Innovation is arguably one of the buzziest and most trendy words in the business ecosystem; from AI to integrated cloud services, telemedicine to disruptive forms of public transportation, “innovation” has always been the key to progress for every industry. With all the hype surrounding this concept, it can be easy to dismiss or even remain ignorant of the key driving role both venture capital firms (VCs), and private equity (PE) players have in kickstarting the dreams of today’s most innovative companies. In truth, their part in the cycle of innovation is crucial to the success of businesses that are in the game of shaping our technological future. Here’s a brief overview of the impact venture capital has on innovation within businesses.

For the Founders – A Source of Capital and a Supporter of Innovation

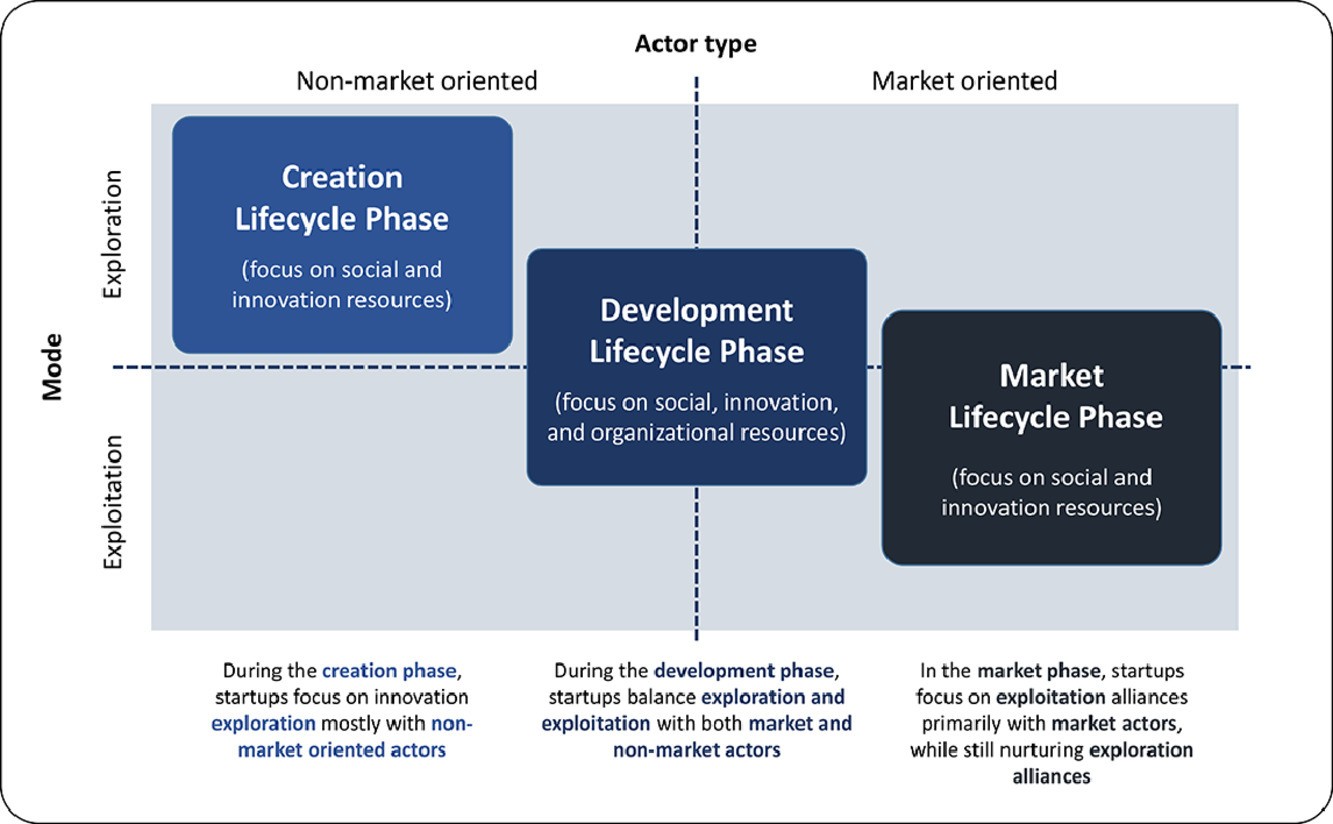

As a founder grows their business and enters the later stages of the ideation-invention-innovation life cycle, both capital and support from a VC will often determine their success at bringing a product or service to market. Most savvy founders in fact, seek VC investors and their institutional capital once they have gained initial traction from their targeted customer base.

