Eyes on the rising SEA

Southeast Asia represents a growing diverse population, with remarkable economic growth potential. ASEAN’s combined GDP makes it the 5th largest economy in the world (after US, China, EU and Japan). The region’s annual GDP has grown by an average of 4.5% since 2010, compared to 3.4% for the world economy; and is expected to continue to outperform the world’s economy through 2029.

SEA boasts a diversified industrial base, including textiles in Vietnam, Thailand’s manufacturing, Indonesia’s vast natural resources and dominance in commodities, Singapore’s financial services, high-tech electronics in Singapore and Malaysia. This dynamic amongst the bloc positions the region for sustained long-term growth.

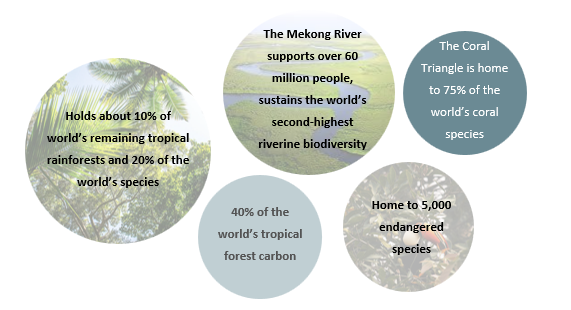

An Ecological Powerhouse

Southeast Asia is one of the most ecologically significant regions in the world, continuing to reveal its incredible biodiversity through recent discoveries. In 2023, scientists identified 234 new species in the Greater Mekong region, including a “vampire” hedgehog with fang-like teeth, a rock-dwelling dragon, and an eyelash viper.

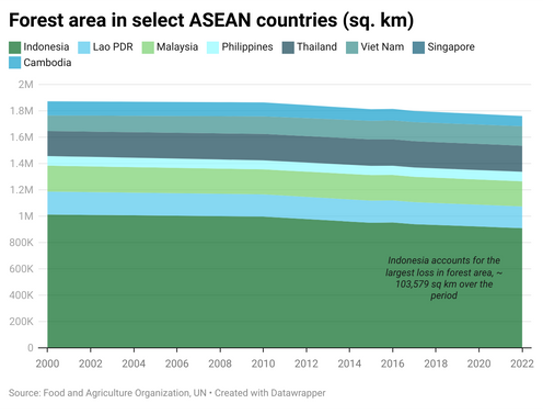

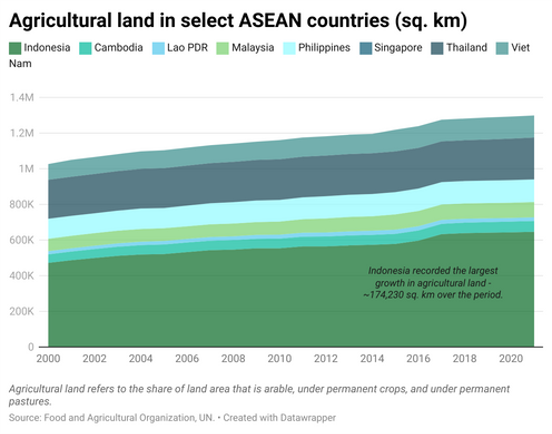

Despite its natural wealth, the region faces severe ecological challenges. Rapid urbanization, agricultural expansion, and deforestation have led to the loss of millions of hectares of forest over the last decade. Climate change is exacerbating threats, with rising sea levels endangering critical areas like Vietnam’s Mekong Delta, responsible for 50% of the country’s rice production. The balance between economic development and environmental sustainability is crucial, as the region’s ecosystems underpin food security, water resources, and the livelihoods of millions.

Balancing growth with sustainability issues

Southeast Asia is a highly diverse region, and its environmental challenges also vary widely. Singapore, for instance, imports 90% of its food, making it highly susceptible to disruptions in global food supply chains. In contrast, Malaysia and Indonesia grapple with high rates of deforestation driven by urbanization and agricultural expansion.

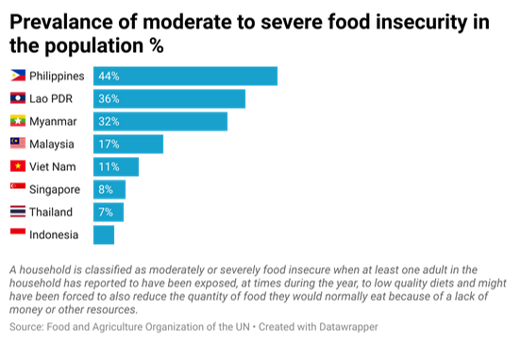

1 in 10 people across the region are affected by food insecurity.

