The average human’s diet is changing.

As we move past the pandemic era and begin looking towards a brighter future, one of the constants in our lives is the consumption of meat and although there have been various campaigns, calls, and media hype around the idea of meat substitutes, the consumption of beef, pork, and chicken continues. In fact, according to CB Insights’ Industry Analyst Consensus, the global meat market could be worth as much as US$2.7 T by 2040.

However, over the last few years, meat companies and their supply chain network have had to change their tune. Driven by several factors, including COVID-19, shifting consumer behaviors, and virus outbreaks in meat factories, organizations in this space the world over are now turning to the idea of creating meat or meat-like substitutes.

An Overview of the Meat and Plant-Based Markets

It would seem to the average person that the meat business is a good one, but as mentioned above, current times have called for massive changes within this industry. For the past ten years, it has seen a huge amount of consolidation activity – industry giants Hormel and JBS have continued to dominate the meat market via a series of acquisitions of new meat brands and products. In fact, since 2014, Hormel is estimated to have spent over US$6.5 B on acquisitions, and most recently acquired the Planter brand for US$3.35 B in February 2021, thus expanding their footprint beyond meat to consumer snacks.

Despite all this activity, the winds of change have certainly impacted most players, and have caused them to consider pivoting to offering meat-free products; JBS, as an example, launched their own meatless protein in June 2020, and in the following year acquired Dutch plant-based meat manufacturer Vivera for US$408 M. Other companies have followed suit, including household names such as Tyson, Smithfield, Hormel, and Cargill.

Alongside the different factors presented above that have catalyzed this change in meat producers, there is also a different challenge: plant-based meat substitutes and the startups that are creating them.

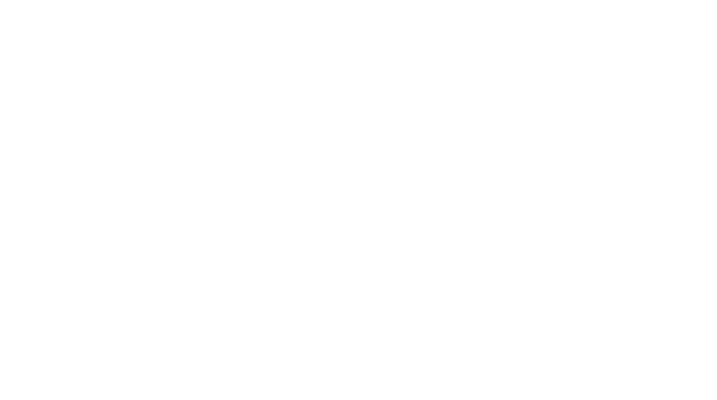

At present, the plant-based meat market is expected to grow by a CAGR of 19.3% to reach a revenue of US$24.8 billion by 2030, highlighting the rise in interest from investors and consumers alike. On the consumer end, various companies have now also become household names, such as Beyond Meat and Impossible Foods. This type of disruption alone serves as a good reason for traditional meat companies to not rest on their laurels.

Why the Change? The Rise of Plant-Based Alternative Food

As briefly mentioned above, several factors are driving change in the meat industry and are also responsible for the proliferation of meatless startups.

