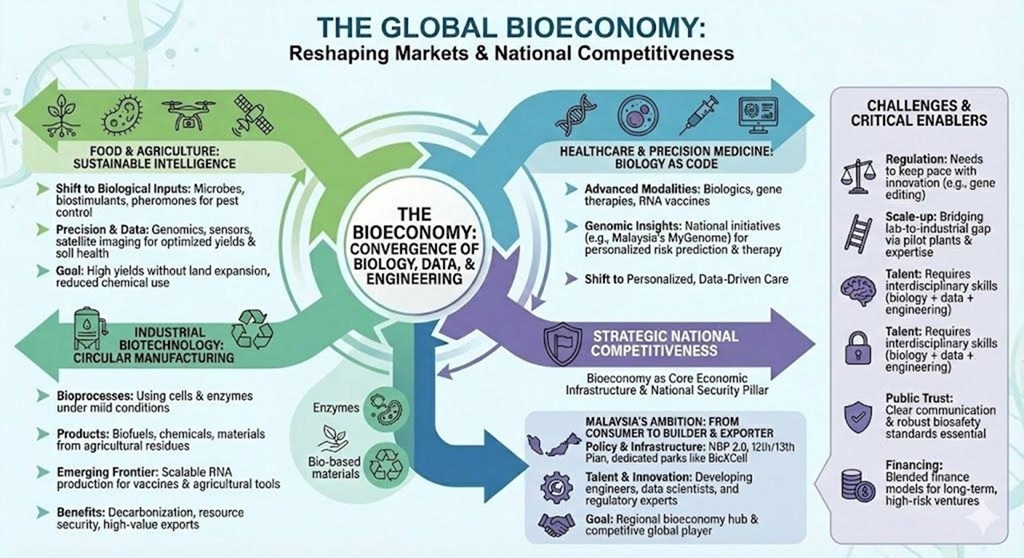

The global economy is entering a new phase in which lifesciences is becoming core economic infrastructure, much like electricity in the industrial age or the internet in the information age. This emerging “bioeconomy” is not just about new drugs or genetically modified crops. It is a broader transformation in how we produce food, treat disease, manufacture materials, manage waste and think about national competitiveness.

Biotechnology sits at the centre of this shift. Engineered cells now produce high-value chemicals, biological inputs are changing the way farmers manage their fields, and advanced therapies are treating diseases at the molecular level. For countries such as Malaysia, this is both an economic opportunity and a strategic question: do we remain primarily a consumer of imported technologies, or do we become a builder, owner and exporter of bio-based solutions?

From Industrial Economy to Bioeconomy

Economic development has historically evolved through distinct waves: hunter-gatherer, agricultural, industrial and information economies. Researchers now increasingly describe a fifth stage, the bioeconomy which is characterised by the sustainable use of biological resources, biological processes and life-science knowledge to generate value across many sectors.

In practical terms, the bioeconomy involves shifting from fossil resources to biological feedstocks; using biotechnology, genomics and related tools to redesign products and processes, and designing circular systems in which biological materials can be reused, recycled or safely returned to the environment. Biotechnology in this context functions as a general-purpose technology, similar to semiconductors or digital networks. Once the underlying platforms exist, they can be adapted and applied in agriculture, healthcare, manufacturing, energy, and environmental management simultaneously. That breadth of application is why the bioeconomy has macro-level implications for growth, trade and jobs.

Food and Agriculture: From Inputs to Intelligence

Agriculture is one of the clearest places where the bioeconomy is already visible. For decades, productivity gains came mainly from synthetic fertilisers, chemical pesticides and mechanisation. Today, biology itself is becoming the main lever.

Engineered microbes and beneficial fungi are being formulated as biofertilisers and biostimulants that improve nutrient uptake, enhance root growth and help plants tolerate heat, drought or salinity. Biological crop protection agents are reducing dependence on synthetic pesticides and lowering chemical residues in soil and water. Major agriscience companies investing in microbial inoculants and biofertilisers signal that these are no longer niche experiments; they are entering the mainstream of commercial agriculture.

