Over the past few months, the Malaysian government has released a series of plans that are aimed at furthering the development of the country’s manufacturing industry, including the National Energy Transition Roadmap (NETR) Phase 1, the Chemical Industry Roadmap (CIR 2030), and the National Industrial Master Plan (NIMP 2030). Within the NIMP 2030 specifically, Mission 3 – Push for Net Zero, outlines the specific strategies the government has formulated to tackle a niggling issue for manufacturers globally – compliance to Environmental, Social, and Governance (ESG) standards.

While NIMP 2030 sets out the “what” of ESG, the recently launched iESG Framework covers the “how”. It serves as a roadmap for manufacturing businesses to incorporate ESG considerations into their operations and for regulators to ensure compliance and accountability.

In this article, we explore and discuss Malaysia’s current ESG ranking, give a brief overview of the iESG Framework, and postulate how the implementation of such a framework can positively impact the industry.

A Snapshot of Malaysia’s Stance on ESG Today

Broadly speaking, ESG has been a hot topic of conversation for industries around the world; in Malaysia, the government has been actively looking into how to bring local businesses and entities up to code when it comes to international ESG standards. In fact, FTSE Russell reports that the country has been placing a strong focus on the Governance pillar of ESG and gave Malaysia a score of 2.5 in 2022, which is a 33% increase over its score in 2018. In terms of the Governance pillar specifically, the nation had an overall score of 4.3 in 2022, an improvement over a score of 3.4 in 2018.

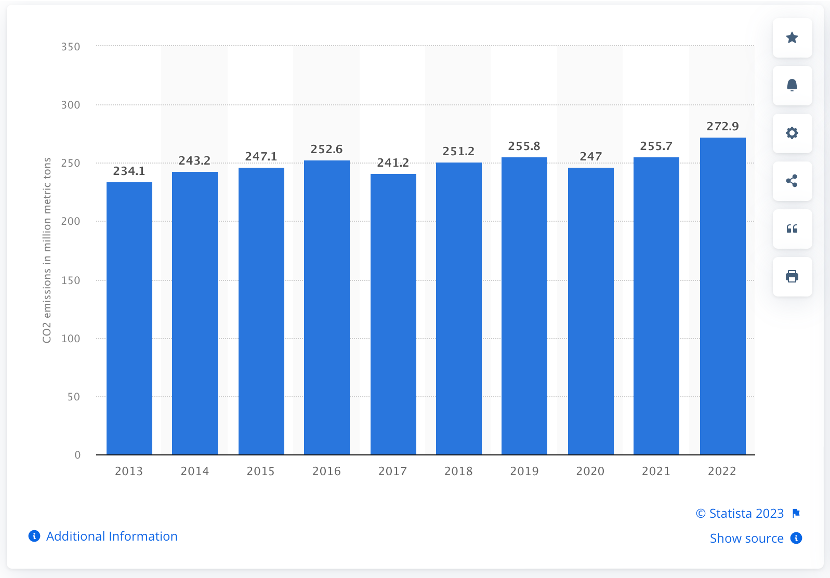

Additionally, when ESG is generally discussed by the media and the public today, one of the key topics is on carbon emissions and how well a country is doing in terms of reducing their footprint. On that note, Statista reports that in 2022, CO2 emissions from energy use in Malaysia amounted to approximately 272.9 M tonnes; the company also found that the amount of fossil fuel energy consumption was also at its highest during this period.

As such, the establishment of a Framework that will help to guide manufacturing companies on their journey towards progress and achieving international ESG standards is a timely idea. In fact, this Framework should help Malaysia achieve its overarching sustainability and net zero aspirations within 7 years or less and could potentially lead the way for the country to tap into a US$12 trillion ESG-focused global market.

Addressing ESG Issues with the iESG Framework

Overall, the iESG Framework envisions a manufacturing industry that is economically prosperous, environmentally sustainable, and socially equitable. As mentioned above, the Framework is strategically aligned with Mission 3 of NIMP 2030 and outlines a comprehensive approach to increasing ESG compliance that takes into consideration the current business environment.

