What is a Sovereign Wealth Fund?

A sovereign wealth fund (SWF for short) is a state-owned investment fund that invests in real and financial assets. Funds are typically comprised of the money generated by the government, often derived from a country’s surplus reserves. SWFs can also be referred to as sovereign investment funds or social wealth funds.

SWFs can come from a variety of sources. Popular sources include surplus reserves from state-owned natural resource revenues, trade surpluses & commodity exports, bank reserves (usually accumulated from budgeting excesses), foreign currency operations, money from privatizations, and government transfer payments.

Having that said, the amount of money in an SWF is usually substantial. Some SWFs may be held by a central bank, while others are simply the state savings that are invested by various entities for investment return.

Types of SWFs

Conventional classifications of sovereign wealth funds include:

- Stabilization funds

- Savings or future generation funds

- Public benefit pension reserve funds

- Reserve investment funds

- Strategic Development Sovereign Wealth Funds (SDSWF)

- Funds targeting specific industries – it can either be an emerging industry, or a sector having state-owned entities in need of a stimulus

Although some classifications may not include foreign currency reserve assets as SWFs, they are nevertheless substantial, and may be used for specific governmental purposes and/or for helping to manage the trading power of a currency globally.

Why are SWFs so Important?

Investments made by SWFs could contribute to long-term growth by funding infrastructure and supporting post-crisis economic development. For instance, SWFs can invest long term in an emerging industry or stimulate certain sectors with state-owned interests in distress.

Countries can create or dissolve SWFs to match the needs of their population. One example is during the COVID-19 crisis, where SWFs can act as a country’s financial reserve during economic instability.

Diverse Portfolio of Assets

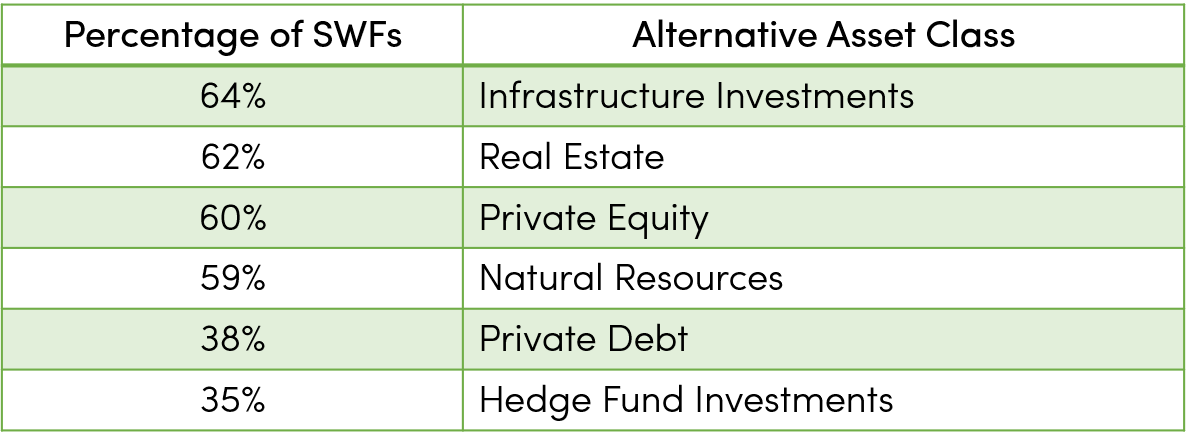

Aside from being critical providers of global capital, SWFs are also increasingly looking to new industries and asset classes. In recent years, many SWFs have been increasing their exposure to alternative assets.

Various economic sectors are driven to look at new products and asset classes that will service this growing market and help further build their position as a key investment destination for SWFs.

SWFs by the Numbers

Over the last few decades, the number of SWFs and the funds’ size has increased significantly. According to the SWF Institute, more than 91 sovereign wealth funds with combined assets amount to nearly USD 8.2 trillion in 2020.

SWF assets under management increased by an average of 8% annually from 2010 to 2019, before falling by 21% to USD 6.4 trillion in 2020 (due to the pandemic and a sharp decline in commodity prices). Despite the drop, SWFs are still larger than those of the private equity (USD 4.1 trillion) and hedge fund (USD 3.4 trillion) industries.

