Like so many buzzwords in the 21st century, ESG (Environmental, Social and Governance) has been splashed across the pages of media platforms, newspapers, and broadcasted over social media channels and traditional TV programmes alike. These days, the average person cannot walk into a mall or order things online without stumbling across another brand with their ESG message. While it may be exciting to think and hope that humanity has finally realised the impact our progress and actions make on the planet, it does make one question, is there an ulterior motive behind companies pledging to do good and go green?

The short answer? Yes. Naturally, businesses will not be making a commitment to sustainability if there aren’t promised returns promised; they owe it to their business and their shareholders to ensure that any effort made in this regard will still bring in the money. However, as mentioned in our previous articles on greenwashing, businesses the world over are now being accused of using the message of sustainability to simply gain more profit.

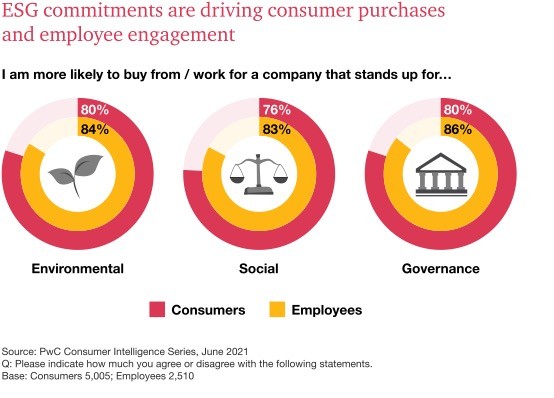

On the back of demand from employees and consumers alike, consumer-facing brands claim to be educating and building awareness about the cause, as noted by PwC in a survey done last year:

While business-facing brands want to be seen as doing what they can to foster a better future for this planet, according to Nasdaq.

However, there is a very real danger here that what we’re seeing when it comes to ESG commitments from both types of companies is all hog/greenwash. As illustrated in the chart by Globescan below, there is a very real movement against businesses claiming to do good, while in actuality it’s all about the profits:

As such, for many organisations, many questions lie ahead when it comes to ESG. Is this a trend or will it be here to stay? What exactly is expected of a company that wants to highlight their sustainability strategy? And lastly, what can a business do to show that they are truly committed to the cause?

The ESG Trend/Commitment

Today, an estimated one-third of managed assets globally are invested in ESGs (approximately valued at US$35 trillion). The reason for this is simple: as more people become aware of climate change and its growing threat to the world, many have turned to aligning their financial commitments to their concerns about global warming and global injustice.

Another key factor playing up the idea of sustainable investing is the fact that government institutions are mostly deadlocked on policies aimed at battling climate change, and as such, people are focusing on the private sector and putting the onus on companies to solve these issues; there was even a recent poll which pointed out that globally, people are now expecting organizations to be responsible for paying the growing cost of climate mitigation.

The last driving factor behind the rise of ESG would be the interest the asset management industry has shown in it; this is due to the fact that selling products billed as “environmentally friendly” or “green” is a very lucrative way of charging higher prices for products.

The questions remain: is ESG a passing trend, or is it here to stay? What is going wrong with this phase of sustainable investing? From a macro perspective, the fact that many companies, organizations, institutions, and countries pledging their resources to fight for the earth seems like an amazing development; however, there are some fundamental problems to be tackled if we truly want to see the results we’re hoping for:

1. Too many goals

Most organizations are looking to take on several different challenges when pledging to the ESG cause, from environment and social governance to diversity, equity, and inclusion; as such, many are confused about their next steps and how to truly align business objectives to the right goals. Inevitably, companies will have to pick and choose which ESG targets their business can truly meet.

