Embarking on a journey towards 2030, the Malaysian Venture Capital Roadmap 2024-2030 (MVCR) presents a transformative blueprint designed to invigorate the nation’s innovation ecosystem. As a life science venture capital firm, navigating through this roadmap not only unveils new horizons of opportunity but also underscores our pivotal role in fueling breakthroughs that promise to redefine healthcare, agriculture, and biotechnology landscapes.

The roadmap articulates a vision where Malaysia emerges as a dynamic hub for venture capital, attracting and nurturing high-growth enterprises that are at the forefront of scientific and technological advancements. This focus aligns perfectly with our investment philosophy, which is centered around backing ventures that not only promise robust returns but also contribute meaningfully to human well-being and environmental sustainability.

By Dr. Ghows Azzam

April 2024

Venture Capital (VC) Landscape in Malaysia

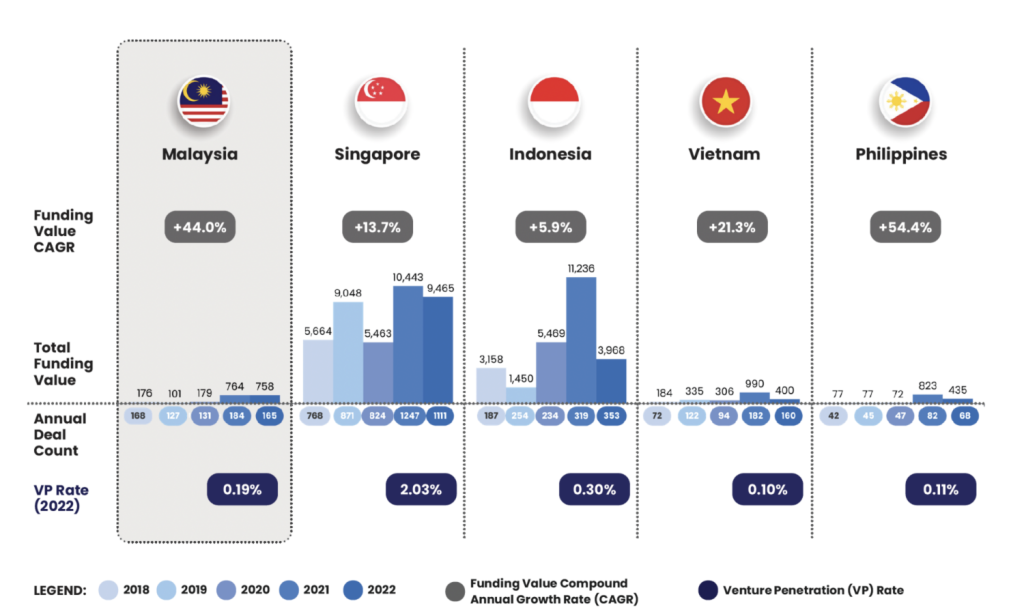

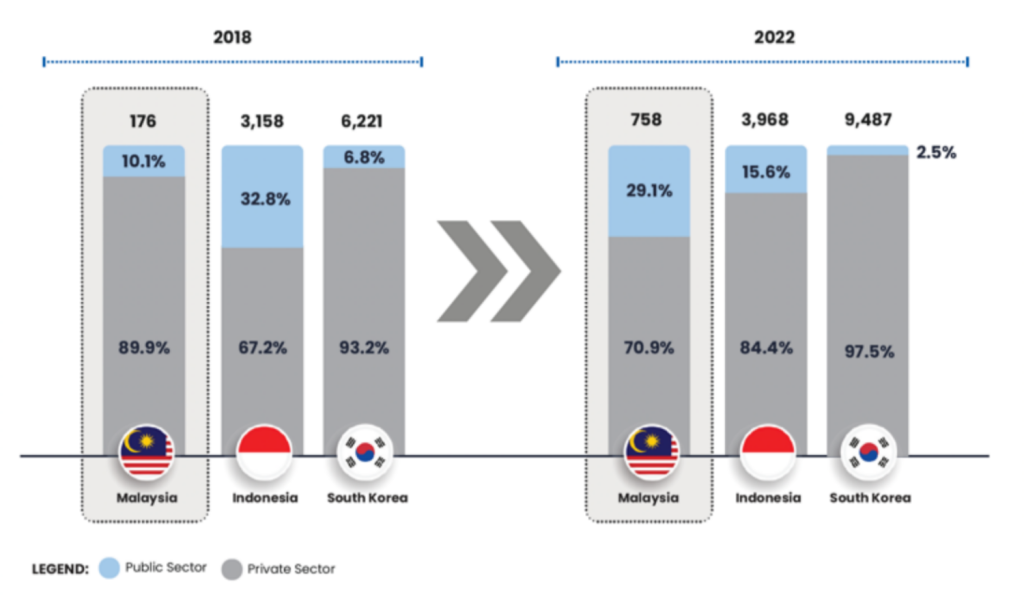

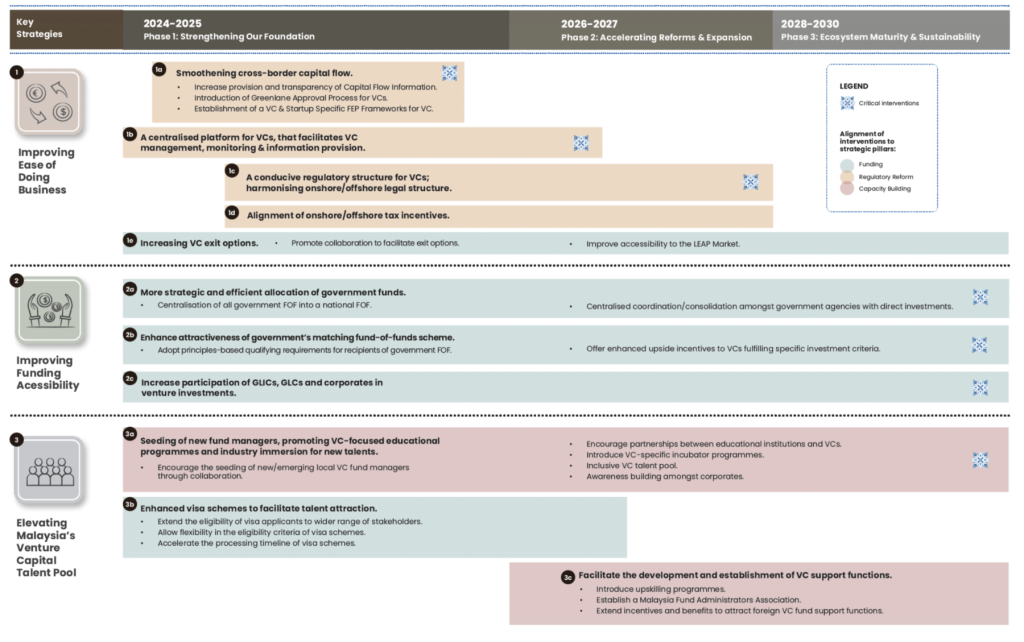

MVCR highlights three main strategic pillars which are funding, regulatory reform and capacity building that aims to enhance the VC ecosystem with four main targets to achieve by 2030. One of the main target is the venture penetration rate to increase from 0.19% in 2022 to a range between 0.25%-0.35% by 2030. Currently, VC funding in Malaysia stands at USD758 million in 2022 (compared to Singapore at USD9.5 billion), and the vision of MVCR us to double the amount of funding available to USD1.4 billion. This is also part of the Key Strategy 2 which is to improve funding assessibility to the ecosystem by streamlining all of governments fund-of-funds (FOFs) and centralising coordination efforts between governent agencies. The idea will be that potential investors will adopt principle-based criteria for the government matching FOFs schemes. This is based on the experience of the current government mathing scheme such as Dana Penjana Nasional that has successfully attract private funding and increase the value of CAGR of 35.8% from 2018 to 2022. This stratergy will be crucial to spur up the startup ecosystem in Malaysia and able to compete with other countries such as Singapore, South Korea or even the UK.

Source: Malaysia Venture Capital Roadmap 2024-2030

Investment Priorities and Key Strategies

The Malaysian government, through this roadmap, identifies three key strategies which includes improving ease of doing business, improving funding acessibility and elevating Malaysias venture capital talent pool which will foster a vibrant venture capital ecosystem. For us, these strategies signify a conducive environment for making impactful investments. Furthermore, the roadmap’s call for collaborative efforts among government entities, private sector players, and academic institutions mirrors our belief in the power of partnership. The us a call to encourage greater involvement from Government-Linked Investment Companies (GLIC), Government-Linked Companies (GLCs) and corporates is also important to allow more capital to be deployed into the ecosystem. Furthermore, enhancing a more efficient cross-border capital flow by coordinating with Bank Negara Malaysia (BNM) will allow for a more efficient movement of capital and allowing deals to be closed faster. There are also suggestions in MVDR to improve tax incentives for VC funds in Malaysia such as improving tax deductions and exemption from capital gain tax to make it more attractive for investors to deploy funds in Malaysia. By engaging in synergistic collaborations, we can accelerate the translation of groundbreaking research into market-ready solutions that address pressing health and environmental challenges. This collaborative approach is crucial in life sciences, where the journey from laboratory to market is complex and multifaceted.

Life Science Sector Focus

The life sciences sector, with its vast potential for innovation, stands as a pillar of Malaysia’s future economic growth. This sector encompasses biotechnology, pharmaceuticals, medical devices, and agritech, each holding the promise to revolutionize how we live, eat, and heal.

Our strategy aligns with the roadmap’s focus by targeting ventures that are poised to make significant contributions in areas such as precision medicine, digital health, sustainable agriculture, and clean biotechnologies. These areas are ripe for innovation and have the potential to yield high returns while addressing global challenges such as health inequities, food security, and climate change.

Navigating Challenges and Seizing Opportunities

While the roadmap lays down a promising path, navigating the venture capital landscape, particularly in life sciences, is fraught with challenges. These include regulatory hurdles, market adoption rates, and the inherent risks of scientific research. However, the roadmap’s comprehensive strategies provide a framework to mitigate these challenges, offering avenues for risk management, regulatory support, and market facilitation.

Another challenge that has been haunting VCs in the region is the difficulty of exit opportunities and liquidity. This is emphasized in MVCR with proposed interventions such as promoting collaboration amongs relevant stakeholder and improve accessibility to the LEAP market. These interventions aims to establish collaboration between accelerators and private corporation to expore potential exits through various means such as secondary sales and suggestions of a more relaxing listing requirements to allow more listings in Malaysia’s capital market.

Seizing the opportunities presented by the MVCR requires a proactive and strategic approach. This involves engaging closely with stakeholders across the ecosystem, staying abreast of emerging scientific trends, and being agile in adapting investment strategies to meet the evolving landscape of life sciences innovation.

MVCR also list down two key enablers which are the establishment of a single-window platform and the establishment of a VC council. The main aim of the single-window platform is to consolidate and centralize the ecosystem, allowing for a more efficient process of accessing VC funds. The establishment of a VC council will be chaired by Ministry of Finance (MOF) will act as a a facilitator to ensure smootoer coordination between stakeholders in both public and private sector. The core members includes Ministry of Science, Technology and Innovation (MOSTI), Bank Negara Malaysia (BNM), Securities Commission, and MAVCAP. The VC council will also feed into the National Economic Action Council (MTEN) and the National Digital Economy and 4IR Council (MED4IR), in which both reports to the cabinet of Malaysia.

With the involvment of multi-ministries and agencies, the hope is also that MVCR will not move forward alone, but align with other roadmaps such as the National Biotechnology Policy 2.0 (DBN 2.0), Malaysia Startup Ecosystem Roadmap (SUPER) and New Industrial Masterplan 2030 (NIMP 2030). A whole government approach will be important to map-out and align all these government blueprints and show continuity to increase the confidence of investors in Malaysia.

Source: Malaysia Venture Capital Roadmap 2024-2030

A Call to Action

As we look toward 2030, the MVCR is not just a document but a call to action for venture capitalists. It invites us to be at the forefront of an exciting journey of discovery and innovation. By aligning our investment strategies with the roadmap’s vision, we can contribute to a future where Malaysia is not only a leader in venture capital but also a beacon of hope and health for the world. In conclusion, the roadmap charts a course for transformative change, and in our case, we think that life sciences will be playing a starring role in this narrative of growth and innovation. We are poised to play a crucial role in this journey, leveraging our expertise, networks, and resources to turn visionary ideas into realities that can heal, feed, and sustain the world in the decades to come. Together, we can harness the power of innovation to create a healthier, more sustainable future for Malaysia and beyond.Top of Form

Whether you are an investor seeking to make a difference, an entrepreneur with a vision for change, or a stakeholder in the broader ecosystem, let’s embrace the opportunities laid out in the MVCR, overcome the challenges that lie ahead, and invest in a future where innovation drives prosperity, sustainability, and well-being for all. The time to act is now. Let us leverage our expertise, networks, and resources to turn visionary ideas into tangible realities that can heal, feed, and sustain the world in the decades to come. Join us in harnessing the power of venture capital to create a legacy of innovation and impact for Malaysia and beyond.

Source: Malaysia Venture Capital Roadmap 2024-2030