1. The Pandemic

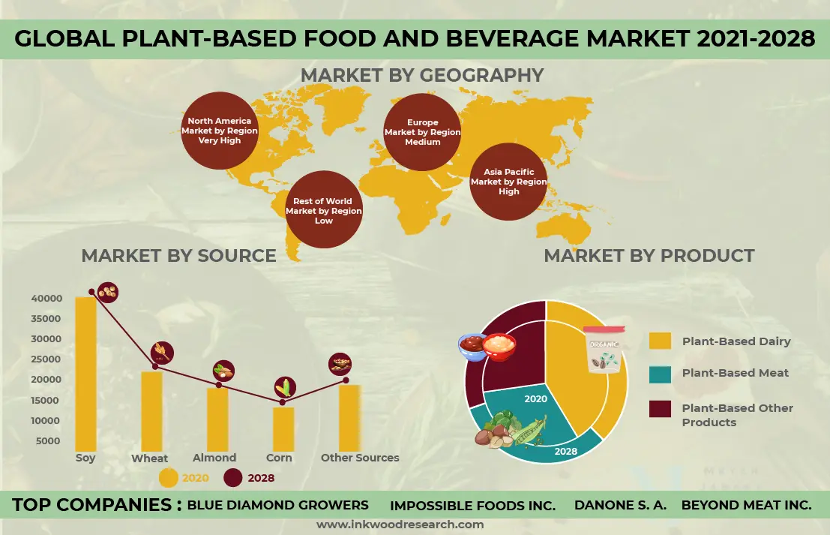

As with every industry everywhere, the COVID 19 pandemic caused chaos in the meat industry. As plants shut down, an acute shortage of meat supply arose, which resulted in increased prices; additionally, as the virus made its way through the world’s population, workers at meat factories fell sick, thus making it harder for these companies to carry out business as usual. This shortage and price hike caused consumers to turn to alternate sources of protein, thus bringing plant-based companies and their offerings into the spotlight.

Aside from supply and pricing concerns, the pandemic period also caused many consumers to question their purchasing decisions as concerns around workers’ wellbeing and the ethical treatment of animals arose. Reports of animals being euthanized by slaughterhouses going out of business and unsafe working conditions for meat supplier employees have both spurred on this shift in consumer behavior.

2. The Unabated Demand for Meat

According to the USDA, China consumed over 40 million metric tons of pork in 2020; this shows a clear continued preference for authentic meat, although plant-based meat alternatives have made a small headway in the country.

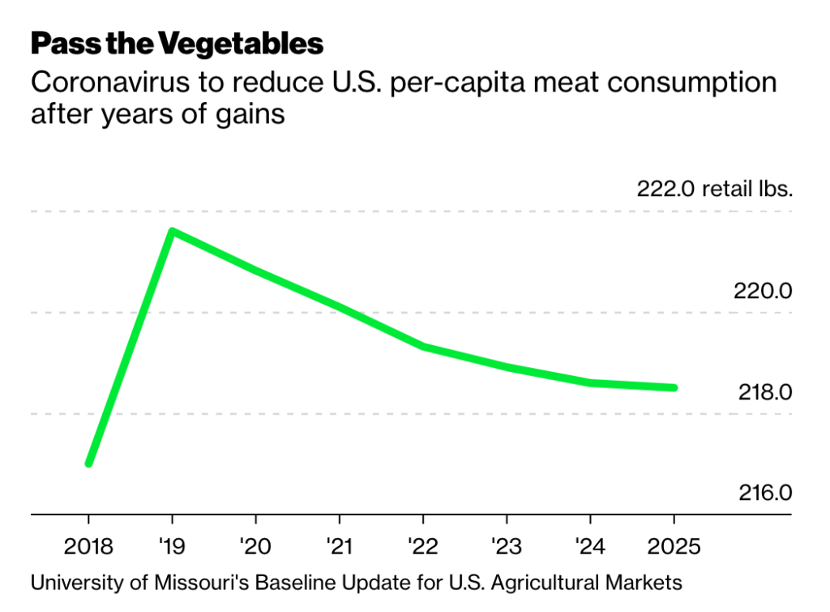

This increasing demand will likely create challenges for feeding future generations of the population, and meatless companies are looking to step in and help fill the gap.

3. Growth in Demographics and the Population

Urbanization, population growth, and a rising middle class will all lead to more meat being consumed. To date, the World Bank estimates that about 56% of people globally live in urban settlements, and this number will more than double by 2050 at which point nearly 7 out of 10 people will live in cities. In terms of population, the number of people on the planet will 9.7B by 2050, which means food production must increase. Emerging markets, such as China, are driving this growth; their protein consumption is expected to grow due to an increase in middle class consumers.

4. The Future of Our Planet and Our Wellbeing

Fostering alternative protein sources will also serve our planet well by reducing the negative environmental impact that is tied to meat production; livestock, as one example, is a major contributor to greenhouse gases, and by reducing livestock, we will also be able to free up cropland, decrease soil erosion, and relieve pressure on the earth’s water supply.