Despite Southeast Asia’s significant cultural output, systemic vulnerabilities – such as heavy reliance on rice and other staple imports – expose millions to risks stemming from climate change, economic shocks and inefficient food systems

Urgent need for health infrastructure and innovation

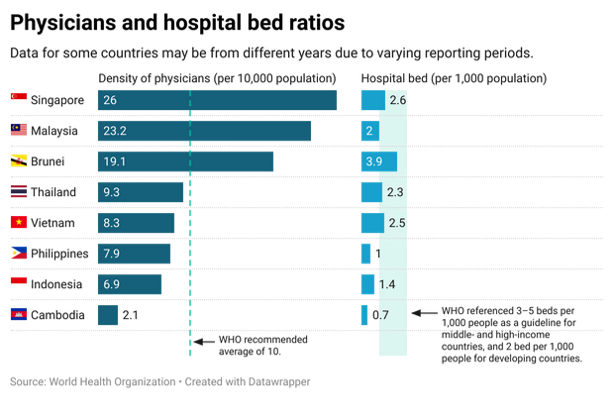

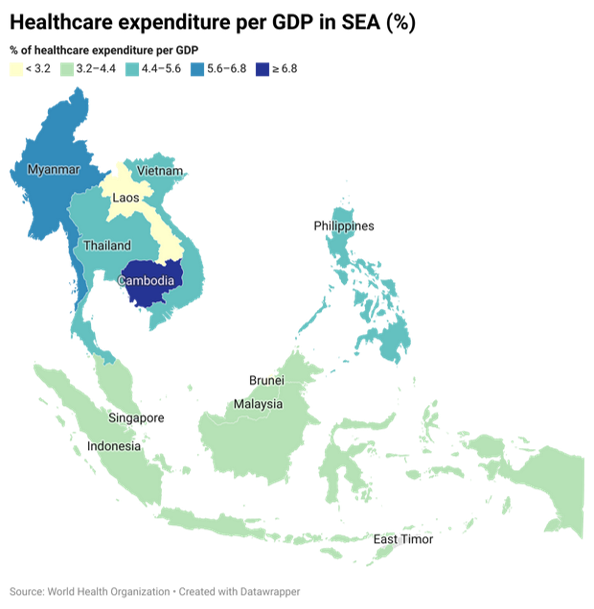

100 milllion individuals across the region lack access to basic healthcare services, leaving significant gaps in health equity.

This varies across the different countries within the region, with some countries recording below-average indicators in terms of physician and hospital bed densities.

60% of all deaths in the region is due to NCDs such as diabetes, cardiovascular diseases and cancer – reflecting a shift from communicable diseases to lifestyle related conditions.

4.1% of GDP healthcare spending lags behind the global average of 9.8%, leaving it underprepared to address emerging health challenges.

Venture Capital’s role – investing in solutions for SEA

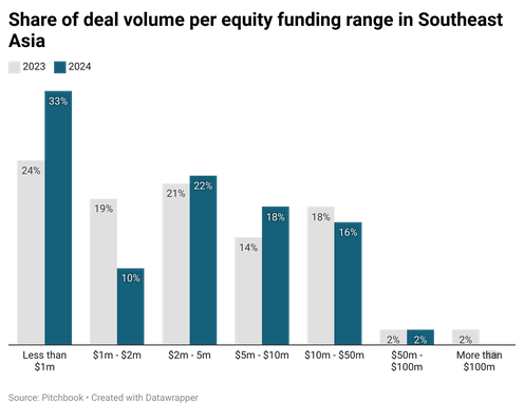

Southeast Asia’s startup ecosystem has been maturing rapidly over the past few years, driven by increasing venture capital investments. The landscape is quite diverse, spanning more than 30 distinct verticals including edtech, green tech, and proptech—a clear sign of the breadth of industries that are being disrupted by Southeast Asia’s innovation ecosystem.

Against the backdrop of rising sustainability and healthcare issues in Southeast Asia, our analysis will focus on the venture funding landscape within these sectors in this region. If VC investments in the region are still in their early stages, specialist VCs, particularly within sustainability and healthcare, are akin to stem cells—undifferentiated but holding immense potential to develop into transformative forces within the ecosystem.

