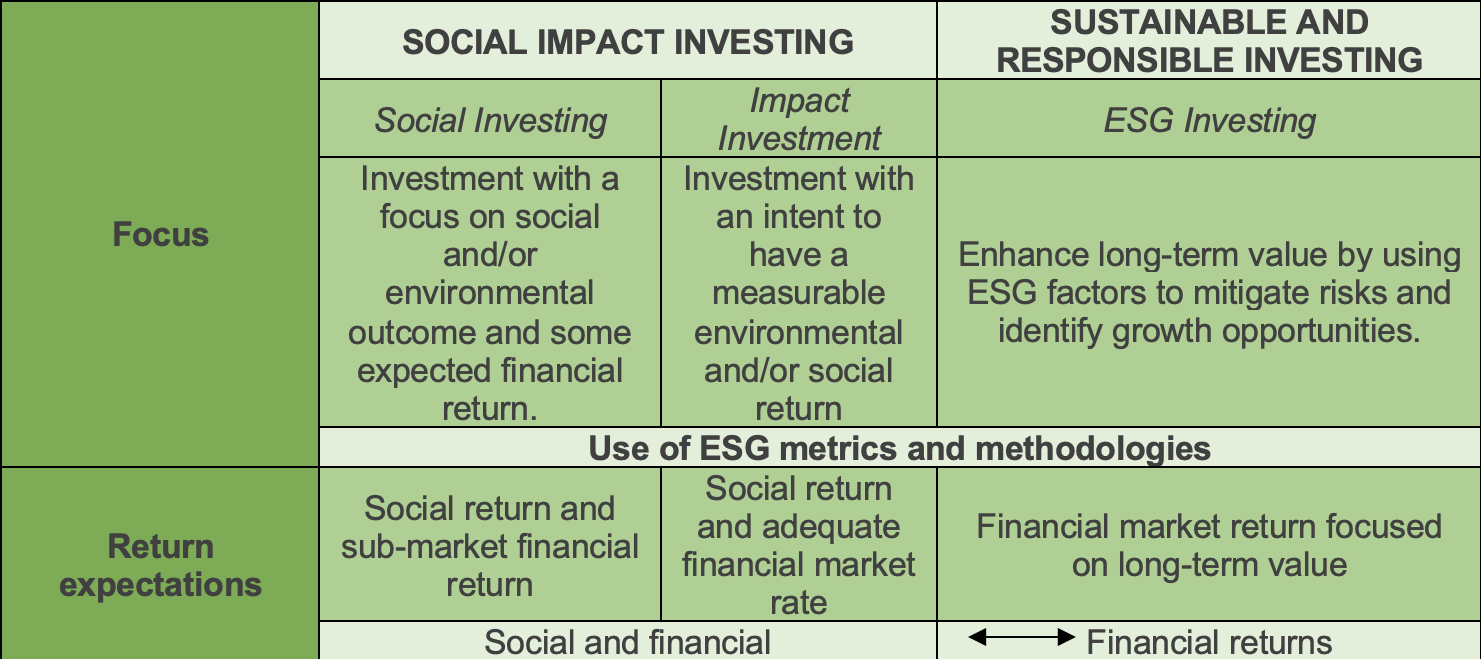

Three concepts that have become increasingly important to everyday investors over the past several years are Social Investing, Impact Investing and Environmental, Social, and Governance (ESG). As the world moves towards ensuring the sustainability of our planet and life as a whole, it is imperative that investors take these three initiatives into consideration when considering deals. Below is a chart that defines each concept as well as the return expectations for each type of capital.

Source: Stylized adaptation from Organization for Economic Co-operation and Development (OECD), based on earlier versions from various organizations. For illustrative purposes only.

As highlighted above, investors looking to do social impact investing must take all three concepts into consideration to create an impact investing strategy, and all of them incorporate the use of ESG metric and methodologies. For the purposes of this article, we will focus on impact investing as the term that blends all three concepts.

Defining Impact Investing

Impact investing is now a major trend in a variety of sectors, including the life sciences and healthcare, clean energy, and sustainable agriculture fields. The biotech sector in particular is expected to have a profound economic and social impact on our future, and will be bringing significant upside to investors.

The Global Impact Investing Network (GIIN) recently did a survey in 2020 of 300 of the world’s leading impact investors who collectively manage US$404 billion in assets; it reports that the impact investing market has seen an impressive evolution over the past 10 years and will continue show steady growth in the future. The results of this survey clearly show that impact investors are willing to accept concessionary or risk-adjusted returns on their investment as long as it aligns with their mission and helps them to achieve their impact goals. The same survey showed that 88% of its respondents reported that their impact investments met or exceeded their financial expectations.

Building an Impact Investing Strategy and its Risks

When considering getting involved in impact investing, investors can take several approaches and have a variety of asset classes to choose from; all come with varying levels of risk and return rates ranging from below-market to market-rate. Which approach an investor should go for will typically depend on their short-term and long-term financial interests and expectations, as well as their impact goals.

Zooming in on the level of risk and investing in early-stage healthcare companies; this asset class has two types of intertwined risk, capital risk and impact risk (i.e., the risk that a new treatment does not reach patients and the impact is thus never realized). An investor takes on scientific, biological and development risks, as science is inherently unpredictable. Additionally, for life science companies that are developing new therapies, diagnostics, or devices, investors will also encounter regulatory risk and reimbursement risk. As such, it should be noted that while investing in private companies can help investors to avoid the volatility of small-cap stocks, there is also a lack of liquidity, so they should only invest in this asset class with patient capital that can be tied up for years.

The Logic of Impact Investing in Healthcare and the Life Sciences

Nevertheless, impact investing in the healthcare space just makes sense. As the market continues to expand, investors should also be aware that philanthropy, government funding, and corporate investments will not usually be sufficient to accelerate innovation and generate impact in this space; as such, it is likely that private equity investments in disruptive life-science startups by individual and institutional investors will play a significant role in commercializing transformation technologies that have the potential to save and/or improve the quality of life for patients everywhere.

Sources:

2. https://blog.victech.com/impact-investing-in-healthcare?hs_amp=true