Pushing Cancer Treatment & Patient Care Forward

Cancer is a generic term for a large group of diseases that can affect any part of the human body. It’s the rapid creation of abnormal cells that grow beyond their usual boundaries, invading adjoining parts of the body and spreading to other organs; the latter process is referred to as metastasis. Widespread metastases are the primary cause of death from cancer.

Regarded as the emperor of all maladies, cancer is a leading cause of death worldwide, accounting for nearly 10 million deaths in 2020. An estimated one in six global deaths is caused by cancer.

A Market in Need

On a global scale, nearly 60% of new cancer cases are from Africa, Asia, Central, and South American countries; almost 70% of cancer deaths are from these regions.

By the end of 2022, an estimated 1.9 million new cancer cases will be diagnosed in the United States, with 609,360 cancer deaths. The growing need for oncology treatment is pushing the oncology market to expand.

The US also has a large aging population of baby boomers, and estimates predict that over 70% of cancer diagnoses will be in adults over age 65 by 2030.

Oncology & Healthcare Spending

A quick recap: oncology is the study of cancer. Oncologists are doctors who treat cancer and provide medical care for cancer patients, they are often referred to as cancer specialists.

The oncology market continues to dominate the largest share of healthcare spending. Analysts projected that oncology costs will rise by 9-12% annually through 2023, with global oncology costs exceeding USD 240 billion.

Governments, healthcare insurance companies, and patients alike are anxious to control costs. Finding sustainable, cost-efficient treatments will be a priority for pharma companies (alongside mounting pressure to reduce treatment costs).

Oncology Drug Treatment Modalities

The field of oncology has three major areas based on treatments: medical oncology (which includes therapeutic drugs), radiation oncology, and surgical oncology. The global oncology drugs market by therapeutic modality are as follows:

- Chemotherapy – The most widely used method of treating cancer patients through potent drugs to destroy cancer cells.

- Immunotherapy – A broad category of drugs that harnesses the patient’s immune system to fight cancer. This includes checkpoint inhibitors, vaccines, T-cell transfers, cytokines as well as gene therapy.

- Targeted therapy – Therapies that disrupt specific molecular targets found in or on cancer cells. Each targeted therapy can only be effective if the patient’s tumor contains that specific mutation or protein. Testing, such as next-generation sequencing, is necessary to identify effective therapies for each patient.

- Others – Other emerging treatments include epigenetic therapy. Imago BioSciences is currently developing an epigenetic enzyme, LSD1, for the treatment of blood cancers associated with high morbidity and mortality.

Chemotherapy previously occupied the largest share in cancer treatment, but immunotherapy is expected to grow rapidly in coming years thanks to high efficiency, increased patient preference, and fewer side effects.