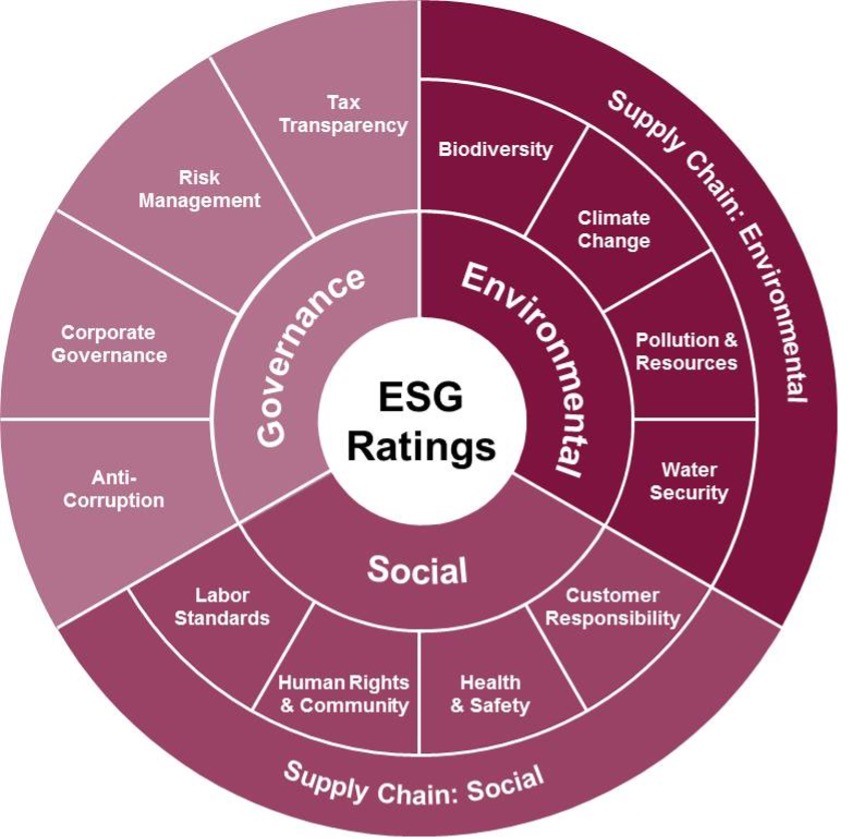

2. How ratings are calculated

The Organization for Economic Cooperation (OECD) and other regulators have been questioning how ESG ratings are calculated since the boom occurred a few years ago; the biggest concern is whether the ratings or numerical scores that companies gain are transparent. While the current ratings take into account all 3 pillars of ESG, there are a large number of organizations that excel in 1 or 2 pillars, but show bad performance for another pillar; however, they somehow manage to maintain a high rating.

3. What the “E” truly stands for

Most of the public and regulators are now questioning how the E in ESG is considered for ratings; currently, the ratings do not measure the impact a company has on the Earth and society, it measures the risk the world poses to a company’s profits. This means that while an organization’s operations may pose a significant threat to the earth, the situation may not be the same reversed, as such, the business’ ESG rating can be upgraded despite its questionable sustainability commitments/practices.

These are just three concerns the world has when it comes to the ESG/sustainable investing boom; there has also been research that has found that companies included within an ESG portfolio actually worse compliance records for issues such as labour and environmental regulations; and it was also found that there was no significant change in the environmental or social behaviour of a company when it is added to an ESG fund.

A sample of an ESG ratings chart

Source: Gravity Group

Making a Real Impact

While all these facts may seem to be doom and gloom for investors looking to achieve their ESG goals and improve their sustainability strategy, there is a light at the end of the tunnel, also known as a way to really walk the talk when it comes to ESG.

One good method? Implementing the Beta Activism approach, which was highlighted recently at the Khazanah MegaTrends Forum. Beta Activism refers to institutional investors that are looking beyond trading securities and moving towards evaluating investments from a systematic and structural lens. The goal would be to achieve better long-term risk-adjusted returns that also drive change on targeted issues to reduce the overall market’s systematic risks.

Key players that need to pay attention are corporations, as they have a big role in driving the UN SDGs and are a key beneficiary of the impact. Additionally, global corporations have massive influence on their audience and with it the power to change perceptions.

The concept of beta activism should be viewed as an enabler that will equip organizations in their preparations for mitigating climate risks. For impact-oriented companies on the other hand, they will need to ask the big questions of why they’re doing this and what impact they’re trying to create. To answer these questions, businesses should use evidence-based research, which will accelerate implementation and measure impact.

For institutional investors, the focus when it comes to beta activism should be on implementing a good governance process and procedures from reliable standards. They will need to be transparent and publish their voting principles as well as their decision-making process.

The issue of greenwashing can also be addressed by embracing beta activism: proper governance, data transparency and good investor judgements can be put in place.

Lastly, beta activism will help lead the way as impact investment continues to gain prominence: to date, around 40% of funds are now centred around impact, and are not just purely financially driven.

While the road to achieving actual ESG goals may be rough, investors and companies alike should keep in mind the six characteristics of sustainability an impact investing: 1) know your objectives, 2) ensure sustainable and consistent commitment 3) have an organization strategy and incentives that are aligned to creating impact 4) use data to gather feedback and gain insights 5) collaborate with others to drive true impact; and 6) centre equity within an organization.

Sources:

2. https://www.nasdaq.com/articles/strong-esg-practices-can-benefit-companies-and-investors-2019-03-13

3. https://earth.org/esg-investing/

4. https://kmf.com.my/presentation/core-session-2-firms-and-transformation/