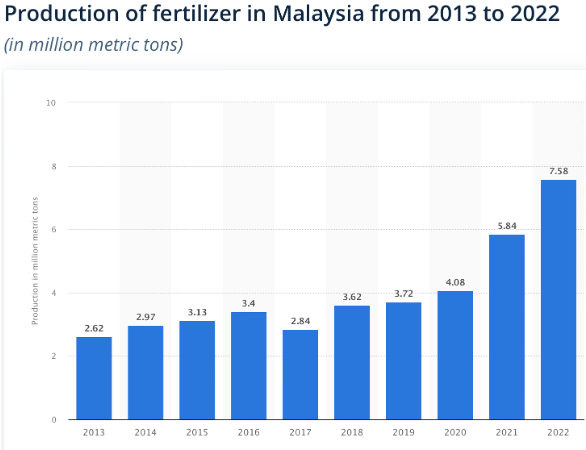

Zooming in specifically on fertilisers, as seen in the chart below, Malaysia has been acknowledged globally as a major producer in the space; as such, two strategic focus areas outlined in CIR2030 involve the increased production of environmentally friendly fertilizers (EFFs), and the modernisation of current fertiliser manufacturing capabilities.

How CIR2030 will be Implemented and Governed

To kickstart the work on CIR2030’s various projects, the government has identified 10 key enablers; these enablers and their initiatives will be tracked, monitored, and implemented according to a set timeline through a governance structure which has four working groups:

Working Group 1 — Policies and Incentives:

- Enabler 1 is a targeted chemical investment campaign, which involves enhancing the chemical investment portfolio and encouraging key domestic industry players to invest in relevant chemical sectors.

- Enabler 2 is the easing of trade, including establishing free trade agreements (FTAs) with key export markets to boost the competitiveness of domestic products.

- Enabler 3 is the adoption of modernised operations, which will see the creation of an innovation acceleration team to help chemical companies adopt IR 4.0 technologies in their operations and processes. Financial support will also be provided to these companies to support the transition.

Working Group 2 — Capabilities and Technology:

- Enabler 4 is the enhancement of the industry’s capability to innovate and commercialise technology. This includes the creation of a Chemical Collaboration Platform (CPP) that will build an ecosystem for advanced research and commercialisation, as well as financial support in the form of research and development (R&D) grants, as well as the establishment of a technology committee to govern and advise on emerging technologies within the industry.

- Enabler 5 is building a large base of skilled labour by reviewing and improving Technical and Vocational Education Training (TVET) and higher education training in the chemical space; for foreign talent, the government will be expanding the Residence Pass and fostering a talent programme to nurture and attract people with the right skillsets for the industry.

Working Group 3 — Infrastructure

- Enabler 6 focuses on developing an improved infrastructure for chemical players by introducing the Extended Product Responsibility (EPR) policy for effective end-life waste management, increasing testing capabilities, and ensuring adequate growth within the country of waste management facilities.

- Enabler 7 involves creating a holistic approach to the proposition of industrial chemical parks to attract investments in the industry.

Working Group 4 — Sustainability

- Enabler 8 is the formation of a regulatory framework for the circular economy, which includes introducing a mandate for plastic packaging that will encourage chemical players to use sustainable materials; an emissions pricing mechanism for companies in this space will also be implemented.

- Enabler 9 concerns sustainable incentives; a digital platform for local waste will be developed, while chemical players will receive educational support and best practice guidance on sustainability. The government will also provide support to companies offering new technology and business models that focus on recycling and the production of end products that use bio-based chemicals and recycled plastics.

- Enabler 10 sees the establishment of a value chain consortia, essentially an association of industry players including businesses, knowledge institutions, NGOs, and ministries to discuss and plan the creation of sustainable practices for producing plastics, synthetic rubber, and oleochemicals.

