Acutus Medical (NSDQ:AFIB) today announced that it has entered a definitive agreement to sell its left-heart access portfolio to Medtronic (NYSE:MDT) for $50 million.

Medtronic will make an upfront cash payment to Princeton, N.J.–based Acutus Medical of $50 million upon the initial closing of the transaction, which is subject to the satisfaction of customary closing conditions including expiration or early termination of all applicable waiting periods under antitrust laws. The deal is also subject to Acutus’ debt refinancing and contingent consideration payments over time based on the achievement of certain milestones and future sales, according to the company.

Acutus Medical’s left-heart access portfolio includes its AcQCross line of sheath-compatible septal crossing devices, AcQGuide Mini integrated crossing device and sheath, AcQGuide Flex steerable introducer with transseptal dilator and needle and the AcQGuide Vue steerable sheath.

Medtronic acquisition of the portfolio comes about two months after Boston Scientific closed its $1.75 billion acquisition of Baylis Medical and its advanced transseptal puncture platforms.

BTIG analysts Marie Thibault and Sam Eiber upgraded their rating of the Acutus Medical’s stock to buy from neutral after the news of the deal: “We expect AFIB shares to move higher today on this announcement, as it offers the company immediate relief on its financing concerns and gives management time to show sustainable commercial traction.”

Thibault and Eiber noted that the deal enables Acutus Medical’s cash balance to extend into early 2024. “However, the left-heart access portfolio was a contributor to revenue and was expected to be a growth driver; accordingly, we reduce our revenue forecast.”

In conjunction with the sale, the company announced a commitment letter from Deerfield Management Company to refinance existing debt with a longer-term credit facility. The company said the combination of the two transactions with its recent restructuring will fund its strategic growth strategies.

“This set of initiatives is an important milestone for Acutus and is the result of the strategic reprioritization we announced earlier this year,” CEO Vince Burgess said in a news release.

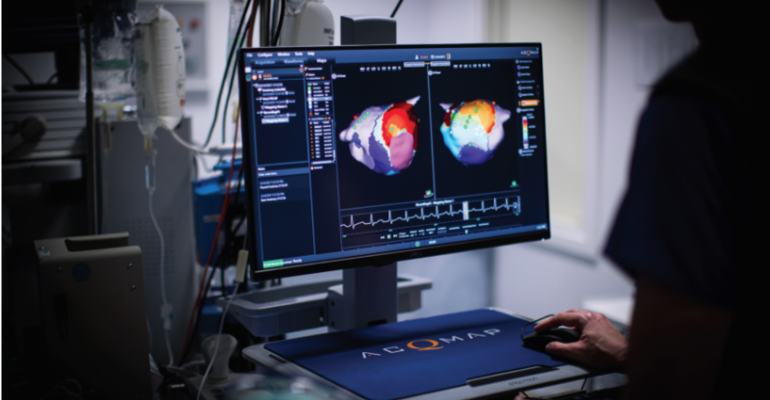

“The extended maturity from our refinancing along with proceeds from the definitive agreement to sell our left-heart access portfolio will allow us to intensify our focus on driving the adoption of our electrophysiology mapping and therapy solutions as well as improving our operational and financial performance.”

The sale of its left-heart access portfolio comes after Acutus Medical announced that it had undertaken a corporate restructuring that resulted in layoffs in January. The restructuring actions were expected to result in operating expense savings of between $23 million and $25 million annually compared to 2021.

Shares in AFIB were up more than 22% to 98¢ apiece in morning trading. Shares in MDT were roughly even. MassDevice’s MedTech 100 Index, which includes stocks of the world’s largest medical device companies, was down slightly.