While there are many different paths to take towards sustainability, one definitive road many companies are taking is to purchase renewable energy for their businesses; in this article, we look at the practice of purchasing energy and the performance of this market in 2023.

What is a Corporate Renewable Strategy?

Touted as the biggest challenge of present times is the issue of climate change. In the world’s rush to industrialise and progress forward, we have produced emissions that have warmed the planet by 1.1C, as mentioned by the IPCC. This has led to numerous natural disasters over the years, including flooding, wildfires, landslides, and the drying up of many of the world’s rivers and lakes, which has affected the livelihood of some of the world’s most vulnerable living communities. As is widely reported by media the world over, the UN has predicted if we do not tackle the problem of climate change now, we could see global warming increase to 2.7C by the end of this century.

This is a scary scenario indeed, and instead of merely relying on national governments to act, many people are calling for corporates to do their part, which is where renewable energy and various sustainability strategies come in. Over the past five years or so, many corporates are beginning to realise the potential in having a sustainability strategy – not just in the monetary sense – but in terms of how implementing such a plan will build resilience for their business, especially in the wake of these current uncertain economic times.

To date, over 900 organisations globally have established science-based targets to reduce their emissions that are aligned with the Paris Agreement, and one of the most important steps they can immediately take is to reduce greenhouse gas emissions (GHG); to do this, they are looking at reducing emissions from power use, and sourcing renewable energy, such as solar and wind power for their day-to-day operations.

What are the Three Ways that Corporates are Purchasing Energy?

While the practice of buying this energy may differ from continent to continent, there are currently three popular methods that corporates are using:

1. The Buying of Green Electricity Certificates:

Companies in the US and Europe are buying certificates that match the consumption of power in their organisation. This is the simplest way to contribute, although it does nothing to build out renewable energy because certificates come from existing plants, and sometimes even from unspecified sources.

2. Signing a Corporate Power Purchase Agreement (CPPA):

This is a long-term supply contract of renewable power and certificates that are usually under a fixed-price structure. CPPAs are used as a guarantee that the power being used by a corporate can be tracked to a wind or solar farm and guarantees a reduction of risks associated with power price changes for a company. Simply put, if an organisation determined its power prices through a CPPA at a certain point in the past, it would be protected from high power prices in the wholesale market. This method can be considered a safe bet for many companies today, especially given the market volatility that has been making headlines around the world in the past 6 months.

3. Investing and Owning Renewable Energy Assets:

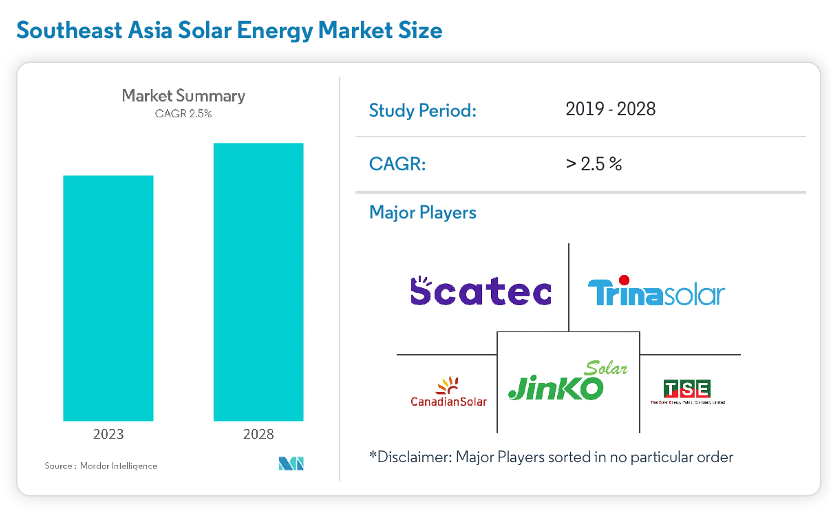

Corporates that employ this method can invest and own these assets off-site by purchasing an equity share in a new project or by co-developing a greenfield project. However, some have also opted to have these assets on-site; examples include linking a private wire from a wind farm or having solar panels on factory rooftops. The latter strategy is gaining popularity in Southeast Asia – it is fast becoming one of the biggest markets for solar energy, with researchers expecting it to grow at a CAGR of 2.5% from 2019 – 2028. In 2020, Vietnam and Malaysia were acknowledged as the two countries in the region leading the charge, with the highest amount of new PV (photovoltaic) capacity installed.

What are the Sectors Dominating the Corporate Renewable Strategy, and How is this Market Performing this Year?

