As we march forward in the year 2023, what are the life sciences trends that are making the headlines and which ones truly have the potential to disrupt the industry?

1. The Pharmaceutical Industry and Climate Change

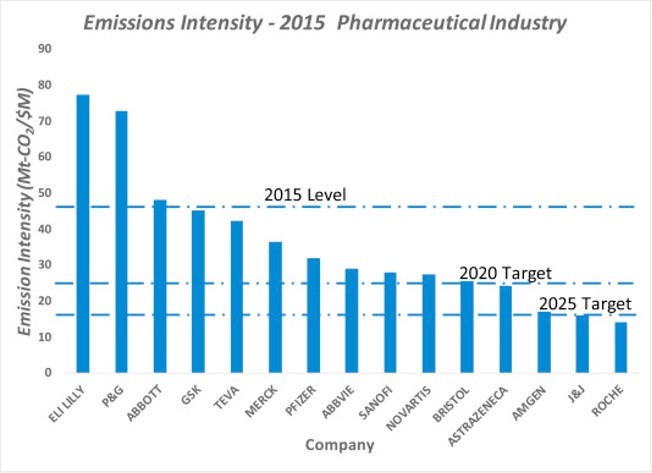

Back in 2019, McMaster University, a widely respected Canadian higher education institution, conducted a study on the pharma industry; this study was the first to assess the carbon footprint of the space, and among other findings, discovered that while over 200 companies represent the global pharmaceutical market, only 25 consistently reported their direct and indirect GHGs in the past five years. Additionally, the study’s researchers assessed the sector’s emission for each one million dollars of revenue in 2015 and found that it was 48.55 tonnes of CO2e (carbon dioxide equivalent) per million dollars; this figure stood at about 55% greater than the automotive sector, which recorded 31.4 tonnes of CO2e per million dollars for the same year.

However, there is a bright side to this story. Since the publication of this study, the pharmaceutical industry has answered the call for change by aiming for carbon dioxide neutrality by 2030. In November 2022, an announcement was made by the CEOs of AstraZeneca, GSK, Merck Group, Novo Nordisk, Roche, Samsung Biologics and Sanofi that they would be joining hands to achieve near-term emissions reduction targets and accelerate the delivery of net zero health systems. This was a key development, marking the first time the global health industry has partnered up to reduce GHGs via the Sustainable Markets Initiative (SMI) Health Systems Task Force, a public-private partnership that was launched at COP26. Thanks to this progress, we can expect to see more firms in the industry taking the pledge to reduce climate change by decreasing their own carbon footprint.

2. BioTech and the Rise of the APAC Region’s Ageing Population

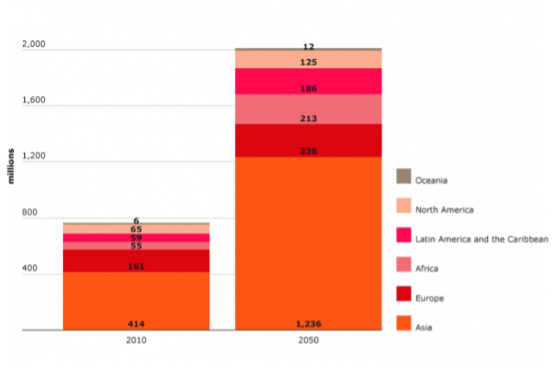

According to the United Nations Population Fund (UNFPA), by 2050, one in four people in the APAC region will be over 60 years old, giving rise to a high demand for ageing-related healthcare measures, including degenerative therapy and regenerative medicine.

To tackle this, biotech firms within APAC are leading the charge to develop novel therapies that can prevent and reverse the ageing process for humans. Australia, as an example, took firm steps forward in 2022, opening a new national academic centre for healthy ageing research, and pledging US$25 million to dementia, ageing, and aged care research.

This is certainly an interesting trend to watch in 2023; there have been many stories around how medical institutions and healthcare facilities are embracing intelligent automation and data management to build smart hospitals and patient systems, however, if these developments are anything to measure against, we may be seeing some interesting progress in the realm of biotech and its innovative solutions to ageing (such as boosting longevity) this year.

3. An Increase in Cybersecurity in the Healthcare Industry

According to a 2022 PwC survey, 43% of heath industry executives listed cyberattacks as one of their top concerns. Brought on by a proliferation of new and innovative ways to store confidential patient data as well as smart medical devices and wearables, the healthcare industry is indeed becoming increasingly vulnerable to cybercrime. This has led to a rise in demand for cybersecurity measures for medical institutions and healthcare facilities, with the weapon of choice being artificial intelligence in the form of automated technologies. By using these systems to defend their digital assets, healthcare professionals can detect threats more quickly via a number of methods, including building detections for browsing behaviour and electronically collecting visitor logs.