Currently, the Malaysian manufacturing industry consists of both big and small players, including micro, small, and medium enterprises (MSMEs). With the Framework, the government is hoping to address the challenges manufacturing businesses face (outlined below) when it comes to ESG compliance.

The fact of the matter is that local companies, particularly MSMEs, cannot be held immediately accountable for standards that entities in developed markets have had a head start on for at least a decade; furthermore, the government firmly believes that MSMEs must not be left to fend for themselves in adopting and embracing sustainable practices, because they may not have the capacity or technological knowledge to do so. To date, almost 98% of Malaysian companies are MSMEs, and they employ 7.3 M people. In the manufacturing industry specifically, MSMEs contribute about 8% to the country’s GDP and 9% to exports.

Based on observation, the government has outlined 5 key challenges being faced by companies today in terms of adopting ESG practices:

- A lack of awareness on impact of/need for industries to adopt ESG practices: Companies have a limited understanding of policies and regulations, and generally do not know how to assess their own readiness to incorporate ESG practices into their operations.

- Difficulty in understanding, managing, and quantifying ESG risks because the topic is so broad and covers so many components of a business:Different departments have different risks, including but not limited to emissions, waste management, production, supply chains, human resources, equity, data management, and governance.

- Training, technology adoption, and digital platforms all incur additional costs for organisations, especially MSMEs.This raises the cost of doing business which equates to higher prices for products and services.

- At present, ESG is viewed as a mixed bag of competing standards and frameworks, which poses a big challenge for entities.In fact, 85% of companies surveyed by the government are currently using multiple ESG reporting frameworks.

- International ESG standards change quickly, and organisations are having to continuously update their data management and transform these data points into meaningful disclosure.

With these issues in mind, the iESG Framework is set to guide companies on their ESG journey while also providing ideas and solutions along the way.

A Brief Overview of the iESG Framework

Simply put, the iESG Framework has an overarching key objective of building and strengthening the system to encourage and enhance ESG practices in the manufacturing industry.

The Framework has 3 Missions, 4 Components, 17 Strategies, and 50 Deliverables, supported by 6 Enablers: Stakeholder Engagement, Human Capital and Capabilities, Financing and Incentives, Digitalisation, as well as Technology Policy and Regulations.

Its 3 Missions include:

- Supporting manufacturing firms to learn, be agile, and to adopt ESG practices.

- Transforming challenges into opportunities.

- Fostering symbiotic public-private partnerships for value creation.

Each of the Strategies and all the Framework’s Deliverables are subsequently categorised into 4 Components:

- Standards – Includes conducting an ESG readiness assessment, formulating sustainability reporting guidelines, transitioning to net zero industrial parks, and introducing a carbon price certificate as well as developing carbon footprints for products.

- Capacity Building – Involves conducting a nationwide awareness program on ESG for industry players including MSMEs, ministries, and government agencies, as well as training programs.

- Financing – Establishing a financing marketplace and promoting Green Financing as well as net zero technologies.

- Market Mechanism – Designing carbon pricing instruments and launching an SDG Investor Map.

In deference to the challenges manufacturing entities currently face, the government has chosen a phased approach to implementing this Framework Phase 1.0 being titled, “Just Transition”. This phase will run from 2024 to 2026 and will focus on heightening awareness, delivering training, and providing financial support. This stage will also lay the groundwork and foster development of a robust manufacturing ecosystem that will ensure a company’s readiness to meet the more rigorous demands of Phase 2.0, the “Acceleration Phase” which will run from 2027 to 2030.