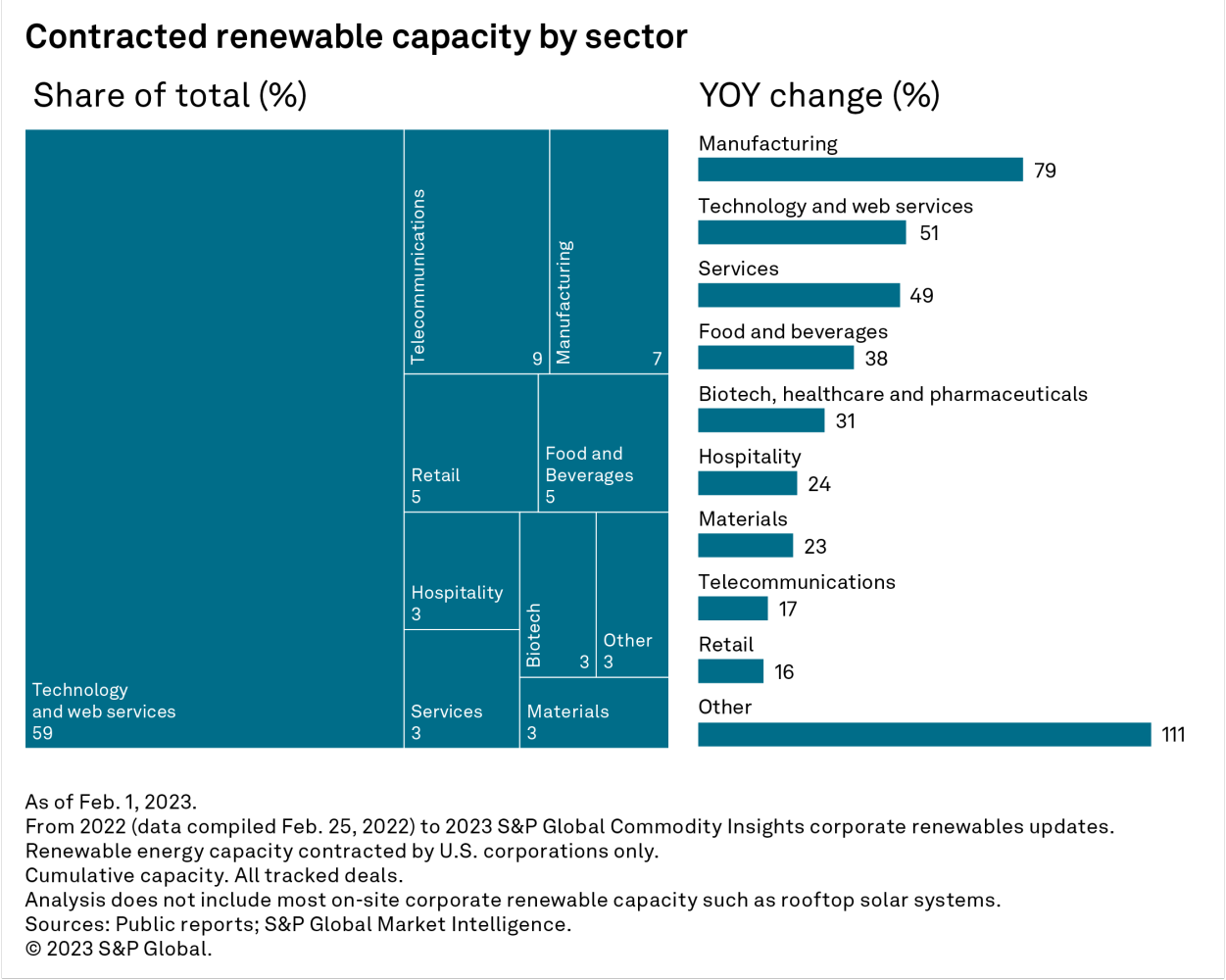

According to a report by S&P, in the US specifically, technology and web services companies are dominating the renewable energy market; this should come as no surprise since these entities tend to consume the most energy due to power-hungry data centres. Additionally, factors such as the push for sustainability in terms of green energy commitments and growing concern for energy security has led to a steady increase in the purchasing of renewable energy for all sectors of business, with manufacturing in the US showing the most significant growth at nearly 80%. However, the retail sector, which is one of the biggest power-consuming industries in the US, is still lagging, accounting for only 5% of corporate-tied renewable energy capacity; the S&P also ranked this sector last in year-over-year change in contracted green energy at approximately 16%.