Just as stem cells rapidly differentiate to become the foundation of vital biological systems, these specialized investment sectors are poised for steadily advancing, shaping industries that will have a lasting impact on our economies and livelihoods.

Venture capital markets activity in SEA

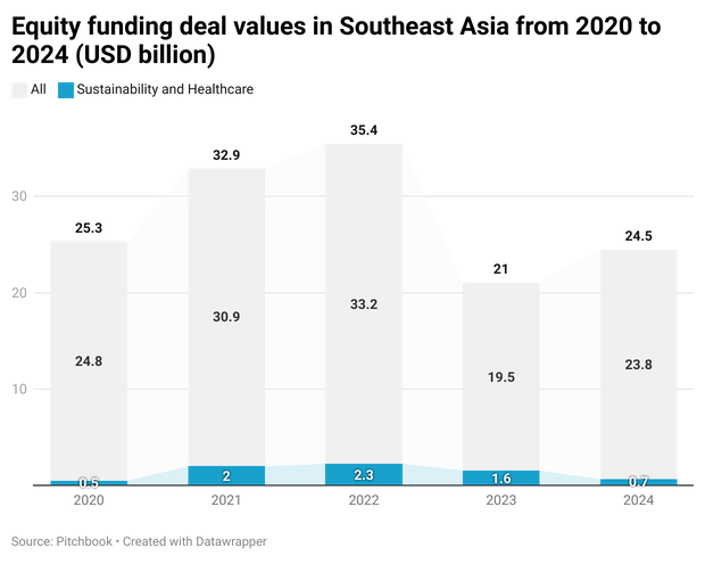

2021 saw a bull market for venture financings across all sectors in Southeast Asia, driving annual funding to a peak. Sustainability and healthcare sectors inclusive, were beneficiaries of the increased government allocations towards start-up investments and the increased attention and familiarity to these “new” sectors due to the pandemic.

Following this peak, the region saw significant corrections in investment flows as higher interest rates led investors to hold onto funds and become cautious about new ventures, resulting in the decline in overall VC funding in 2022-2024. Sustainability and healthcare sectors followed suit, despite staying above pre-pandemic levels.

2%-7% percentage of investments made in healthcare and sustainability sectors.

Venture funding in SEA has mainly flowed towards fin-tech/digital/consumer products, driven by a more mature ecosystem and faster growth profile (towards profitability).

