Russia’s invasion of Ukraine has had immediate effects on the country and its surrounding neighbours, effects which have been widely reported (i.e., influx of refugees, a spike in demand for humanitarian aid); However, this is a war that will have far-reaching consequences that are already sending reverberations throughout the world. Here are 5 key sectors of the global economy that have already been greatly impacted by the Russia-Ukraine War.

1. Food Insecurity – An already growing issue gets bigger

Globally, the issue of food insecurity has been on the rise for several years, even before the Ukraine war and the COVID-19 pandemic. In 2020, over 800 million people experienced hunger, which was a jump of a hundred million over 2019. While this can be attributed to the impact of the pandemic, there are also longstanding issues that drive food insecurity, including conflicts, extreme weather, pests, and diseases. In 2021, acute food insecurity (when a person’s life or livelihood is in immediate danger due to a lack of food) affected 388 million people across 42 countries, which is a hike of 5% over 2020.

Zooming into the Ukraine conflict, the biggest food commodities affected are wheat, maize, and fertilizers. Russia is known as the largest global exporter of wheat, with a share of 20% of the market and Ukraine accounts for another 10%. As of March 2022, the price of wheat was 50% higher than it was in February and almost 80% higher than it was in March 2021; with 35% of the global population consuming wheat-based products as a staple part of their meals, this has had a massive impact on food security.

Additionally, global cooking oil prices, which have been steadily increasing since the pandemic, has also been affected by the war, since Ukraine supplies nearly half of the world’s sunflower oil, while 25% of the same supply originates from Russia; since March, interrupted shipments and logistics chains have sent cooking oil prices through the roof.

2. Healthcare – An immediate need

On 3 June, the WHO marked 100 days of war in Ukraine. The country’s health system, which was already suffering since the conflict began is under even more severe pressure, which prompted the WHO to increase its presence to meet escalating health needs. In the 100 days since the war has begun, there have been over 260 verified attacks on health care facilities in Ukraine; as such, the WHO has updated its amount of funds needed to help the country to US$147.5 million, which will help humanitarian needs, provide immediate healthcare delivery, and help the health system stay resilient.

Beyond Ukraine

The rise of cybercrime has not only impacted big conglomerates, but also IT systems for entities that are delivering healthcare services. Due to the conflict, there may be a rise in disruptive cyberattacks on healthcare systems globally, with the average cost of a data breach in this space reaching US$9.42 million in 2021.

In terms of logistics, airfreight no longer travels over Russia, causing delivery companies to revise their routes or rely on slower and more costly modes of transport. Air cargo prices have already increased, and rerouting costs are similarly expected to grow. Additionally, with the current congestion on transport routes, many factories producing healthcare essentials have halted or delayed production, which can cause long-term disruptions.

Lastly, much of the world’s supplies of raw materials that are used to make hospital equipment come from Russia and Ukraine. Because of the world’s dependency on these raw materials, a rise in prices for medical supplies can happen. Disruptions to production of these materials are also expected, which will impact the global supply chain and the pricing of plastics.

3. Mineral Commodities – Mining for a “safe haven”

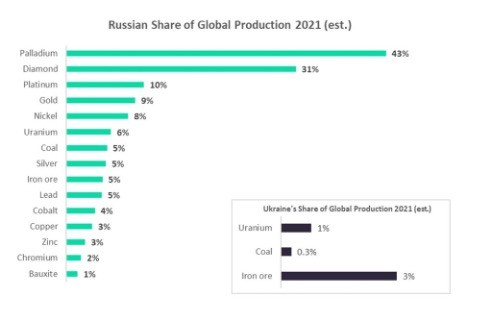

The conflict’s effect on global commodity markets can be seen in the rise of prices of several metals including gold (which is considered a safe haven), and nickel, because of supply concerns.

Source: Mining Technology: Russian invasion of Ukraine: Potential impact on supply chains of mineral commodities

Overall, there will be a significant impact on the mining industry’s supply chain, as Russia one of the top three producers globally of diamond, gold, platinum group metals (PGMs) and nickel. It also supplies seaborne, met coal, and aluminum to European markets. Similarly in Ukraine, there will be a disruption in the supply chain for coal, iron ore, and uranium.