Pushing a Valuable Industry Forward

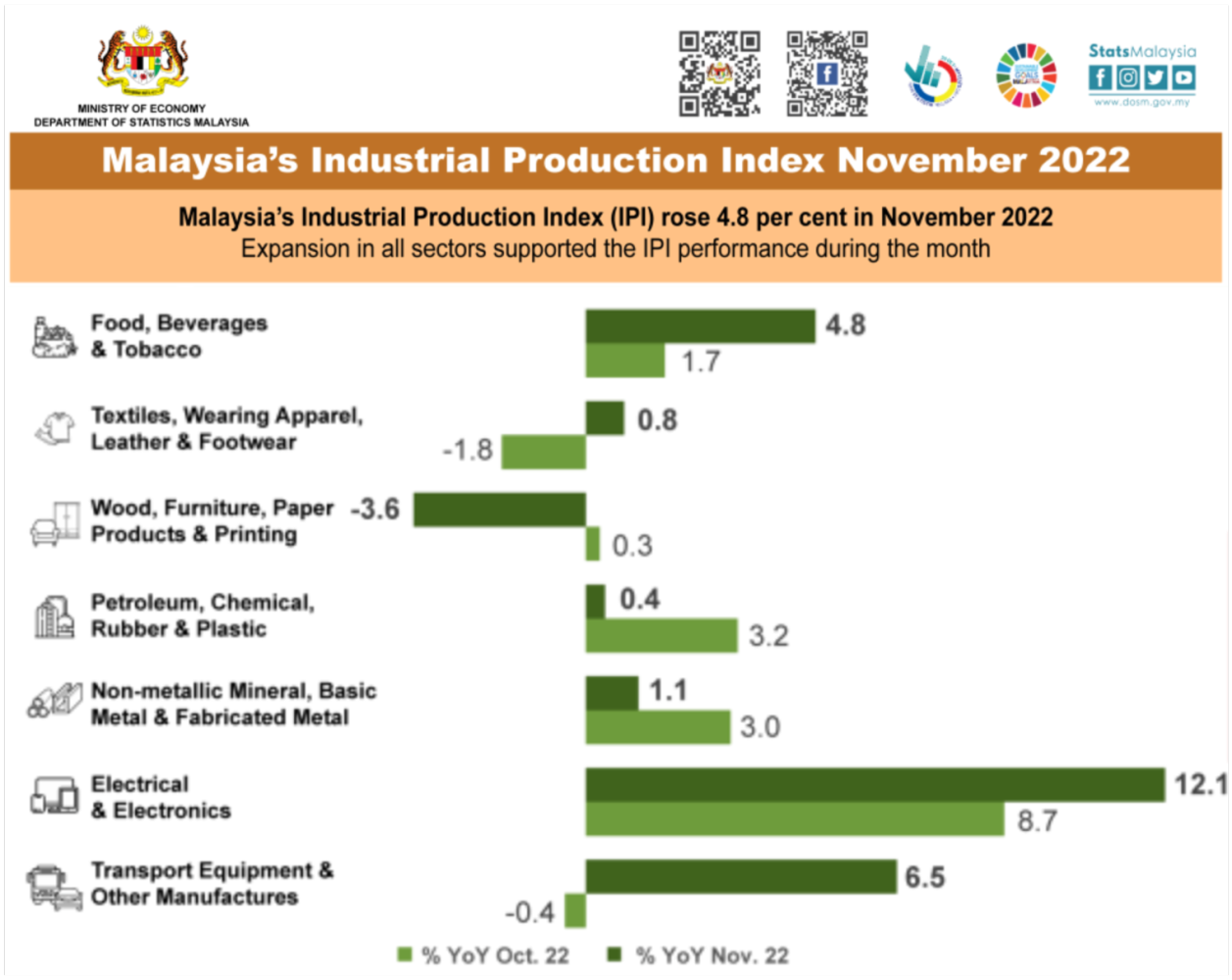

Strategically speaking, Malaysia’s chemical industry is considered to be one of the nation’s most valuable spaces, having contributed 6% to the GDP in 2022. It also employs nearly 293,000 workers, or 12.5% of the 2.6 million total manufacturing labour force. Specific segments, such as the chemical and petrochemical sector stands out as the third-largest contributor to the country’s trade of manufactured goods and has forward linkages the electrical and electronics (E&E), automotive, agriculture, and pharmaceutical industries.

As such, the announcement of CIR2030 shows Malaysia’s commitment to growing an already burgeoning industry so that it reaches its full potential and pays dividends to the nation’s economy – all while adhering to stringent ESG-based standards to ensure that its impact on the environment is minimised.