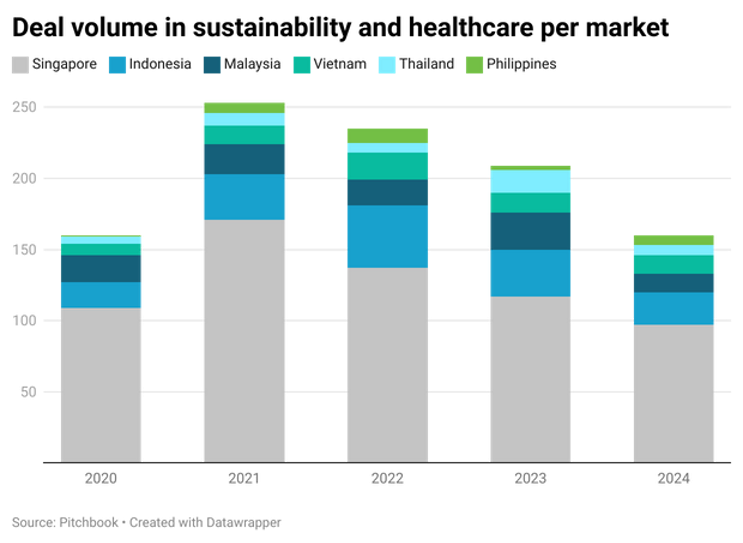

Singapore continues to outperform major markets in SEA

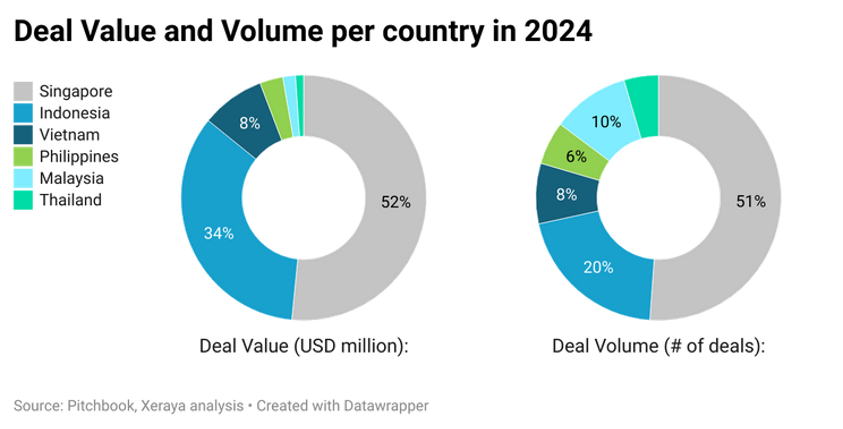

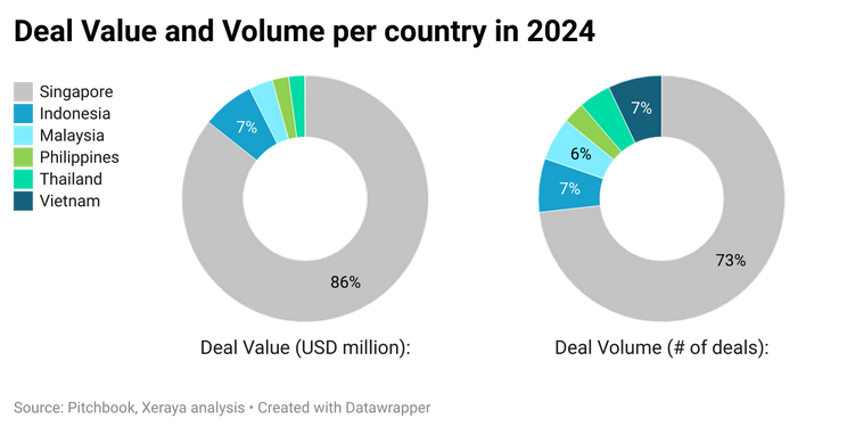

Singapore outperforms major markets in ASEAN-6 for sustainability and healthcare venture activity, accounting for more than half of deal equity and volume in 2024. This is an on-going trend over the years, a testament to Singapore’s commitment to an innovation-driven and knowledge-base economy.

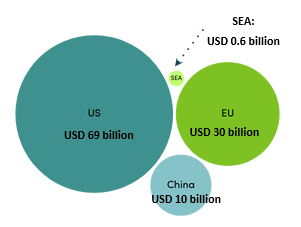

*Numbers for US, EU and China are estimates. Based on various sources which may have different categorization of sectors.

For additional context, venture financings in the sustainability and healthcare sector in SEA lags far behind the more mature ecosystems such as US/EU/China.

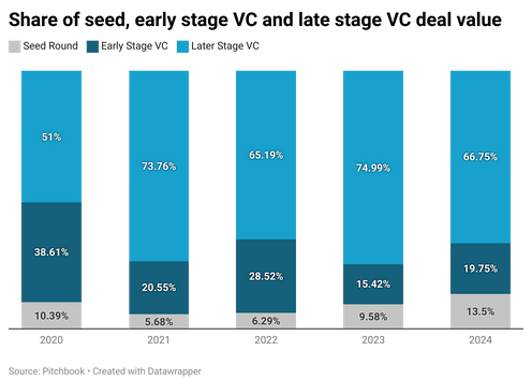

Late stage deals outpace early stage and seed rounds

Late-stage VC deals pull in more funding because scaling a business takes serious capital—whether it’s expanding into new markets, ramping up operations, or gearing up for an exit.

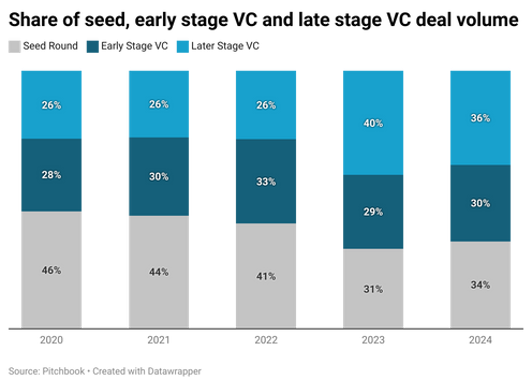

However, volume-wise, lower funding rounds are more the norm in the region.

The deal value on the x-axis is not indicative of the funding stage. All monetary figures are in USD.

67% share of deal value contributed by Later Stage VCs in 2024, despite contributing only 36% of total deal volume.

65% sub-$5m deals account for 65% of the total deal count in 2024.

