Thanks to a robust manufacturing industry, Malaysia has flourished from a low-productivity, agrarian-based economy to a nation that is fast approaching developed nation status. Since 1986, the three previous industrial plans have driven this progress; they raised the living standards of citizens and fostered the growth in Gross National Income (GNI) per capita, which has increased 3 times between 1967 to 2019, making the country one of the fastest-growing economies in modern history.

With the NIMP 2030, the government has considered current challenges surrounding economic progress, including (but not limited to) – integration into the global value chain (GVC), local skill and knowledge building, environmental and social governance (ESG) concerns, the new industrial revolution, and the aftereffects of the recent pandemic – to build a plan that further speeds up industrial development. While 21 sectors in the manufacturing industry are covered by the NIMP 2030, here are the first 3 key segments that Xeraya Capital will be keeping a close eye on as they develop under the various missions and 18 policies outlined in the plan.

Sector 1: Pharmaceuticals

Identified as one of the five priority sectors for NIMP 2030, Malaysia’s pharmaceuticals field has been recognized as a high-impact and emerging growth segment for the country’s manufacturing industry and will support its aim of increasing the industry’s value-add (GDP) by 6.5% from 2022 to RM587.5 billion by 2030, which is an increase of 61% over the current GDP.

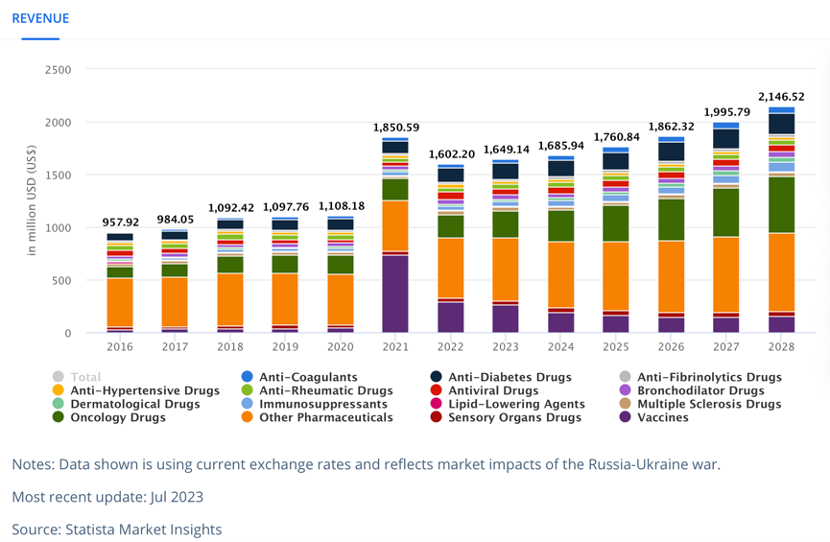

At present, the pharmaceuticals market in Malaysia is expected to reach a market size of $1.6 B by end-2023, with the largest contributor being the manufacturing of oncology drugs, which has a projected market volume of $259.7 M. In terms of GDP, according to the Pharmaceutical Association of Malaysia (Phama), the sector has already contributed over RM6 billion, and will potentially contribute another RM10 billion by 2024.

As such, the overarching strategy for fostering the continued growth of the pharmaceuticals sector per the NIMP 2030 is to encourage companies to integrate, innovate, and produce advanced products, which will help to boost Malaysia’s economic competitiveness and build resilience. For this field, the government via NIMP 2030 has outlined key growth segments for the sector, which include biologics, active pharmaceutical ingredients (API) manufacturing of niche botanicals, and halal medicines.

To accelerate the progress of these segments, the plan suggests increasing collaboration and creating synergies between players in the machinery and equipment (M&E) sector, as well as the pharmaceutical and chemical sectors. As an example, advanced inspection solutions formulated by companies in the M&E field can bolster the production of insulin, vaccines, solvents, preservatives, and excipients, while enhanced API production in the chemical field can lead to the production of higher quality generic drugs.

With these goals in place, the government believes that integrating these value chains will improve the interconnectivity of Malaysia’s economic ecosystem, thus improving resource utilization, reducing costs, increasing innovation, and enhancing product complexity.

To kickstart these efforts, government entities including the Ministry of Investment, Trade and Industry (MITI), the Ministry of Health (MOH), as well as the Malaysian Investment Development Authority (MIDA) will be collaborating and helping to build partnerships among businesses, universities, and government agencies to facilitate knowledge sharing, the adoption of best practices, and the advancement of product development through research and development (R&D), testing, and standards compliance. Via these different initiatives under NIMP 2030, the pharmaceutical sector’s GDP value is therefore expected to reach RM2.5 billion by 2030.

Sector 2: Medical Devices

Another priority sector for NIMP 2030, Malaysia’s medical devices field already has a strong base in the economy which can be enhanced for future growth in a higher range of product segments.

Currently, in terms of domestic consumption, the country imports 95% of its medical devices, a clear indication that the government’s plan of promoting the local manufacturing of medical devices is required. As for market performance, revenue from medical devices is projected to reach $3.27 B by-end 2023, which the largest segment being cardiology devices, which has a market volume of $480 M.

As such, with NIMP 2030, synergies between the M&E sector and the medical devices sector will be fostered, including the creation of advanced inspection solutions for imaging and endoscopy, implantable devices, and minimally invasive surgical tools. As with the pharmaceuticals sector, the plan calls for medical devices companies to embrace collaboration with key entities within its ecosystem (including the aforementioned government bodies and ministries) for knowledge sharing, R&D, as well as standards compliance.