Consumers are also looking for healthier ways to live; in Southeast Asia specifically, the WHO reports that 1 in 5 adults are overweight, and investing in a plant-based diet can help to tackle this issue.

5. Technology to the Rescue

Advances in agricultural tech or ag tech as well as synthetic biology are advancing efforts to create meatless products. Two examples are cellular agriculture and molecular engineering, both of which are helping make meat substitutes better emulate the flavor and texture of actual meat.

Carrying the Torch Forward: Beyond Meat and Impossible Foods

Considered by many to be pioneers and forerunners in the plant-based space are two US companies, Beyond Meat and Impossible Foods and British company Quorn.

Beyond Meat

In 2019, this alternative protein brand went public at a valuation of nearly US$1.5 billion. In the following year, it reported net revenues of US$407 million and net losses of US$53 million, mainly due to challenges such as supply chain woes during the pandemic. Today, it is still on the rise, and reported a net revenue of US$100.7 million for 2021. In Asia, Beyond Meat has already made inroads into “meat-centric” economies such as China, doing collaborations with Starbucks, KFC, Pizza Hut and Taco Bell, and marketing its Beyond Pork products, which are specifically tailored with the Chinese consumer in mind. That being said, the company continues to face hurdles with rising inflation and planned job cuts, which saw its shares sink by about 75% in 2022.

Impossible Foods

Beyond’s chief competitor, Impossible Foods, has also won a fair share of attention. To date, it has raised US$2 billionin total disclosed funding, and its products are available for consumers to purchase at chains like Burger King, White Castle, and Red Robin. This company is currently still quite focused on making its footprint in the US, although countries such as Australia, Canada, Macau, New Zealand, Singapore, the UAE, and the UK also sell their products. One key differentiator for the brand is its marketing attempts: in order to woo uncertain consumers, it has embarked on ad campaigns with pictures of meatless burgers dripping with cheese that mimics the look of regular fast-food burgers.

In terms of revenue, Impossible made US$4.5 million last year. However, it too faces a challenge when tackling the APAC economy, with the price point being a hurdle as well as cheaper alternative brands offering the same type of product.

Quorn

The oldest of the three, Quorn was established in England in 1985, and boasts the mission of getting more people into vegan and vegetarian diets. Unlike its US counterparts, the company uses fungus to make its meatless products and focuses on the at-home consumer and their daily consumption of their offerings. In 2021, the company, which focuses largely on the European market made a pre-tax profit of GBP 7.36 million; this was down from GBP 8.46 million the year before, due to grocery market disruptions caused by the macroeconomic issues of COVID 19, Brexit, and emerging inflation.

Asia – The Next Frontier

Today, it is possible to walk into the more high-end supermarkets in Asia and find plant-based or alternative meat products, including Beyond Meat. However, as briefly mentioned above, the pricing of these imported products is causing a dent in any plant-based company’s plans.

To tackle this, local companies are taking note of the price point concern and are offering their own products; one such candidate is Manila-based Century Pacific Foods, which makes unMEAT products. Just like Impossible Foods and Beyond Meat, the company’s products are 100% plant-based, however, it has set its price point for each product to not be more than 30% or 40% than regular meat. This intriguing decision thus makes it more difficult for international giants like Beyond Meat to penetrate the market.

To do so, they must look at localizing their message to meet Asian consumers demands, including emphasizing that the meatless alternative products they produce taste like the real thing, and that it is healthier to consume said products. A study by Singaporean company Anew, which makes soy-based luncheon meat, revealed that health was a primary motivation, after flavor, for many locals to transition to a plant-based diet.

While not an impossible task, companies must look beyond a linear marketing message such as environmental concerns and tailor their products and story to fit a narrative that will appeal to Asian consumers.

A Plant-Based Diet is Here to Stay

As the demand for plant-based alternatives in other categories, such as milk, dairy, and fish are also seeing traction, we may also be facing a future where popular plant-based alternative companies branch out to offer options for all types of diets. At the very least, this bodes well for our planet’s resources; greenhouse gas emissions and pollution can become less serious issues for us to tackle, and we may finally be able to meet climate goals and keep our ecosystems intact.