The manufacturing industry has long-been a key driver of Malaysia’s economy and is well-recognised as playing a crucial role in the country’s journey towards achieving developed nation status.

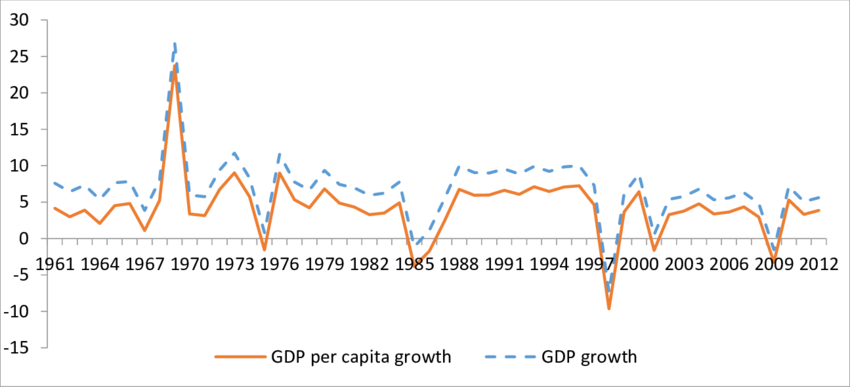

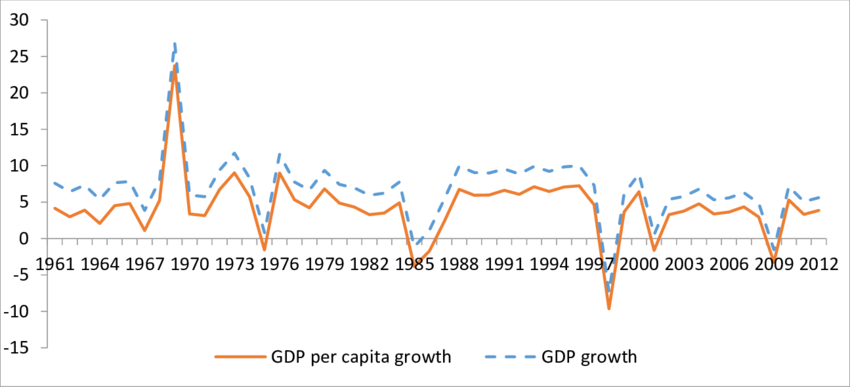

In the decades preceding the 21st century, Malaysia recorded rapid economic growth; between 1970 and 1980, the economy grew by 8.3% before dropping to 5.9% during the brief recession in the mid-1980s, and then subsequently rising to 9% from 1990 until the Asian Financial Crisis of 1997. Throughout these years, the manufacturing industry progressively led the nation’s economic expansion, growing from 13.3% share of the country’s GDP in 1970, to approximately 30% by 1997. In terms of exports, the trade of manufacturing goods increased from 12% in 1990 to 81% in 1997.

The industry’s seemingly unstoppable boom was even prevalent after the Asian Financial Crisis; while the economy contracted by 7.5% in 1998, it was able to bounce back the following year expanding by 5.4%, a feat that was largely contributed to by the success of the country’s manufacturing space.

Keenly aware of manufacturing’s pivotal role in the development of the country, the Malaysian government has released a series of Industrial Master Plans; beginning in 1986, each Plan has outlined various initiatives that are geared towards boosting the progress of this vital industry. IMP1 (1986 – 1995) laid the foundation for the growth of Malaysia’s manufacturing sectors and promoted the processing of natural resources instead of exporting them in raw form. IMP2 (1996 – 2005) subsequently had the aim of broadening the nation’s manufacturing capabilities via cluster-based industrial development strategies. The government’s third iteration of the Plan, IMP3, was then focused on increasing Malaysia’s global competitiveness by intensifying exports, nurturing domestic manufacturing companies, and encouraging international investment in domestic resources and facilities.

Since that time however, Malaysia and the world has had to face a new set of economic challenges – globalisation, a skills shortage, sustainability concerns, and the COVID-19 pandemic, are all key considerations that have prompted the creation of the 4th Industrial Master Plan, the NIMP 2030. Touted as being markedly different from the previous Plans, NIMP 2030 takes on a Mission-based approach in industrial policy development.

There are 21 sectors the government will be focusing on in this Plan, Xeraya has identified 6 fields that will be important catalysts for the success of NIMP 2030. Here is Part 2 of our story on these sectors.

Sector 4: Chemical

One of the priority sectors under NIMP 2030, the Chemical field has been acknowledged as an emerging growth sector for Malaysia’s economy. Via the initiatives and projects outlined in the Plan, this segment will play a crucial part in the country’s progress. For instance, will help to increase Malaysia’s position in the Economic Complexity Index (in 2021, the country was ranked 24th) and pave the way for the nation to achieve one of its ultimate goals – to emulate the economic complexity of neighbouring economies such as Japan, South Korea, and Singapore.

In 2022, the chemical sector’s GDP contribution to the economy stood at 6%; companies within this space were mainly producing and exporting feedstock and intermediate products, as well as importing value-added intermediates (specialty chemicals).