Another promising frontier in sustainable crop protection is the use of biologically derived pheromones to manage insect pests with far greater precision than conventional chemicals. In rice cultivation, for example, pheromone-based mating disruption has emerged as an effective method for controlling the rice stem borer, one of Asia’s most destructive paddy pests. Instead of killing insects outright, these pheromones interfere with the pest’s ability to locate mates, leading to a natural reduction in population over time. Because they target behaviour rather than physiology, pheromones avoid the resistance problems commonly seen with insecticides and have no harmful effects on beneficial species, soil microflora or surrounding ecosystems. They can be deployed through controlled-release formulations that steadily emit synthetic versions of the insect’s own signalling compounds, offering growers a highly targeted, residue-free and environmentally safe alternative that aligns well with the broader shift toward biological inputs and regenerative farming. As rice remains a strategic staple crop for Malaysia and much of the region, pheromone-based biocontrol represents a scalable tool for raising productivity while reducing chemical dependency, strengthening both food security and sustainability goals.

When these biological tools are combined with data and precision agriculture, the impact multiplies. Genomics and phenotyping enable precision breeding of crops tailored for local conditions. Sensors and satellite imaging help farmers apply inputs exactly where needed, while traceability systems link sustainable practices to premium markets and emerging carbon schemes.

For Malaysia, with established strengths in palm oil, rubber and other crops, as well as ambitions in high-value agriculture, biotechnology offers three important advantages. It can lift yields without expanding cultivated land, easing pressure on forests and biodiversity. It can improve soil health and water efficiency, making farming more resilient to climate variability. And it can open new market segments for certified sustainable and bio-based products, aligning with the 12th and the 13th Malaysia Plan and the national aspiration to be a competitive bioeconomy hub.

Healthcare and Precision Medicine: Biology as Code

Healthcare has always been closely associated with biotechnology, but the nature of innovation is changing. The sector is shifting from a model based on broad-acting small-molecule drugs to one built on biologics and advanced modalities such as monoclonal antibodies, recombinant proteins, cell and gene therapies, RNA-based vaccines and next-generation diagnostics.

These platforms let clinicians intervene more precisely, targeting the underlying molecular drivers of disease rather than just symptoms. At the same time, the ability to “read” biological information has improved dramatically. As sequencing costs have fallen, genomic data, molecular diagnostics and biomarker panels are becoming central to how we predict risk, select therapies and monitor response.

Across ASEAN, national genome initiatives are becoming critical pillars of precision medicine, enabling countries to build population-wide genetic reference datasets that can inform diagnostics, therapeutic design and public health strategies. Malaysia’s MyGenome project is laying the foundation for a comprehensive national genomic database that captures the country’s rich ethnic diversity, providing essential insights into disease susceptibility, pharmacogenomics and inherited disorders. Singapore has taken a similarly ambitious route through large-scale genome programmes integrated with its national health system, enabling clinicians to apply genomic information in early detection, rare disease diagnosis and oncology. These initiatives are not isolated scientific exercises; they are strategic investments in healthcare resilience and economic competitiveness. By generating locally relevant genomic data instead of relying solely on Western-centric datasets, both Malaysia and Singapore are positioning themselves to lead in personalised medicine, support biotech innovation and attract global partnerships in clinical research, therapeutics and digital health.

Within this landscape, the human microbiome, the community of microorganisms in and on our bodies is one important layer of biology, but not the only one. Microbiome-informed approaches are being explored for chronic disease, immunity, metabolism and mental health. They sit alongside genomics, proteomics and other “omics” fields as part of a broader shift to personalised, data-driven medicine.

In Malaysia, universities, hospitals and young companies are beginning to explore these opportunities. Efforts range from personalised nutrition and functional foods to next-generation diagnostics and targeted therapies. These initiatives attract foreign direct investment, deepen public–private collaboration and create demand for specialised skills in genomics, bioinformatics, clinical trial design and regulatory sciences. Over time, they can support not only better health outcomes, but also new exportable services and products in the health and life-science sectors.

Industrial Biotechnology and the Circular Economy

Industrial biotechnology applies biological systems such as cells, enzymes and metabolic pathways to manufacturing. Instead of relying on petrochemical processes that operate at high temperatures, high pressures and high emissions, bioprocesses use organisms or enzymes to catalyse reactions under milder, more resource-efficient conditions.

This shift is already visible in several markets. Fermentation technologies convert sugars and agricultural residues into a growing list of products: biofuels, platform chemicals such as succinic acid, specialty solvents, organic acids and food ingredients. Engineered enzymes are deployed in textiles, detergents, pulp and paper, food processing and pharmaceuticals to reduce energy use, improve yields and lower waste. Bio-based polymers, elastomers and surfactants are offering alternatives to conventional plastics and materials.