With the threat of cyberattacks continuing well into 2023, this trend will continue to be a key focus for the healthcare industry. In fact, the global healthcare cybersecurity market was valued at US$14.7 billion in 2022 and is expected to expand at a CAGR of 18.4% from 2023 to 2030.

4. Digital Health and the Rise of Digital Therapeutics

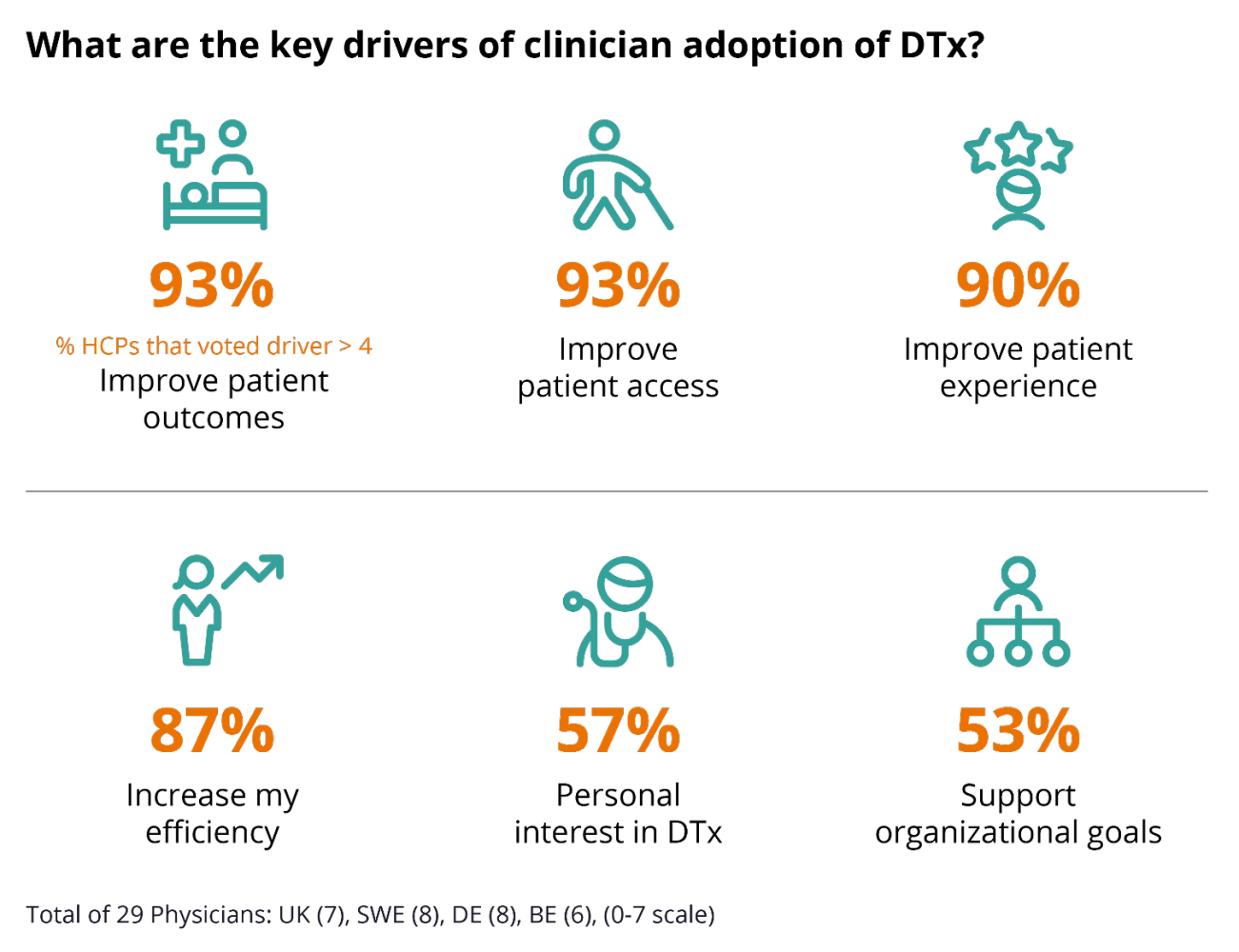

Pioneering innovation is indeed taking place in healthcare, with the introduction of digital therapeutics (DTx). Broadly defined as software solutions that have evidence-based therapeutic capabilities, this class of drugs have been proven to have a measurable impact on health outcomes. Essentially, DTx works via digital interventions which typically induce or facilitate specific patient behaviour; some examples include improving medication adherence, enacting self-care instructions, or guiding patients to lead a healthier lifestyle. Thus far, most studies in this space have focused on psychiatric applications as well as diabetes and respiratory health.