Emerging Treatments

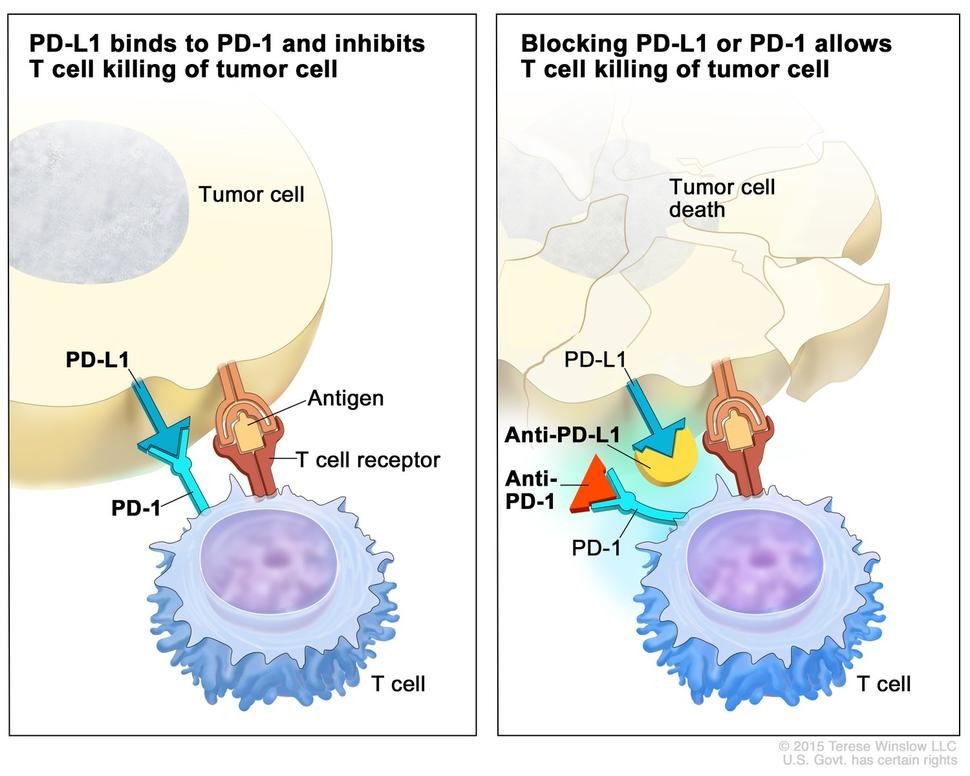

According to FiercePharma’s top 15 list of cancer drugs in 2022, 3 of the top 6 drugs are programmed cell death protein: 1 (PD-1) and PD-1 ligand 1 (PD-L1) inhibitors. This checkpoint inhibitor class is a new cancer-drug category that enables the immune system to recognize and destroy cancer cells. Ongoing research suggests this class has unprecedented efficacy in a broad range of hematologic malignancies and tumor types, with the advantage of not losing efficacy over time, leading to better patient outcomes.

Mechanism of action for 1 (PD-1) and PD-1 ligand 1 (PD-L1) inhibitors (Terese Winslow LLC, National Cancer Institute)

Antibody-drug conjugates and Bruton tyrosine kinase inhibitors have also taken center stage. These drugs help shrink tumors while sparing healthy cells. Research has demonstrated that these treatments offer exceptional clinical efficacy and safety.

Throughout 2020, powerhouse drugs like Revlimid®, Keytruda®, Opdivo®, Avastin®, and Imbruvica® continued to rake in billions in sales. In the previous year, they netted over USD 43 billion in combined sales. While new treatments continue to gain popularity, established drugs still claim a large market share.

In 2022, the top 15 cancer drugs are expected to generate almost USD 90 billion in sales annually. However, emerging treatments may shift the tide and open new pathways.

Rolling Out New Treatment Options

The use of artificial intelligence (AI) in the development of new drugs will continue to be more widespread in 2022. With recent innovations in software, big data, and machine learning, it has become easier to interpret millions of pages of scientific research data, helping medical researchers and pharmaceutical companies quicken the pace of drug development.

Big pharma companies are seeing the benefit of using digital platforms that integrates all health information. While it provides clinical benefits, pharma companies would enjoy reduced costs associated with managing conventional information systems, not to mention the reduced amount of time needed for drug development, review, and approval.

Oncology drug approvals in recent years are also at an all-time high. Despite the challenges brought on by the COVID-19 pandemic, the pharmaceutical industry continues to churn out oncology therapies at a remarkable pace.

The US Food and Drug Administration approved 21 new drugs to treat cancer in 2021, and 20 in 2020 (these do not include drugs for the treatment of various hematologic malignancies and such). For comparison, only 11 oncology drugs were approved in 2019.

Sources:

- https://www.evicore.com/insights/oncology-trends-2021-more-precision-therapies-than-ever

- https://www.pharmacytimes.com/view/trends-in-oncology-pharmacy-in-2022

- https://www.fda.gov/drugs/development-approval-process-drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products

- https://www.marketwatch.com/press-release/global-oncology-drugs-market-2022-future-trend-business-strategies-revenue-value-comprehensive-analysis-and-forecast-by-2031-2022-02-21

- https://www.aptitudehealth.com/oncology-news/2022-us-oncology-market-outlook/

- https://www.cancer.org/research/cancer-facts-statistics/all-cancer-facts-figures/cancer-facts-figures-2022.html

- https://www.aptitudehealth.com/oncology-news/emerging-oncology-trends-2021/

- https://www.fiercepharma.com/special-report/special-report-top-15-best-selling-cancer-drugs-2022

- https://www.cancer.gov/about-cancer/treatment/types/immunotherapy/checkpoint-inhibitors

- https://www.who.int/news-room/fact-sheets/detail/cancer

- https://www.cancer.net/navigating-cancer-care/how-cancer-treated/chemotherapy/understanding-chemotherapy