A rapidly advancing area within industrial biotechnology is the large-scale production of RNA, which is poised to become a foundational input for vaccines, therapeutics and even agricultural applications. Until recently, RNA manufacturing was limited by complex enzymatic processes and high material costs, making RNA-based products expensive and difficult to scale. New bioprocess innovations are changing this trajectory. Researchers and companies are developing microbial and cell-free systems capable of producing RNA in far greater volumes, with improved yields and significantly lower purification burdens. As these platforms mature, RNA can be manufactured in industrial fermentation tanks much like enzymes or amino acids today, unlocking economies of scale that dramatically reduce costs. This shift will not only expand access to RNA vaccines and gene-modulating therapies, but also enable new classes of bio-based products, from RNA pesticides to precision gene-regulation tools in agriculture. In the broader bioeconomy, scalable RNA production represents a step toward more flexible and programmable biomanufacturing, where biological information can be rapidly translated into commercially viable products at industrial scale.

Malaysia has been proactive in positioning itself in this space. Under the National Biotechnology Policy 2.0, sustainable industrial development and the bioeconomy are explicit priorities. Dedicated facilities such as the Bio-XCell park in Iskandar Malaysia provide specialised infrastructure and incentives for companies in biomanufacturing. Firms producing bio-based succinic acid, amino acids and other fermentation-derived products are already anchoring local supply chains that connect Malaysian biomass to global markets.

From a macroeconomic perspective, industrial biotechnology does three things at once. It supports decarbonisation by substituting fossil-derived products with lower-emission alternatives. It strengthens resource security by leveraging domestic biomass rather than imported hydrocarbons. And it creates higher-value exports, as many bio-based materials and ingredients command premiums in international markets, especially where ESG performance is a differentiator.

Bioeconomy and National Competitiveness

Globally, more governments are treating the bioeconomy as a strategic domain, comparable in importance to semiconductors or artificial intelligence. The reason is straightforward: mastery of biological systems and bioprocesses has implications for food security, health resilience, climate goals and industrial competitiveness.

The strategic importance of biotechnology has been underscored by recent developments in the United States, where the Department of War announced a major initiative to elevate biotechnology as a core pillar of national security. The programme focuses on strengthening domestic biomanufacturing capacity, accelerating synthetic biology tools and securing supply chains for critical biological materials. This move reflects a broader recognition among advanced economies that biotechnology is no longer limited to health innovations but is integral to defence readiness, supply resilience and technological leadership. By framing biotechnology as a strategic asset on par with semiconductors, cybersecurity and advanced materials, the United States is signalling that the global competition for bioindustrial capabilities will intensify.

For countries like Malaysia, which aim to grow their bioeconomy footprint, this shift highlights the need for coordinated policy, investment in talent, and infrastructure capable of supporting secure and competitive biomanufacturing ecosystems. Malaysia has articulated its ambition clearly. The original National Biotechnology Policy set a target for biotechnology to contribute a noticeable share of GDP, and subsequent frameworks, including NBP 2.0 and elements of the 12th and 13th Malaysia Plan, have reinforced the emphasis on innovation-driven, sustainable growth. The policy mix includes regulatory frameworks to ensure safe and ethical use of biotechnology; incentive structures to attract investment; and programmes designed to link smallholders and rural communities to bio-based value chains.

Biotech parks and innovation clusters such as Bio-XCell provide shared facilities, logistics and support services that lower entry barriers for local and international firms. Initiatives like the Bioeconomy Community Development Programme help smallholders participate in higher-value chains, spreading the benefits of the bioeconomy beyond urban centres. According to the Malaysian Bioeconomy Corporation, bioeconomy-related activities already contribute several billion ringgit to national output, with agriculture, healthcare and industrial biotechnology all playing meaningful roles.

For an investorsm this policy environment matters because it signals long-term commitment. Stable regulation, clear national priorities and public co-investment help to de-risk private capital and support a pipeline of opportunities across the value chain – from early-stage technology platforms to commercial-scale manufacturing.

Capital Flows and Market Dynamics

The bioeconomy cuts across asset classes and time horizons. Venture capital supports early-stage companies in areas such as synthetic biology, gene and cell therapies, platform enzymes and enabling tools. Growth equity and infrastructure investors finance the scale-up of fermentation plants, biologics manufacturing facilities and specialised logistics. Public markets provide exit routes and liquidity once companies reach sufficient scale and maturity.