The Expected Outcomes of the iESG Framework

The strategic outcome for this Framework is to have the manufacturing industry moving in line with Malaysia’s national agenda of achieving the United Nations’ SDGs by 2030 and achieving its net-zero aspiration by 2050. Specifically, the Framework should catalyse a seamless shift towards sustainable production and consumption, empower sustainability reporting, attract more ESG-compliant investments in the industry, and enhance Malaysia’s export competitiveness and foster market expansion for manufacturing companies.

Forming the ESG Backbone of the Government’s Manufacturing Plans

Overseen by the Ministry of Investment, Trade, and Industry, the iESG Framework essentially emphasizes the government’s belief in the nation’s ability to transition towards sustainability and achieving its net-zero ambitions for 2050. Should the Framework be implemented successfully, key benefits for the industry and the country include the fostering of sustainable industry growth and job creation. As a 2015 Paris Agreement signatory, Malaysia has already committed itself to reducing greenhouse gas emissions by 25% in 2030.

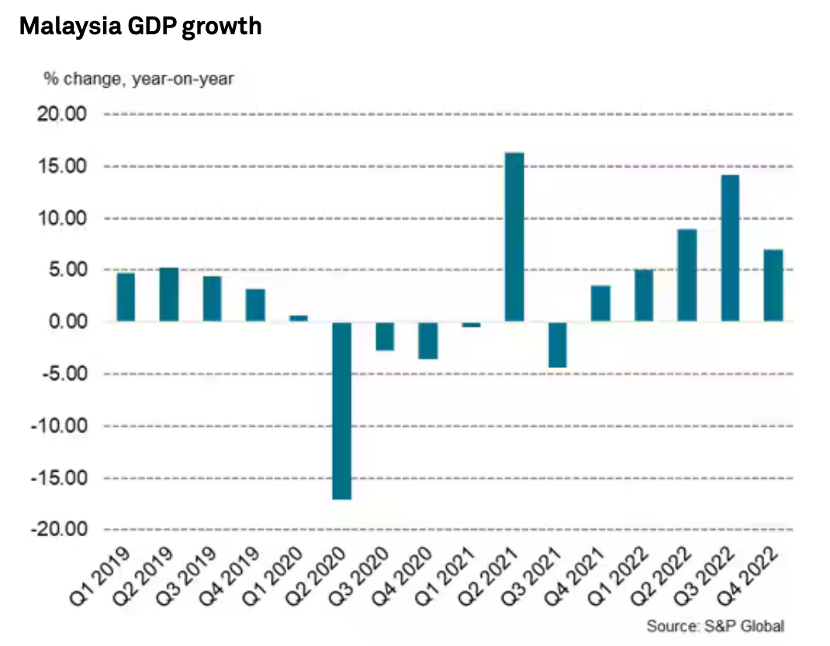

As 2023 comes to an end, this Framework, along with the policies launched by the government in recent months are all setting the scene for the manufacturing industry, a segment of the Malaysian economy that has been crucial to the country’s progress post-pandemic.

Although the Federation of Malaysian Manufacturers (FMM) reported that the industry slowed down in the first half of this year, there is hope that the economic outlook for 2024 will be positive; in their Business Conditions Survey, the Federation noted that 35% of respondents believed that the economy would improve next year.

Ultimately, time will tell if the manufacturing ecosystem will be able to meet the goals and objectives outlined by the government in its Policies, while also complying with the guidelines and strategies proposed in the iESG Framework. The success of these plans will no doubt require the cooperation and participation of all the relevant parties involved.

Sources

PRIMARY SOURCE:

- Ministry of Investment, Trade, and Industry: iESG

Other Sources:

- FTSE Russell: Malaysian ESG Scores

- Statista: CO2 Emissons from Energy Consumption in Malaysia 2013 – 2022

- New Straits Times: iESG framework can lead to global US$12 trillion market opportunities – Tengku Zafrul

- S&P Global: Malaysia Records Buoyant Growth in 2022

- KPMG: Net Zero Readiness Index – Malaysia

- The Star: FMM: Manufacturing sector to slow further 1H23, cautious about rest of the year.