4. Energy – Decreasing dependency on Russia in the West

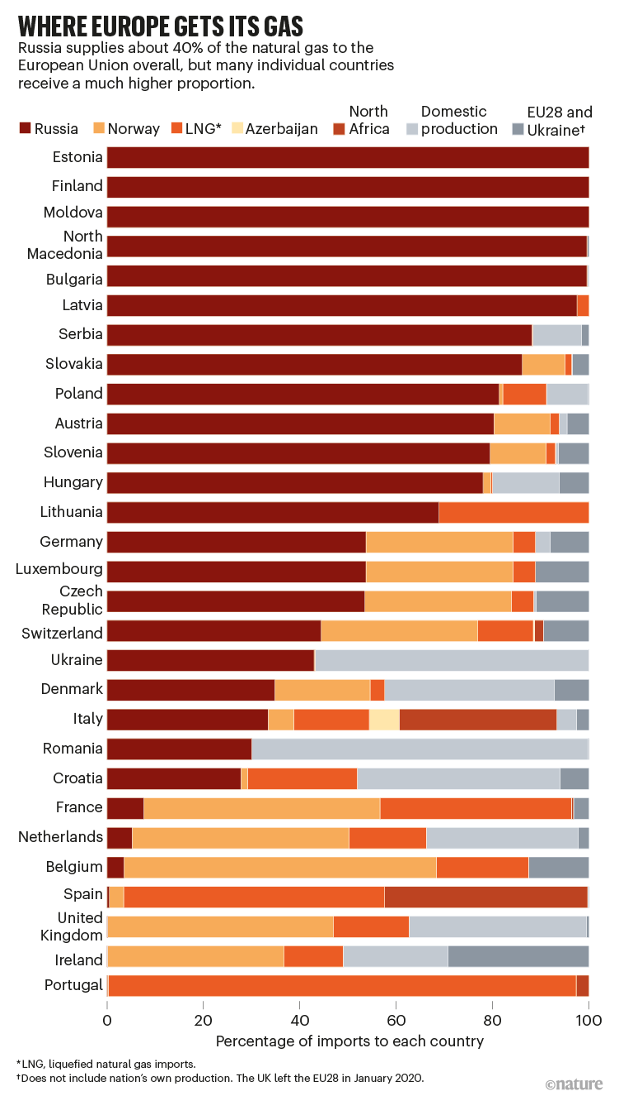

As per the International Energy Agency, energy is another sector where Russia serves as the biggest oil exporter to global markets, and European countries depend on its natural gas. While the US, the EU, and other governmental bodies have imposed economic sanctions on the country and pledged to stop depending on its fossil fuels, many Western nations are continuing to receive their energy supply from Russia.

In 2019, the EU was importing about 40% of its natural gas, over a quarter of its oil, and around half of its coal from Russia; in fact, the amount of Russian energy sources entering Europe has increased since the conflict with Ukraine started, with an estimated of US$24 billion being spent on oil and gas in March 2022 alone.

To reduce this dependency, the European Commission has publicly announced plans to reduce imports of Russian gas by two-thirds at the end of 2022. This will be done by boosting imports from other countries (60%) and new renewable-energy generation as well as conservation measures (33%).

5. Semiconductors – A necessary but tough relationship

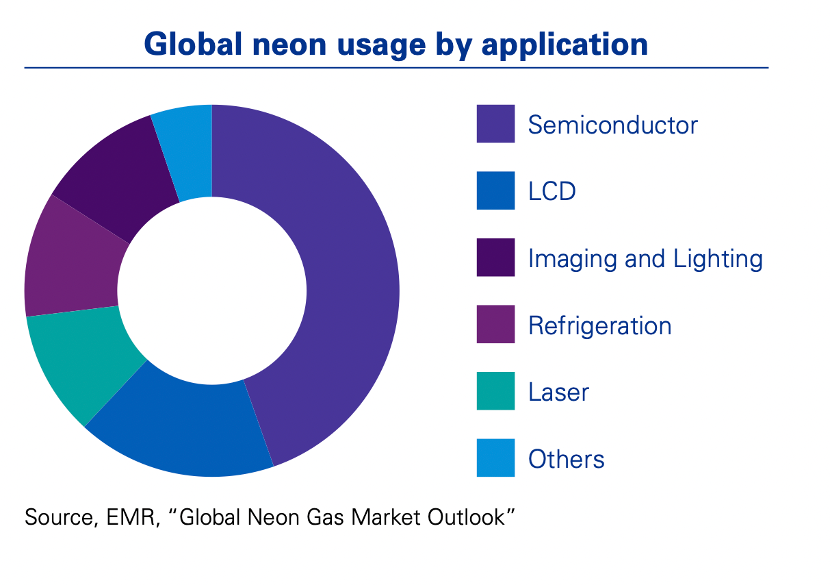

As mentioned above, both Russia and Ukraine produce a significant share of the world’s mineral commodities, and for the semiconductor industry, the supply of raw materials is at risk; Ukraine makes 70 – 80% of the global supply of neon, while Russia produces 35 – 45% of the palladium supply.

Neon, the deep-ultraviolet (DUV) lithography process that is used in the manufacturing of semiconductors is still being produced in Ukraine. It is recyclable and can be reused, but many semiconductor companies have not made this investment, even after the 2014 Russian annexation of Crimea, when the price for neon increased dramatically by 600%.

Palladium, which is used in plating applications and is a crucial component for catalytic converters, is less impacted by the war, but its shortage could also affect the production and demand of semiconductors, thus impacting automakers – catalytic converter shortages will also reduce chip orders.

Other materials such as nickel, gold, and silver are also important parts of the manufacturing process; prices for both gold and silver have increased. Since purchasers of semiconductors are usually on direct pass-through price agreements for these fluctuations, they could potentially feel the impact more than manufacturers will.

The Ukraine War – A Truly Global Conflict

These five sectors are just some of the biggest industries impacted by the ongoing conflict. It may be too early to tell how long-lasting the repercussions of this war will affect the global markets, but the fact remains that many sectors and countries are already feeling the heat from it, even from thousands of miles away.

Sources:

5. https://www.mining-technology.com/comment/supply-mineral-commodities/

6. https://www.nature.com/articles/d41586-022-00969-9

7. https://assets.kpmg/content/dam/kpmg/ua/pdf/2022/05/impact-on-semiconductor-industry.pdf