Market cycles will always bring volatility, particularly in publicly listed biotech, but the underlying structural drivers are durable: ageing populations and rising healthcare expectations, food security concerns, climate and sustainability imperatives, and the convergence of AI, automation and biology. These long-term forces continue to pull capital into the sector even when short-term sentiment fluctuates.

For Malaysia and the broader region, the strategic question is how to position within global value chains. One route is to become a preferred testbed for agricultural innovation, industrial bioprocesses and clinical development, leveraging diverse ecosystems and competitive cost structures. Another is to deepen capabilities in biomanufacturing, serving as a regional hub for biologics, vaccines, enzymes and other bio-based products. A third is to build specialised services in areas such as regulatory science, data analytics and quality systems that support multinational biopharma and industrial biotech firms.

Ecosystems that combine strong science, predictable regulation, high-quality infrastructure and patient capital are emerging as the most attractive. Malaysia has many of these ingredients, but competition from other bioeconomy hubs is intensifying.

Challenges and Critical Enablers

The bioeconomy’s potential is significant, but it will not realise itself automatically. Several cross-cutting issues need to be addressed.

Regulation must keep pace with innovation. New technologies such as gene editing, synthetic biology and microbiome-based products do not always fit neatly into existing rules. Regulators face the dual challenge of safeguarding health and the environment while allowing responsible experimentation and timely market access. Risk-based, transparent and harmonised regulatory approaches will be critical.

Scale-up remains a major bottleneck. Many promising processes work in the lab but struggle at industrial scale. Bridging this gap requires access to pilot plants, bioprocess engineering expertise, and substantial capital expenditure. Shared facilities, contract development and manufacturing organisations, and public–private partnerships can help spread risk and accelerate learning.

Talent is another constraint. The bioeconomy does not only need scientists; it needs engineers who understand biology, data scientists who can interpret complex biological datasets, regulatory specialists, IP experts and commercially minded leaders who can translate science into products and businesses. Education systems and retraining programmes will have to adapt accordingly.

Public perception and trust are essential. Biotechnology touches food, health and the environment domains where people rightly pay close attention. Clear communication, robust biosafety standards and ethical guidelines are needed to maintain social licence. Missteps in one area can easily spill over into broader scepticism.

Finally, financing models must reflect the sector’s characteristics. Many bio-based ventures involve long development timelines and technical risk with binary outcomes. Blended finance, catalytic public funding and mission-driven investors can play an important role in complementing traditional venture and private equity capital, especially in the early and scale-up phases.

Conclusion

As the bioeconomy accelerates globally, it is becoming clear that lifesciences will define the next era of economic competitiveness just as digital technologies shaped the last. The convergence of biology, data and engineering is transforming how nations produce food, deliver healthcare, manufacture materials and secure supply chains. For Malaysia, the momentum built across genomics, industrial biotechnology, biomanufacturing and sustainable agriculture signals a real opportunity to lead rather than follow. Yet capturing this opportunity requires deliberate coordination: aligning policy with infrastructure, cultivating deep talent, attracting long-term capital and fostering public trust. The countries that succeed will be those that view biotechnology not as a niche sector, but as strategic economic architecture. If Malaysia continues to build on its current trajectory, it is well positioned to become a regional leader in the bioeconomy and a competitive player in the global lifesciences landscape.

Selected References (abridged)

Abavisani, M. et al. (2025). The frontier of health: Exploring therapeutic potentials of the microbiome. PharmaNutrition, 31, 100435.

Arujanan, M., & Singaram, M. (2018). The biotechnology and bioeconomy landscape in Malaysia. New Biotechnology, 40, 52–59.

Lokko, Y. et al. (2018). Biotechnology and the bioeconomy—Towards inclusive and sustainable industrial development. New Biotechnology, 40, 5–10.

Narisetty, V. et al. (2022). Technological advancements in valorization of 2G feedstocks for bio-based succinic acid production. Bioresource Technology, 360, 127513.

Rahman, A. et al. (2015). Stakeholders’ perception and acceptance towards biotechnology in agriculture-based industries in Malaysia. Scientific Bulletin. Series F. Biotechnologies, XIX.

Wei, X. et al. (2022). From Biotechnology to Bioeconomy: A Review of Development Dynamics and Pathways. Sustainability, 14(16), 10413.

Yang, L. et al. (2021). Shifting from fossil-based economy to bio-based economy: Status quo, challenges, and prospects. Energy, 228, 120533.