Funding trends in Sustainability

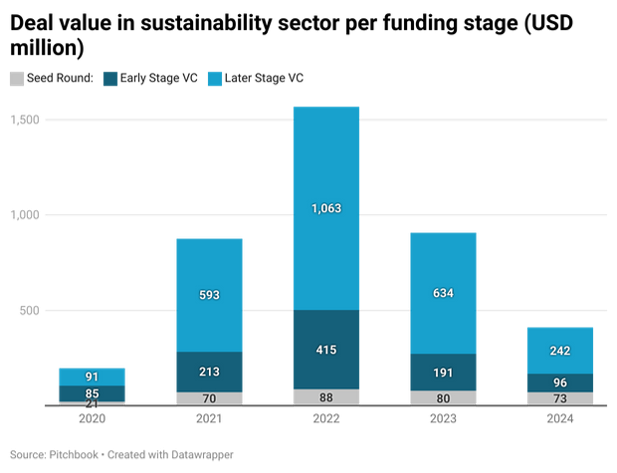

We define sustainability as companies with technologies related to food security, agricultural tech, renewable energy and climate change. Funding peaked in 2022, and is showing a downward trend in 2023 and 2024. Funding volume is mainly contributed by later stage deals.

-74% decline from the 2022 peak to 2024.

Most significant drops were recorded by early stage VC and later stage VC funding.

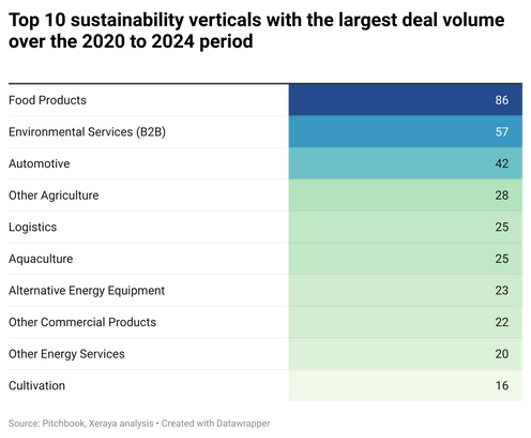

Food Products and Environmental Services top deal volume – out of the 39 verticals within sustainability sector over the past 5 years. This underscores the strong regional commitment to food security and enhancing local mobility.

Funding trends in Sustainability

The deal volume includes deals with undisclosed funding amounts.

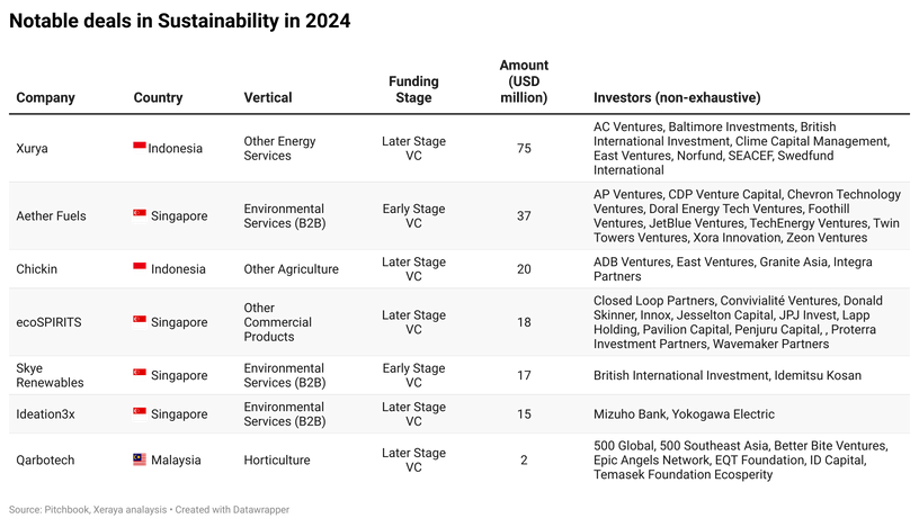

In 2024, Singapore leads its regional counterparts, accounting for slightly more than half of deal value and volumes in the Sustainability sector. Looking at specific verticals, we see funding flowing towards sustainable energies including liquid fuel (Aether Fuels), solar energy (Xurya, Skye Renewables) and solid waste management (Ideation3x).