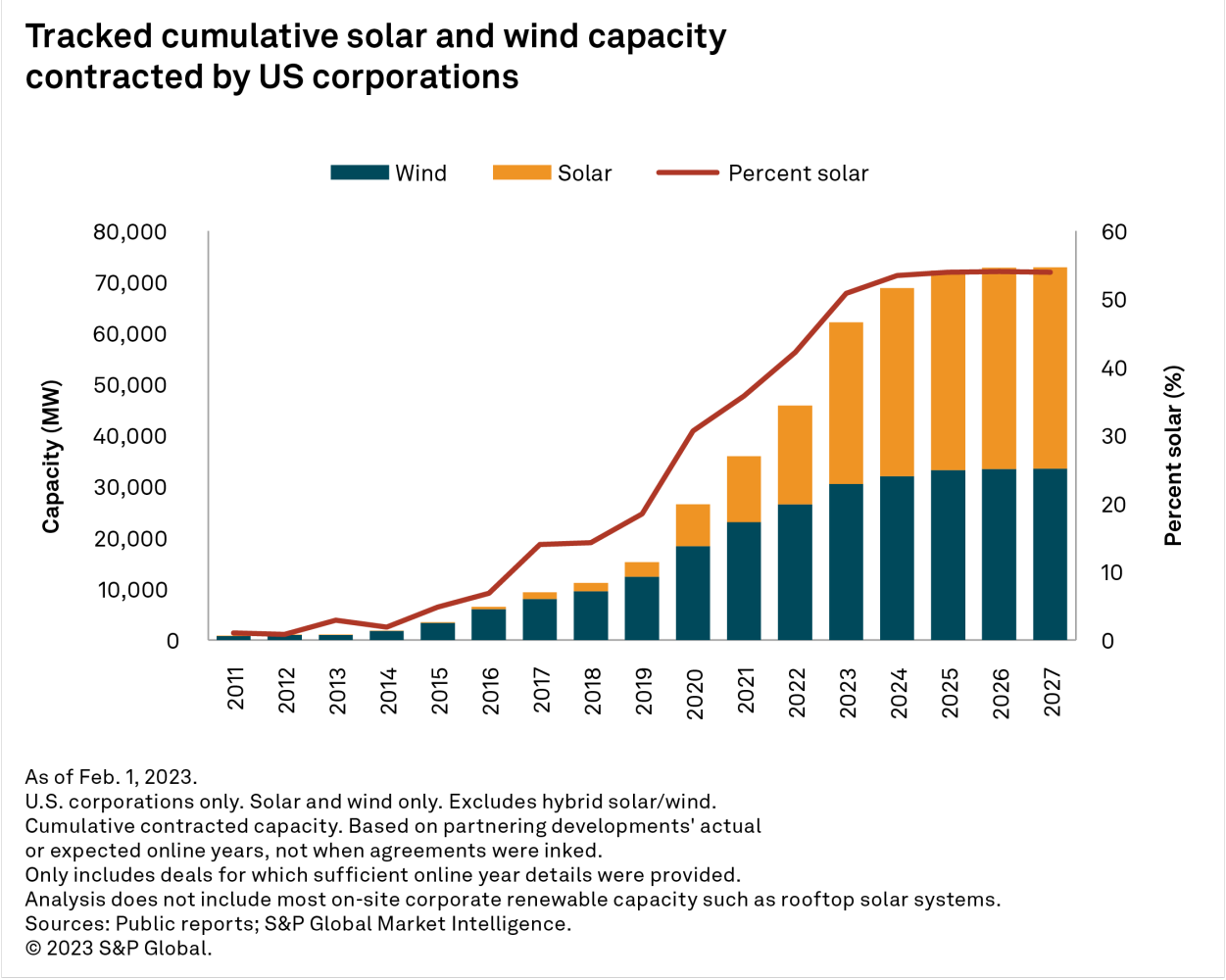

Overall, US corporates can be seen as doing their part in terms of renewable energy; with the top 10 corporates in the country recording a cumulative green portfolio of more than 52 GW. In terms of the type of energy being purchased, wind continues to stay ahead of solar, with a 7 GW lead at end 2022. That being said, solar is expected to grow over the next three years, with operating capacity estimated to double between 2022 to 2025. By contrast, corporate-contracted wind capacity will increase by a modest 6.8 GW in the same period.

A Way Forward for Sustainability and Corporates

Today, many large corporations are spending millions or billions of dollars on energy every year, but some companies outside of energy-intensive sectors still perceive energy to just a cost to manage. As opined by Harvard Business Review this is a costly mistake as investing in a corporate renewable strategy can reduce risks, improve resilience, and create new value for every type of business. Firms can take advantage of this sustainability push by keeping energy costs low or through differentiation. Simply put, companies have a choice to make about where to source its energy and how much to pay for it; these decisions can have a significant impact on its cost structure.

Last but certainly not least, companies that carefully their energy use and the effect this use has on the environment and the climate, will continue to have a leg up (in the eyes of customers, investors, and partners) over other corporations that merely consider a corporate renewable strategy as a “nice-to-have” but not a “must-have.”

Sources