This strategy will help Malaysia accelerate its economic development journey. Effective diversification of product manufacturing in the medical devices sector, including the creation of technological items that require rich and deep know-how, will enhance the nation’s strategic competitive positioning, and put it at the forefront of innovation in this space.

Sector 3: Palm oil-based products

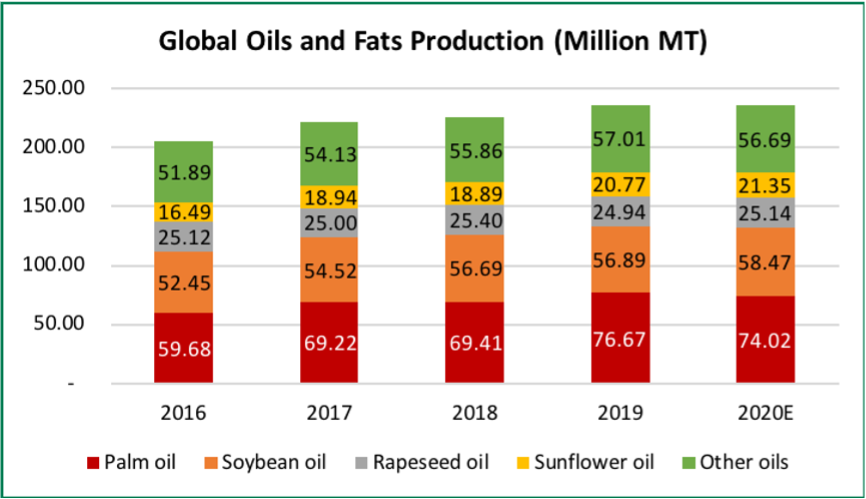

As a sector, the palm oil-based products field has been a major contributor to Malaysia’s economic growth. From 2006 to 2020, during the implementation of the 3rd Industrial Master Plan (IMP3), the nation became recognized as a leader in various sectors, including palm oil. At present, Malaysia continues to hold this leading position in the market. In 2022, trade performance reached RM2.48 T, a figure that was 2.5 times the baseline value outlined in IMP3; specifically in terms of exports, Malaysia exceeded its target by RM569 B, an achievement that was supported by outstanding trade performance by palm oil and palm oil-based agriculture products, which recorded its highest export value ever, increasing by over RM10 B and registering double-digit growth.

As per the Malaysian Palm Oil Council, Malaysia is indeed one of the world’s largest palm oil exporters; in 2020, the country accounted for 25.8% and 34.3% of the global palm oil production and exports, respectively.

However, there is room for further growth and solidifying the country’s prominent position in this market. In fact, the palm oil sector has continuously been a key segment of the manufacturing industry for Malaysia, with the government recommending several initiatives for the advancement of this field.

For instance, in 2022, it was suggested by the Ministry of Plantation and Commodities that companies within the palm oil ecosystem must embrace IR 4.0 technologies, such as AI and automation to improve their current manufacturing processes. Embracing these technologies would help build smart palm oil mills that are based on zero discharge, which in turn catalyses efficiency in the production of palm oil. Additionally, to reduce the carbon footprint of palm oil products, Malaysia has begun increasing biogas capture in palm oil mills; as of 2021, 135 palm oil factories have installed biogas systems. In the same year, Malaysia’s sludge palm oil or palm acid oil saw an uptick in demand from the European market, as they can be used as raw material for biofuel (such as biodiesel and biojet) production.

Under NIMP 2030, palm oil has an important role to play, not just in developing the nation’s economy, but also in terms of making the manufacturing industry greener in terms of its various production processes; as an example, under Strategy 3.2, an action plan calls for the industry to implement energy efficiency measures and adopt renewable energy, which includes the abovementioned biofuel that is produced from palm oil. This field can also contribute value to strengthening industrial clusters for regional development as outlined in Strategy 4.3 which mentions the rich natural resources of Sabah; in this state, there are opportunities to drive growth in downstream activities for palm oil instead of exporting this product in its raw form.

Propelling the Manufacturing Industry Forward

As mentioned in the NIMP 2030, this plan has been developed by the Malaysian government with the intent of making Malaysia a global leader in industrial development, to create wealth across the nation from manufacturing activities, and to strengthen the country’s position in the global value chain. Collaboration from entities in both the public and private sectors will help to drive the initiatives of NIMP 2030 forward, a build a vibrant economy for generations to come.

Stay tuned for Part 2 of this ongoing story on the 6 key sectors to watch under NIMP 2030.

Sources:

Ministry of Investment, Trade, and Industry: New Industrial Master Plan 2030

Pharmaceuticals –

- Statista: Pharmaceuticals (Malaysia)

- Phama: Industry Overview

- CodeBlue: Malaysia’s New Industrial Master Plan Targets High-Value Pharmaceuticals, Medical Devices

Medical Devices –

- AndamanMedical: Malaysia’s Medical Device Market

- Statista: Medical Devices Malaysia

Palm Oil Based Products –

- Malaysian Palm Oil Council: Malaysian Palm Oil Industry

- Malaysian Investment Development Authority: Palm oil industry must be ready to accept new technology changes, says Fadillah.