When chosen well, VCs can also advance a company’s progress with innovation simply by tapping into their network in the innovation community; the right VC can help a company see around corners, anticipate pitfalls, and will also come with a group of advisors who can guide founders on how to solve any bottlenecks for their business, ensure that their product or service fits with a market, and advise them on which KPIs should be prioritised, as well as how to measure the performance of their company. They in essence become a partner of the business.

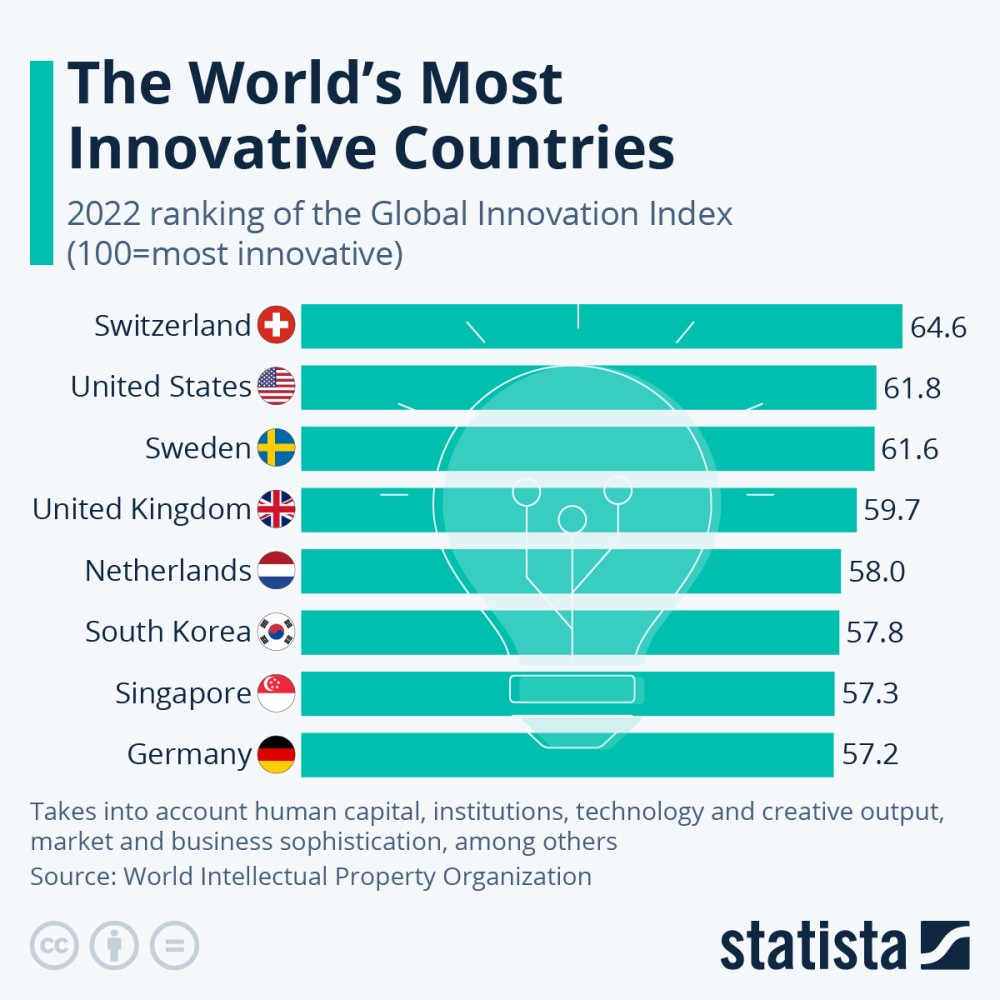

A study conducted by researchers from Tilburg University in 2015 emphasised the role VCs must play in the development of a company and its innovation strategy. It is widely acknowledged that technological innovation is what puts many companies ahead in whatever industry they are in, however, this venture often costs, and since banks rarely lend to risky long-term projects, founders must turn to other sources of funding to innovate, including venture capital.

The study also noted that having venture capital support often increases a company’s absorptive capacity – this term is defined as “a company’s capacity to identify, assimilate, and exploit new knowledge that has been generated outside of its business, thereby absorbing it.” (Cohen and Levinthal 1989, 1990).

Being able to master this ability leads to the company having a competitive edge – they combine in-house skills (“make”) with external (“buy”) innovation activities (often from a VC partner’s network) to produce more and better innovations.

In this instance, a VC’s support can bolster the absorptive capacity a company has – of the 30 companies in the study, the researchers observed a change in strategy after the investment of a VC; companies that have already built absorptive capacity are able to increase it, while businesses that have yet to build it are encouraged to do so by their VC partners.

For the Investors – A Chance to Participate in the Innovation Economy