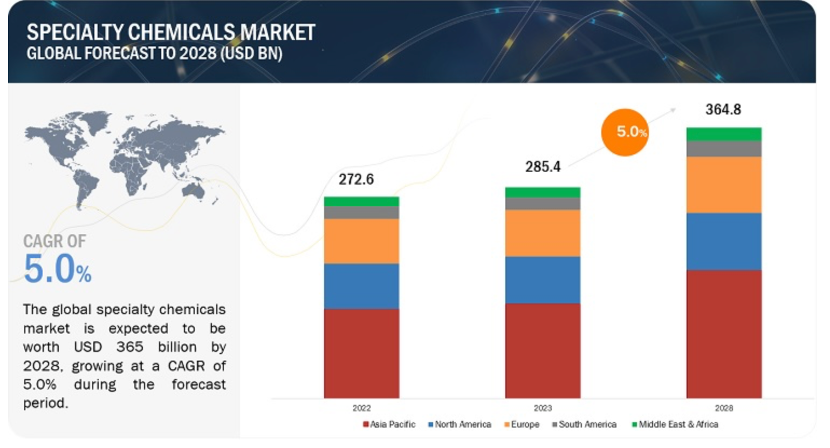

This latter category has shown the most potential for growth; in 2019, it accounted for 11.7% (or RM4.8 B) of investments in the Malaysian manufacturing industry. In fact, this is a segment that is booming on a global level – by 2028, this market will be worth $365 B, growing at a CAGR of 5% YoY. Based on these promising figures, under Mission 1 (Action Plan 1.1.3) of NIMP 2030, the Chemical sector will see a pivot from simply producing base chemicals to a dramatic increase in the production of specialty chemicals.

In terms of the type of specialty chemicals to be produced, 5 key focus areas have been identified:

- Electronic chemicals (used for etching, bonding, and testing semiconductors);

- Construction chemicals (concrete and metal constructions);

- Nutrition chemicals (flavouring and extending shelf life of food items);

- Care chemicals (textile manufacturing and personal care products);

- Agro-chemicals (pest control, fertilisers, and plant growth boosters).

As a result of this shift in priorities, Malaysia will see its domestic value chain strengthened, which in turn will reduce the country’s need to import; the strategy will also boost local development of niche expertise in specialty chemical technologies and complement the development and growth of other prioritised sectors (such as pharmaceuticals and E&E) as well as create opportunities for export. The Ministry of Trade, Investment, and Industry (MITI) will lead this Action Plan, with support from the Malaysian Investment Development Authority (MIDA), and key industry players. Together, their key activities will include attracting investments, fostering upskilling of local capabilities, and facilitating an ecosystem that will support the production of specialty chemicals.

Additionally, there are planned projects under NIMP 2030 that will aim to integrate the value chain of the chemical field with other sectors such as pharmaceuticals. Synergies will be created between the two sectors, with one prime example being the improved production of Active Pharmaceutical Ingredient (API) chemicals to create better quality generic drugs.

Sector 5: Petroleum Products and Petrochemicals

Since 2011, petroleum and petroleum products including petrochemicals have been among the top exports for Malaysia, with the main export destinations being China, the ASEAN region, and the US. As with palm oil and palm oil-based products, in 2022 the sector helped to drive the country’s trade performance, recording its highest export value ever and increasing by over RM10 B, as well as registering double-digit growth.

Simply defined, petroleum products refer to fuels that are made from crude oil and the hydrocarbons contained in natural gas; these fuels include jet fuel, distillate, and gasoline. Petrochemicals on the other hand are defined as chemicals derived from petroleum – the production process relies on multi-phase processing of oil and associated petroleum gas, and includes goods such as ethylene, propylene, and benzene.

To date, Malaysia has a leading position in terms of the market for these products, driven by the government’s previous Plan IMP3. Under NIMP 2030, however, the question of sustainability has come into play for this field. Identified as a hard-to-abate sector, the petroleum and petrochemicals spaces are capital-intensive and is involved in upstream activities, which makes it inherently difficult for companies to lower emissions due to their reliance on fossil fuels for energy and feedstock, their energy-intensive manufacturing processes, and their relative inability (financially) to adopt expensive decarbonisation technologies.

As such, the government has placed some of its initiatives to develop this sector under Mission 3: The Push for Net Zero. Specifically, Mission-based Project 3 (MPB3) sees the manufacturing industry deploying large-scale carbon capture, utilisation, and storage (CCUS) solutions to decarbonise the petroleum sector. There are 4 key components for this Project, including:

- Carbon capture: Capturing CO2 from industrial processes;

- Transportation: Involving ships, pipelines, and land transportation;

- Carbon storage: CO2 storage in depleted oil fields;

- Carbon utilisation: Developing products from the captured CO2 in alignment with circular economy principles.

To begin with, the entities championing this MBP will be investing in research and development (R&D) on CCUS technologies, subsequently facilitating the transfer of these technologies into Malaysia through partnerships with global companies. After that, the government will be prioritising the utilisation of CCUS to decarbonise selected oil and gas plants.

Sector 6: Food Processing

A sector that involves performing a series of mechanical or chemical operations on food to preserve or change it, the food processing field in Malaysia is another booming space. The country’s strategic location in the middle of vital air and shipping lanes makes it ideal for food production and processing, while its abundant natural resources from land and sea serve to make it a perfect place for the research, cultivation, production, and processing of foods. According to MIDA, in 2021, this sector accounted for about 10% of the manufacturing industry’s output and is growing at a rate of 3% YoY.

At present, there are 4 categories of food that are being produced, harvested, and processed in Malaysia:

- Livestock and Dairy: In terms of livestock, poultry processing constitutes 60% of Malaysia’s meat processing; while it can export poultry meat, the country still replies on imports for other meat products such as beef and mutton. Dairy products, such as milk powder, condensed milk and liquid milk are high demand segments and much of the nation’s current needs are met with imported goods.

- Fisheries: Producing 2.2 M tonnes of fish in 2019, this segment is very much export-oriented, with seafood processing involving the output of prawn and frozen products, canned fish, and surimi products. In 2020, the total exports of these products exceeded RM1.03 B.

- Cereal Products: Malaysia has well-established cereals segment; while it is dependent on imported raw materials, the country is a net exporter of cereal preparations and products, with net exports of over RM2.97 B in 2020.

- Chocolate and Sugar Confectionery: The 6th largest cocoa grinding and processing nation in the world, Malaysia is a net exporter of cocoa products, sending these items over 90 countries. In 2020, the exports of cocoa preparations were valued at RM6.2 B.

While these numbers are promising, the fact remains that Malaysia needs to bolster food production and processing to address its current food shortage challenges. In 2022, agro-food imports stood at RM64 B in comparison to exports of RM39 B in 2021, and the Department of Statistics Malaysia (DoSM), imports of food accumulated to RM482.8 B over the past decade, while exports totalled RM296 B.

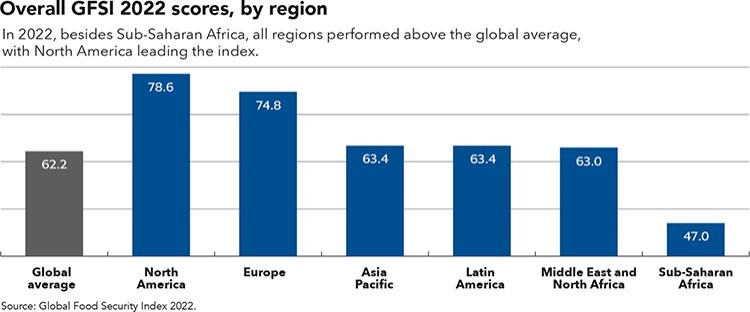

Additionally, the country ranked 40th on the Global Security Food Index (GSFI) in 2016, having a heavy reliance on imports for essential food products. Post-pandemic, its ranking dropped further to 41st. It is thus clear that Malaysia does not produce enough food locally, as agricultural productivity stands at 45% of the average for high-income countries.

To tackle this growing issue, the government previously launched the National Agrofood Policy (NAP 2.0), which runs from 2021 to 2030. This Policy was formulated with a vision to develop a sustainable, resilient, and technology-based agrofood sector, with a focus on prioritising food security and nutrition for citizens. Additionally, under NIMP 2030, the government has outlined two key goals for the space, including having companies expand into the production of ready-to-eat meals and the cultivation of alternative proteins, such as plant-based and food-technology alternatives to animal protein; products under these categories include items made from plants, fungus, algae, insects, and lab-grown meat.

NIMP 2030: A Plan That Encompasses the Entire Manufacturing Ecosystem.

A thorough read of the NIMP 2030 indicates that the government has outlined an exhaustive list of areas, sectors, and various components of the manufacturing industry that require solutions which can help further develop this crucial part of the Malaysian economy. While the 6 sectors highlighted in these articles are by no means the only fields to consider as vital to fostering progress, they are all fields that require varying levels of work from government institutions, industry players, and even venture capital firms. At the end of the day, the success of NIMP 2030 in increasing Malaysia’s economic complexity, positioning the country as a regional hub for innovation, and creating high-value job opportunities, hinges on the participation of all the relevant entities that operate within the ecosystem of the manufacturing industry.

Sources:

PRIMARY SOURCE:

MITI: New Industrial Master Plan 2030

Introduction –

- Nomura Foundation: Industrial Restructuring in Malaysia

- National Graduate Institute for Policy Industries (Japan): Chapter 4 Malaysia

Chemical –

- The Observatory of Economic Complexity (OEC) – Overview of Malaysian Economy

- Markets and Markets Research – Specialty Chemicals Market by Type, Application, and Region: Global Forecast to 2028

Petroleum Products and Petrochemicals –

- US Energy Information Administration – Oil and Petroleum Products Explained

- ScienceDirect – Petrochemical

Food Processing –