For the healthcare industry, a period of discontinuity is forecasted for the near future on several fronts. The COVID-19 pandemic still has aftereffects on the supply chain, has accelerated the adoption and progress of digital care, and many sectors are stretched thin due to labour shortages. Setting the pandemic aside however, other structural changes for healthcare systems globally give a sense of optimism. Technological innovations, such as digital tools that are changing how patients interact with care, the use of AI, and software that provides value-based care, are all helping companies to build new business models.

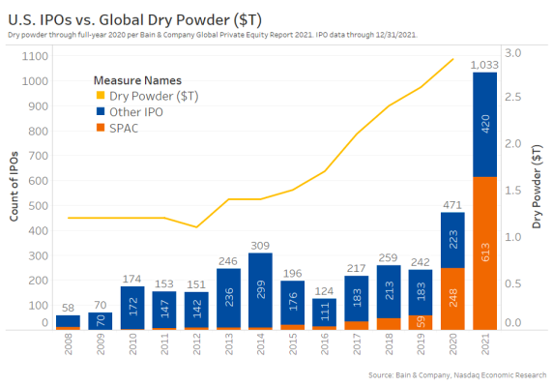

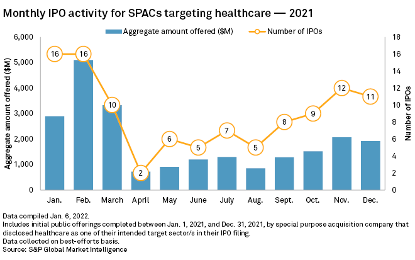

The markets are also reacting to these changes. The relative merits of private markets versus public markets are now in question. One of the key buzzwords that has been grabbing investor attention and media headlines is special purpose acquisition company (SPAC). Overall, 2020 saw 254 SPAC filings raising $74 billion; in 2021, that number ballooned to 613 SPAC listings that raised a total of $145 billion.

SPACs via IPOs in Healthcare

Similarly in 2021, a record number of IPOs by SPACs were recorded in healthcare, but many of these haven’t fared well, and SPACs specifically could be facing enhanced regulation. The pandemic has highlighted the private markets as a more favourable choice for investors because systemic disruption usually needs a fast and nimble response which private ownership can afford. Additionally, because private investors take a longer time horizon which is not metered by quarterly earnings, they can make investments in these innovations which are needed to inflect change.

As such, the near-to-medium future will probably see more healthcare assets either going or staying private. There is currently a massive amount of capital which has fuelled these developments, including infrastructure funds, growth-equity funds, sovereign wealth funds, hedge funds, and crossover funds.

Investors looking into this situation should also zoom in on the specific sectors of healthcare.

Healthcare providers

- Successful provider businesses will have superior clinical outcomes, playbooks for growth, central IT infrastructures, and engaged teams.

- Value-based care is accelerating the birth to specialty practices in disciplines such as cardiology and orthopaedics.

- Companies aimed at bringing traditional health care systems online to compete with disruptive innovators on value and customer experience will provide opportunities.

- Labour shortages can still happen; organizations investing in a better work environment and technologies to streamline workflows will withstand the challenge.

- Home-based care models will grow, creating opportunities for investors to deploy capital directly in these models and the technologies/services that support them.

Healthcare payers

- Payers are evolving into diversified health service companies; technologies that streamline or automate core payer functions will attract investors.

- More attention will be given to companies helping payers deliver a different member experience and better health outcomes via improved member engagement.

- Specialty-specific benefit management solutions will see a surge in investors, but strategic planning is required to optimize the value creation.

- Entities that can help payers and risk-bearing providers address the social determinants 0f health will flourish.

Biopharma

- Tools using AI and multiomics data to accelerate drug discovery and development are becoming increasingly popular.

- Pharma services platforms across research and commercialization will continue to attract activity.

- Platforms with pharma services for both research and commercialization will continue to be attractive to investors.

- Investors will be enticed by derivative plays in specialty pharmaceuticals (including pharmacies and disruptive pharmacy benefit managers).

- Investing in assets with pipeline risk may present unique opportunities for high returns.

- Cell and gene therapies as well as mRNA (known as therapeutic modalities) will grow and create openings for deals.

MedTech

- The management, maintenance, and repair of equipment will become more valuable.

- Specialty contract development and manufacturing companies and firms in preclinical, commercialization, and regulatory support will all gain investors as technology takes centre stage.

- There will be opportunities to replicate proven playbooks (especially in MedTech) for reigniting growth through commercial excellence and M&A.

Life sciences tools and diagnostics

- The number of diagnostics providers will continue to increase as more facilities outsource their testing centers and as the demand for direct-to-consumer testing heats up.

- New technologies that miniaturize, automate, and digitally integrate lab workflows will attract growing investor interest.

- Investors will seek new technologies that miniaturize, automate, and digitally integrate lab workflows.

- “Pick-and-shovel” businesses supporting the latest innovations will also attract interest.

Healthcare IT

- The digital health tools that prove superior clinical outcomes, target diverse patient populations, and also integrate in-person care will flourish.

- Investing in customer-centric digital front-door care models (i.e., digital triage, telemedicine, and digital payments) will continue to be on trend.

- Fintech companies are already expanding to healthcare, and solutions that simplify and unify payments (as well take fraud and abuse out of the system) will draw increasing focus.

The Period of Discontinuity and the Path Ahead

With global affairs impacting the economy on all levels and the start-stop nature of the industry, this period of discontinuity gives way for innovators and incumbents alike to forge a path ahead for healthcare, and for societies, this is the chance to commit to health equity in the wake of a tragedy. There will be substantial changes to the industry, which previously moved at a much slower pace. Investors in this space who create value – in health improvements and the subsequent financial returns – will ultimately be the winners in the years to come.

Sources:

1. https://www.bain.com/insights/2022-and-beyond-global-healthcare-private-equity-and-ma-report-2022/

2. https://uk.finance.yahoo.com/news/16-billion-spac-deals-already-160000464.html?guccounter=1

3. https://www.nasdaq.com/articles/a-record-pace-for-spacs-in-2021