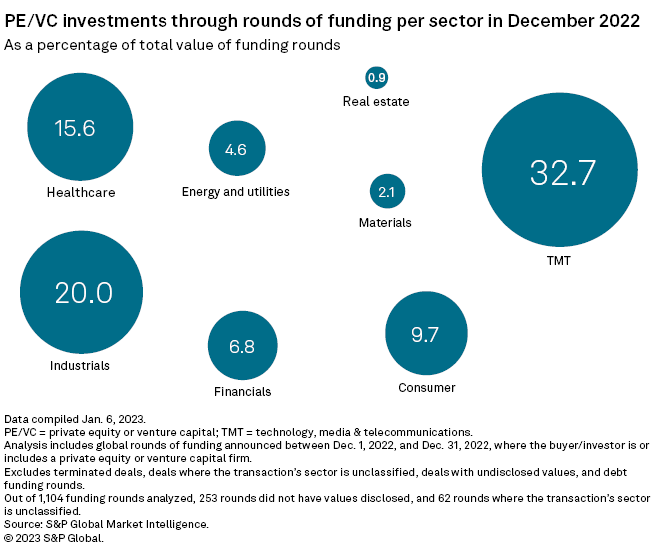

For corporates and individuals that are seeking a way into the innovation economy, VCs can open a door to companies that have growth potential but are not available in the public markets. Aside from diversifying their portfolio, these investors can benefit from making investments in smaller and earlier-stage companies because they can offer higher returns than traditional investment vehicles – the investor can get a stake in the business at a lower cost in comparison to making an investment in a company that is already at the rapid growth phase.

Additionally, these LPs will become part of a community that is fostering the growth of market-shaping businesses, companies that are disrupting the traditional way things are done within an industry. By investing their money in a company via a VC vehicle, they participate in the innovation economy and depend on the VC to manage the risks and the progress of these portfolio companies.

At the Intersection Between Innovation and Capital

Overall, a VC must balance their intent between giving investors an attractive return on capital and supporting entrepreneurs who are looking to scale their business which in turn drives success. Financially speaking, VCs are also the conduit between invested capital from LPs and the capital invested in a company with potential.

On a macro level, this cycle of investment and funding is what keeps the global economy from stagnating; since the dawn of written history, innovation has been the catalyst for economic momentum; without funding, some of the world’s most important inventions, such as the wheel and the telephone, would not have gotten off the ground, let alone be brought to market. As such, for both founders and investors, as well as society at large, VCs and their activities are truly the engine of economic growth and progress, and their work will continue to impact the course of technological advancement and innovation.

Sources: