In the world of value-driven investing, Shariah-compliant strategies are gaining traction among a diverse group of investors. Much like the Environmental, Social, and Governance (ESG) frameworks that have grabbed the attention of the investment community, Shariah principles resonate with a broader audience seeking ethical alignment in their portfolios.

Wider and deeper global presence as more countries adopt or expand Islamic Finance

The Islamic finance landscape has seen a robust growth over the last decade, backed by solid fundamentals and increasing regulatory support. Assets in this sector witnessed a steady climb to USD 3.25 trillion in 2022, marking a clear sign of the industry’s health and its widening appeal.

In addition to the countries in the forefront of Islamic finance like Iran, the Gulf Cooperation Council states, Malaysia, Türkiye, Bangladesh, and Pakistan, Islamic finance has expanded well beyond traditional borders and in countries that are not Islamic of Muslim-majority – such as the UK.

The industry’s geographical expansion has brought more diversity and depth to markets, for example with different instruments, structures and investor capital.

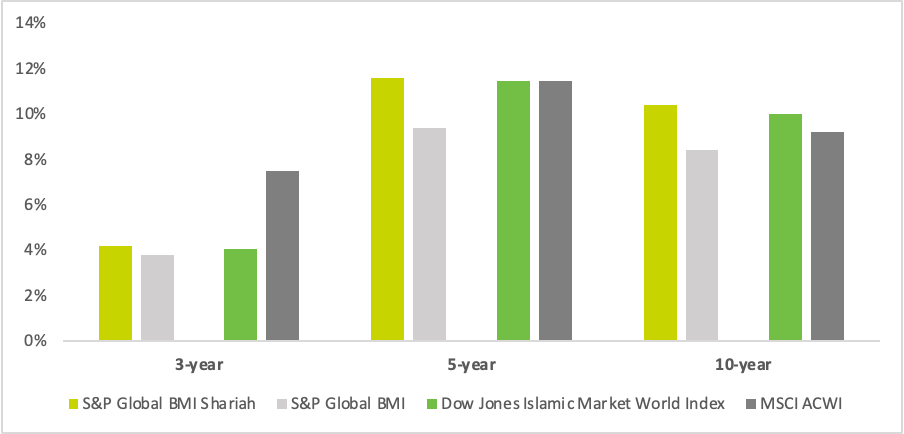

Whatever is driving the growth of Islamic financials assets – be it political, capitalizing on a growth industry or leveraging funding options – the interest is backed by solid outperformance of Islamic assets. Global Shariah indices, in relative terms, performed better than the comparative conventional indices over the longer term, including across the 3-year, 5-year and 10-year periods.

Islamic Venture Capital (“IVC”) as a growing subset of Islamic Finance

Venture capital (VC) investment, in particular, offers an exemplary model for Shariah-compliant financing, provided certain adjustments are made to align with Islamic principles. This approach is appealing because VC entails investing in tangible economic activities, with returns generated through active investor engagement and shared business risks—core tenets of Islamic finance.

Islamic venture capital (IVC) investments are quite similar to traditional ones, with the key difference being their adherence to Shariah principles. While conventional VC funds are free to invest in any profitable venture, IVC funds are restricted from engaging with industries not allowed by Shariah, like alcohol, pork, and adult entertainment, among others. Additionally, they’re limited to only using acceptable Islamic instrument structures, and requires continuous monitoring to avoid breaking of compliance.

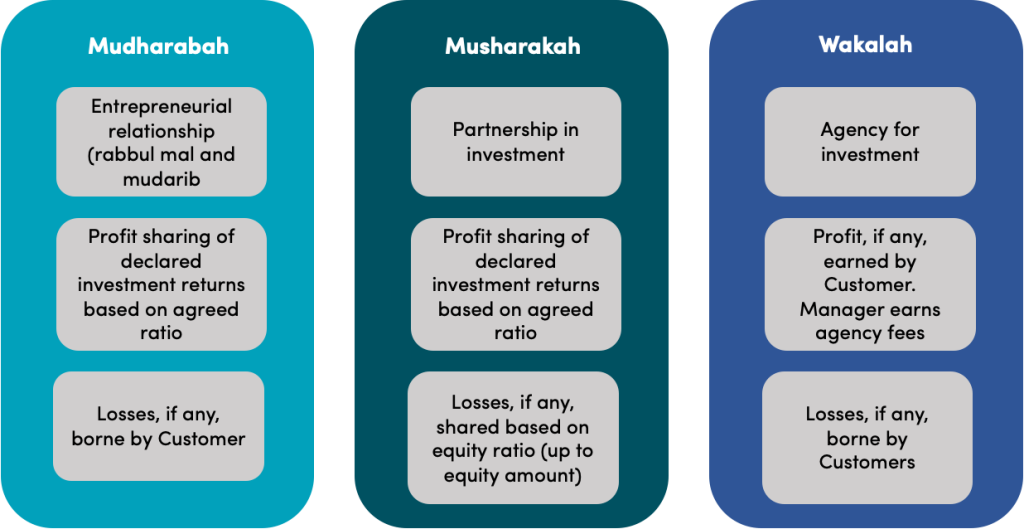

IVC can be structured through Mudharabah, Musharakah, and Wakalah partnership

Mudharabah is a partnership where one party provides capital and the other manages the business is the most commonly used due to its simplicity and alignment with Islamic principles of profit and loss sharing. The involved parties consist of the Rab al Maal, who serves as the investor by providing capital, and the Mudarib, who acts as the entrepreneur responsible for managing the capital (it is also maybe overlooked that the conventional VC/PE structure essentially mirrors a Mudarabah contract with investors as LPs/Rabbal-Mal and the GP/Mudharib being the VC firm itself). In cases where the venture yields profits, these profits are distributed according to a predetermined ratio. Conversely, if the venture incurs losses, the capital provider assumes the entire financial burden, limited to the amount of capital contributed. A fundamental aspect of the Mudharabah structure is that the entrepreneur is shielded from bearing losses unless found negligent.

Musharakah involves a joint venture where all partners contribute capital (in the form of cash or in kind) and share profits and losses based on a pre-agreed ratio. However, in the event of a loss, the loss will be shared on the basis of capital contribution.

Wakalah is a contractual arrangement where one party acts as an agent for another, managing investments in return for a fee.

Aligning financing instruments to Shariah principles

Typical venture capital financing often involves instruments like preferred shares and convertible debt, which have features that are misaligned with Shariah principles in the following ways:

- Riba (usury), i.e. the guarantee of a fixed return on investment, similar to interest.

- Preference to certain shareholders in profit distribution, liquidation and asset claims, which may go against the principle of equitable risk and reward sharing in business transactions.

- Convertible or callable features, which can introduce elements of uncertainty or speculation (gharar).

In essence, for Islamic finance, the returns are meant to be tied directly to the performance and profits of the venture, ensuring that all parties involved share both the risks and the rewards. As such, especially in the case of preferred stocks, it has faced criticism by various shariah scholars, and AAOIFI’s Shariah Standard No. 21 declares them Shariah non-compliant. It is however worth noting that the AAOIFI’s standard was issued in 2004 and has not been updated since.

The Shariah Advisory Council of Securities Commissions Malaysia has released a resolution in 2022, which takes a different stance in that it states that the defining features of preference shares could be made Shariah compliant. In the case of dividends distribution, it is permissible as and when declared by the company based on the concept of taradhi (mutual consent). While preferred stocks may indicate a dividend (whether cumulative or non-cumulative) amount at the point of subscription, it is merely indicative and still contingent on the company’s profit.

And in regards to the preference (in both payment of dividends and liquidation proceeds), it is permissible based on the concept of tan’azul (to forego a right), whereby the ordinary shareholders waive their rights to receive dividends/proceeds by giving preference to the preferred shareholders. The tan’azul takes place via ratification by the Board of Directors of the company.

The current level of maturity in Islamic Finance in Malaysia is definitely in large part due to the constant interplay and dialogue between the market participants and the regulatory body’s Shariah Advisory Council. This process lends itself to a continuous process of active innovation and evolution of Islamic law.

For convertible debt, a Shariah-compliant alternative would be performing Commodity Murabahah transactions. In this structure, a financier buys a commodity and sells it to the investor with a deferred payment at a markup. The investor then sells the commodity for cash to a third party. This approach allows for capital flow similar to a convertible debt but aligns with Shariah by avoiding interest and ensuring transactions are backed by tangible assets.

The aim is to ensure that all financial transactions are backed by tangible assets or services and that both the investor’s return and the capital repayment are contingent on the actual performance of the business, thereby upholding the principles of risk-sharing that are central to Islamic finance.

Although the discussion here is limited to just the main instruments, i.e preferred stocks and debt, there have been work done on aligning other financing structures such as SAFE to also adhere to Shariah principles.

In addition, to ensure compliance and robustness of the IVC, and also as issued on the Guidelines on the Registration of Venture Capital and Private Equity Corporations and Management by the Securities Commission of Malaysia in 2015, the IVC must appoint a Shariah Adviser(s) to provide the Shariah expertise and guidance on all matters pertaining the Shariah investing.

Catalyst for Malaysia’s Islamic Finance Sector

Islamic Venture Capital is a significant catalyst for Malaysia’s Islamic finance sector and the wider VC environment. It will spur not only economic expansion but also market diversification, appealing to a vast pool of investors oriented towards ethical investment principles.