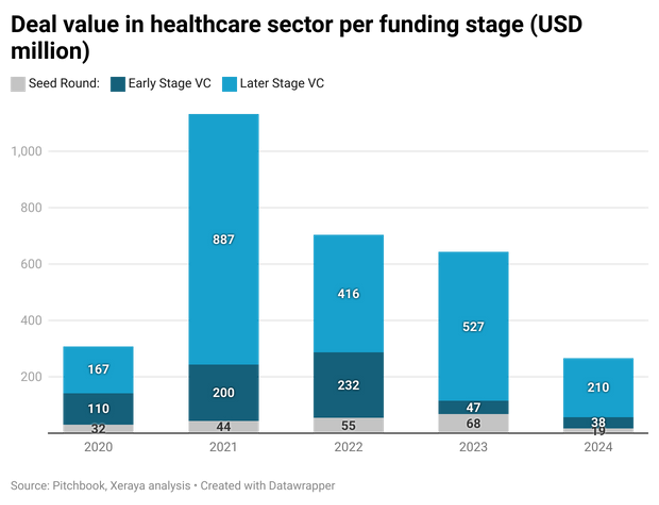

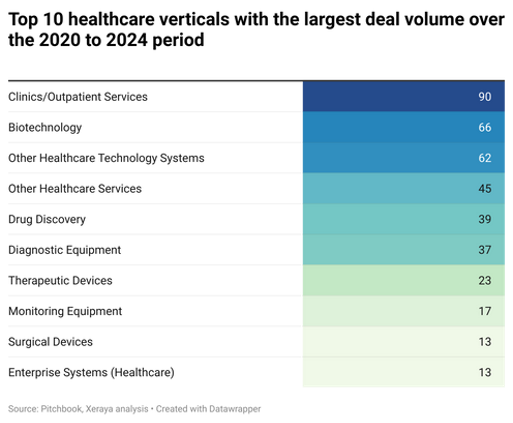

Funding trends in Healthcare

Venture funding in healthcare peaked in 2021, driven by the increased attention to the sector due to the pandemic. However, funding has been declining post-2021. To note that we exclude healthcare servicing (such as physical clinics and hospitals) as part of our categorization to focus more on technology-driven innovations.

-76% decline from the 2021 peak to 2024.

The majority of funding has gone to later stage deals, highlighting the increased capital requirements for growth.

Digital health services are the highest funding recipients – out of the 27 verticals within healthcare sector over the past 5 years. This includes telemedicine, online pharmacies and the like, bridging access from providers to the community.

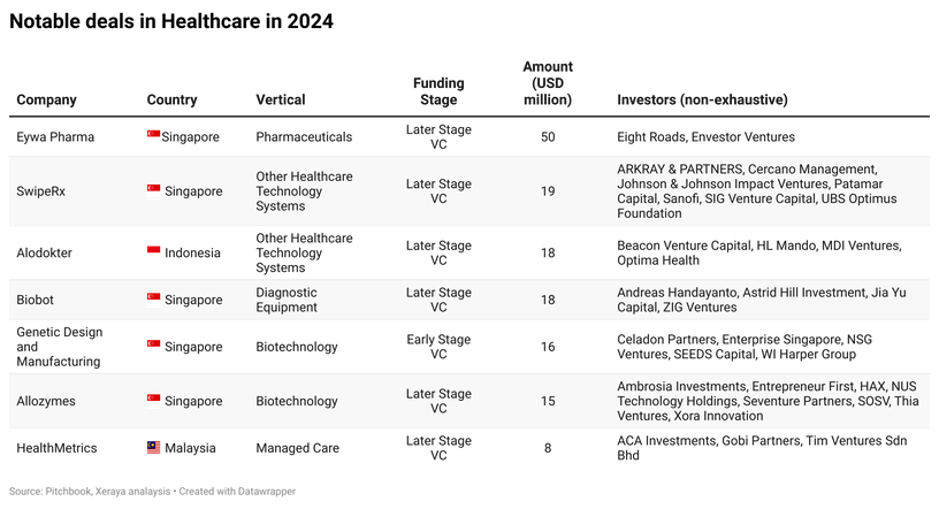

Funding trends in Healthcare

For Healthcare venture funding, Singapore recorded an even higher lead in comparison to its regional peers. The larger funding amounts are typical of later stage VC deals in Healthcare, such as Eywa’s (generic drug developer) USD 50m fundraise in 2024.

The deal volume includes deals with undisclosed funding amounts.

Disclaimers

This document is prepared by Xeraya, with data sourced from PitchBook and additional analysis by Xeraya. While we strive for accuracy, the information may change and should not be considered as financial or investment advice.

We make every effort to ensure accuracy, but if any inaccuracies are found, please contact us for clarification.

For inquiries, contact xeraya@xeraya.com