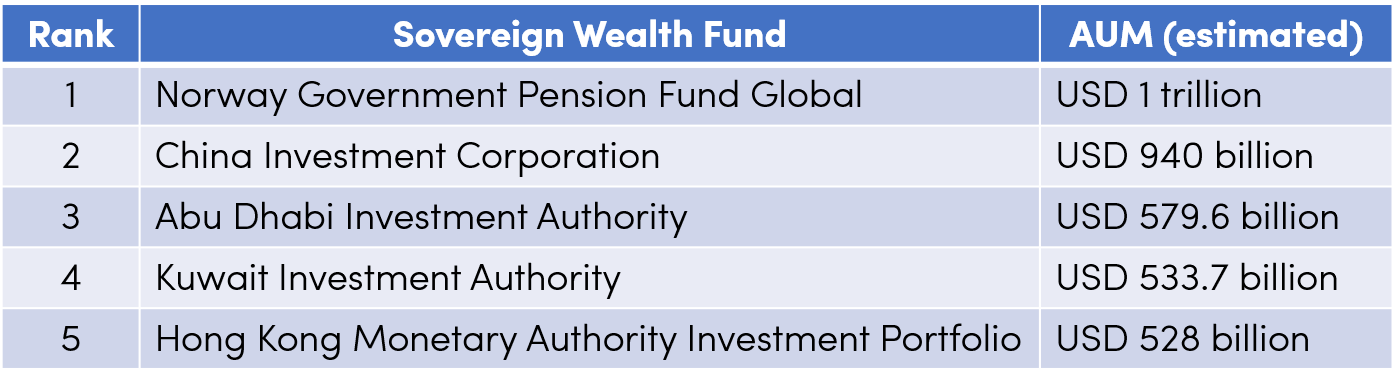

The top five largest SWFs by assets as of August 2020:

Economic Rebuilding During Post-Pandemic

As a key source of long term capital, SWFs have an important part to play in post-pandemic economic rebuilding. Given the sheer size of their AUM, SWFs are particularly good financiers of infrastructure projects, among other long-term productivity-enhancing investments, due to their long-term investment horizon.

With the increasing awareness (and preference) towards ESG investing, SWFs would provide the extra potential to rebuild and bounce back from the pandemic.

It can be a force for positive change in the coming years.

Tapping Into Emerging Markets via Venture Capital Deals

Since 2010, SWFs have been active on venture capital, and since 2014, the bet consolidated with more SWFs and larger capital deployment. 2018-2019 was a record period for SWFs investing in venture capital.

According to a report from PitchBook, SWFs participated in 142 VC deals worth USD 13.4 billion in 2019, a stunning increase of more than 19x from 2010, when they poured USD 700 million into 17 deals. They hit an all-time high in 2018, investing nearly USD 40 billion in 198 deals.

SWFs can be considered today as key players of the VC industry, fostering change and framing innovation both internationally as well as at home.

Focusing on Biotechnology & Life Sciences

According to the 2020 Sovereign Wealth Funds Report by IE University and ICEX-Invest in Spain, SWFs were most active in the technology (25% of deals), services (18%) and life sciences (17.6%) sectors. In total, there were 11 deals made in pharma and 10 deals made in biotech.

Investment in green assets (environmentally friendly and sustainable initiatives) by SWFs globally increased to USD 11 billion over the period 2015-2017.

In recent years, biotechnology investments outpace any other technology subsector in terms of the number of deals closed. A few reasons explain this recent trend:

- A growing interest in advancing human development by adopting innovative healthcare solutions and technologies for the well-being,

- Increased awareness regarding the potential benefits of applying biotechnology for long-run issues such as ageing populations, growing middle-classes and urbanization, and

- Accepting that life sciences innovation requires long-term capital and SWFs is fitted for this kind of investment.

Some of the recent life sciences deals involving SWFs (and their VC arm):

- March 2021 – the Mubadala Investment Company (from Abu Dhabi) announced an investment of GBP 800 million in the UK life sciences sector via a newly created UAE-UK Sovereign Investment Partnership; along with a GBP 200 million investment from a UK government fund, the Life Sciences Investment Programme, over the next five years.

- November 2020 – Xeraya Capital (venture capital and private equity company owned by Malaysia’s SWF, Khazanah Nasional Berhad) participated in a USD 50 million investment round of a UK-based digital health firm, Congenica.

- October 2020 – Mubadala also invested USD 235 million into Evotec SE, a German biotechnology company specializing in drug discovery and development.

- July 2020 – The Qatar Investment Authority (QIA) invested in German biotechnology company CureVac developing a COVID-19 vaccine (and other RNA-based therapies).

- June 2020 – Singapore’s Temasek led an investment round of USD 250 million in BioNTech, the German biotechnology company developing a COVID-19 vaccine.

Summary

Sovereign wealth funds are state-owned investment funds derived from a variety of sources. The amount of money in an SWF is usually substantial, allowing them to contribute towards a country’s long-term growth by various means. SWFs have an important role in reflecting government policy to forging innovation and change. This can be achieved effectively via venture capital deals, and SWFs have boosted their investment in VC deals by more than 19x over the past 10 years. Recent trends indicate a growing interest in the biotechnology and life sciences sector.

Sources:

- https://www.investopedia.com/articles/economics/08/sovereign-wealth-fund.asp

- https://londonlovesbusiness.com/sovereign-wealth-funds-can-help-bolster-national-growth/

- https://www.swfinstitute.org/fund-rankings/sovereign-wealth-fund

- https://www.privateequityinternational.com/why-are-sovereign-wealth-funds-in-love-with-venture/

- https://pitchbook.com/news/reports/q2-2020-pitchbook-analyst-note-sovereign-wealth-funds-multiple-avenues-to-vc-exposure

- https://sites.tufts.edu/sovereignet/capital-ideas-pharma-and-biotech-continue-to-draw-swf-investment-2020-data-show/

- https://www.ie.edu/university/news-events/news/sovereign-wealth-funds-active-technology-25-deals-services-18-life-sciences-17-6-sectors-according-2020-sovereign-wealth-funds-report-ie-university-icex/

- https://thecorner.eu/news-europe/european-economy/sovereign-wealth-funds-focus-on-technology-and-life-sciences/84645/