What has brought on the rise of DTx? Factors such as changing medical protocols and a global need to bring down the cost of healthcare have contributed to the growth of this industry; in fact, MarketsandMarkets predicts that by 2027, the value of the DTx market will reach US$17.7 billion, growing at a CAGR of 31.6%. In terms of concrete developments, Japan became the first country to approve local startup CureApp’s DTx app for hypertension. Additionally, in the last month of 2022, vaccine giant Moderna partnered with a Japanese startup called Allm to build a DTx focused on infectious diseases which aims to revitalise activities. There is a lot more to explore for life science companies looking at this space, and 2023 should see a flurry of activity and progress for DTx players.

5. Bringing it all Together in Healthcare with Interoperability

In healthcare, interoperability means the coordinated exchange of information across various devices, networks, and information systems that hold the promise of improved patient outcomes. While the data gleaned from these different sources isn’t enough to drive progress alone, IT professionals in this space can begin with organising and adhering to a set of standards in terms of vocabulary, content, format, privacy and security, as well as identification. They can do so by engaging with one of several integrated-as-a-platform companies which provide data management solutions alongside automated tools that help healthcare companies integrate their various software applications and create a synchronised system which collects data and uses it effectively, thus paving the way for true interoperability.

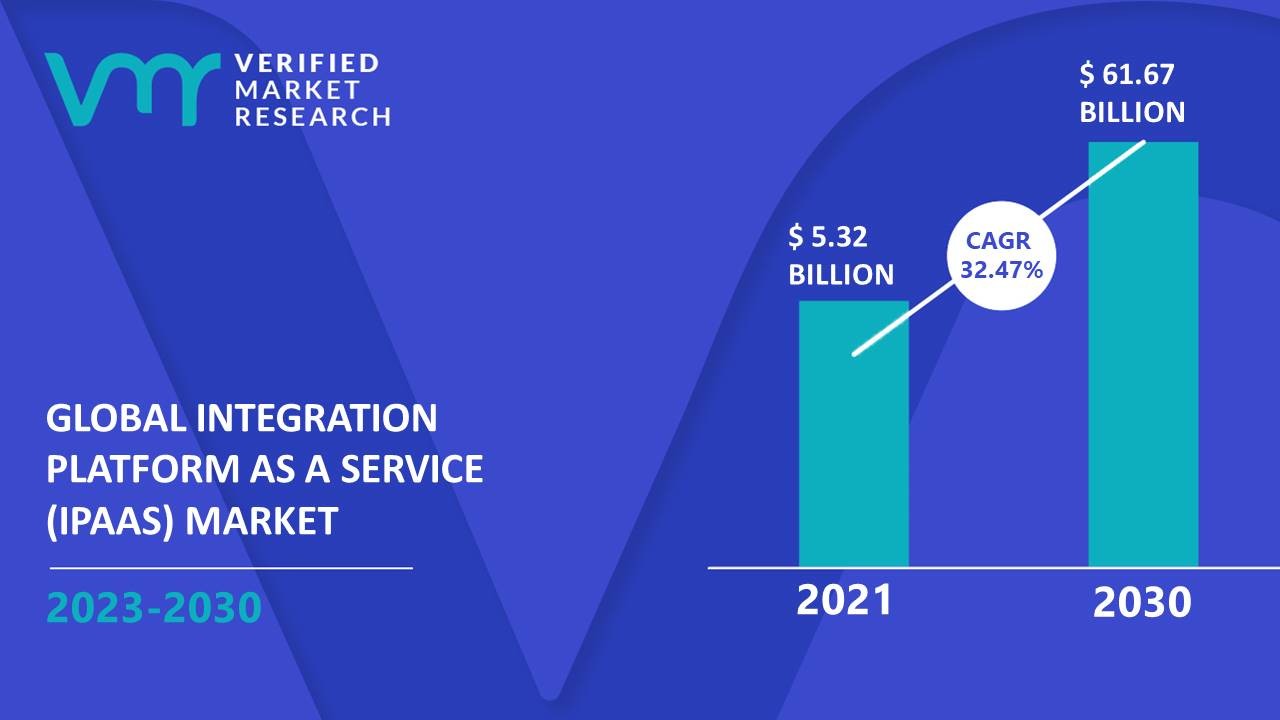

Across the different industries globally, iPaaS services are in demand; its market size was valued at US$5.32 billion in 2021, and is estimated to reach US$61.67 billion by 2030, growing at a CAGR of 32.47% from this year; it is thus safe to say that healthcare and life sciences companies seeking to make use of these platforms for interoperability purposes in 2023 will be pioneering the way for their peers to explore this new and efficient way of operating institutions and facilities.

Innovation can be the Key to Unlocking Solutions

Year upon year, life science companies and their investors seek ways to improve healthcare and its various sectors to benefit the lives of patients the world over. Alongside this general need for progress, global issues such as a shortage of healthcare workers that have driven hospitals to full occupancy, global supply chain woes that not only mean shortage of medical supplies but also higher costs for everyday items and constrained levels of equipment, and rising inflation which may eventually mean higher prices for medical care, will drive these innovative thinkers to meet these challenges and create new solutions that truly provide a future-proof way forward for the industry.